If you’re new to Medicare, you’ve come to the right place! Get ready to learn the Medicare basics.

Medicare can be confusing, especially when you first enroll and don't have any experience with it. There can be a learning curve, but once you start to understand the ins and outs, the program makes sense. Here we will discuss the basics of Medicare and what you need to know.

What is Original Medicare?

There are different aspects of Medicare called "parts" that make up the entirety of the program. Original Medicare is comprised of Medicare Part A and Part B. As long as you are 65 or older and a natural-born citizen or a permanent legal resident that has lived in the U.S. for five years, you qualify for Medicare. You also qualify if you have certain disabilities or illnesses, such as end-stage renal disease (ESRD) or ALS.

Medicare Part A

Often referred to as hospital insurance, Medicare Part A covers inpatient hospital care, hospice care, and some home health services. It also covers nursing home care, as long as it is not custodial or long-term care.

Anesthesia, chemotherapy, and inpatient dialysis are also covered. Hospice care is covered when you have a terminal illness and a doctor confirms you have six months or less to live.

For home health services, you must be determined to be homebound. Unless deemed medically necessary, Part A will not cover the following:

● Custodial care

● Long-term care

● Private rooms/nursing

As long as you or your spouse paid Medicare taxes for at least 40 quarters (about 10 years), Part A is premium-free. If you have not paid Medicare taxes for at least 40 quarters, the Part A premium in 2023 is $506 (you’ll only pay $278 if you worked at least 30 quarters). There is also a $1,600 deductible for Medicare Part A.

Medicare Part B

The second half of Original Medicare is Medicare Part B, which covers your outpatient care. This includes doctor appointments, lab work, mental health care, preventive screenings, and some vaccines (such as COVID and flu shots). While Part B does usually cover medications administered in a medical setting, it does not cover drugs you would get from a pharmacy.

In 2023, your costs for Medicare Part B include:

· Monthly premium of $164.90

· Annual deductible of $226

· Coinsurance, which is usually around 20% of the Medicare-approved cost

If your modified adjusted gross income (MAGI) exceeds $97,000 (filing as an individual) or $194,000 (married filing jointly), you will likely owe the Income-Related Monthly Adjustment Amount (IRMAA).

Medicare enrollment

You are automatically enrolled in Medicare if you live in the United States and started receiving either Railroad Retirement Board (RRB) or Social Security retirement benefits at least four months before your 65th birthday. Enrollment is also automatic the first month you collect disability benefits after an ALS diagnosis. Otherwise, there are two times you can sign up for Part A:

Initial Enrollment Period (IEP)

Everyone's IEP is different, as it is determined by your birth date.

Your IEP starts three months before the month you turn 65 and lasts for the three months after, for a total of seven months. Enrolling during the first three months ensures coverage starts when you turn 65, and enrolling in the last three months delays your coverage.

If you do not sign up during your IEP and do not qualify for a Special Enrollment Period, you may incur late penalties. It depends on how long you go without creditable coverage.

Learn more: Medicare Late Enrollment Penalties

General Enrollment Period

If you missed your IEP, you have from January 1 until March 31 to take advantage of the General Enrollment Period. Your coverage will begin the month following the month you enroll. So, if you sign up in March, your coverage will begin April 1.

Once you sign up for Parts A and B, you then have from April 1 through June 30 to choose a Medicare Advantage (Part C) or Part D prescription drug plan.

If your IEP includes January, February, or March, enrolling during this time would be still counted as your Initial Enrollment Period.

To sign up outside of these periods, you would need to qualify for a Special Enrollment Period (SEP).

What is Medicare Part C?

More commonly known as Medicare Advantage, Medicare Part C plans are sold through private insurers and provide all of your Original Medicare benefits in a single plan.

All Part C plans are required by law to provide the same level of coverage as Original Medicare, but almost all of them (nearly 99%) come with a host of additional benefits. The most common additions are dental and vision services, prescription drugs, and fitness benefits like SilverSneakers.

Compare Medicare plans in your area

But the add-ons don’t end there. Flex cards, meal delivery, transportation, hearing aids, and more are available through some Medicare Advantage plans. That’s why you need to compare benefits carefully, not just the costs. And if your plan includes prescription drug coverage, don’t forget to check the formulary. That’s the list of prescription medications the plan covers. If yours aren’t on it, then it’s not the plan for you.

What is Medicare Part D?

Medicare prescription drug coverage comes through Part D. You can join either a standalone Medicare Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD).

Whichever you choose, always check the drug formulary before joining any Part D plan. That is the list of medications the plan covers. In addition, see on which “tier” the plan places the medication. The higher the tier, the higher your copay or coinsurance cost will be.

As with Medicare Advantage plans, Part D costs vary according to the plan and provider you choose. The average premium for a Part D plan in 2023 is $31.50.

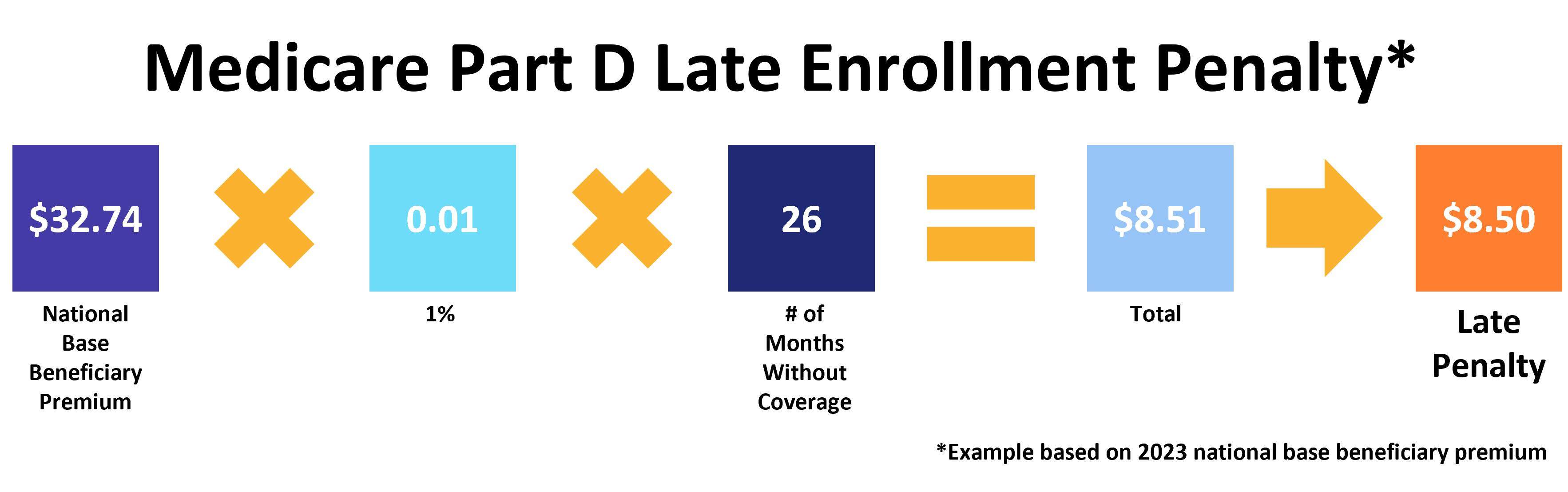

Medicare Part D also has a late enrollment penalty, which can accrue if you go 63 days or more without creditable drug coverage. In this instance, “creditable” means the plan provides equitable coverage at a similar cost to Medicare. So, discount clubs do not count as “creditable.”

The Part D late enrollment penalty is an extra 1% for every month you did not have drug coverage. The calculation looks like this:

Like the Part B penalty, you pay this for as long as you have Part D coverage.

What about Medigap?

Medicare Supplement Insurance, more commonly known as Medigap, is not a “part” of Medicare – although all Medicare Supplement plans must follow CMS guidelines. It also does not provide additional benefits the way most Part C plans do.

Instead, Medigap plans help pay your out-of-pocket costs when you have Original Medicare. How much the plan pays depends on which one you choose. There are ten standard Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, and N).

The best time to sign up for Medigap is during the first six months you have Medicare Part B and are age 65 or older. This is known as your Medigap Open Enrollment Period (OEP), and it is one of the only times you have guaranteed issue rights.

As the name implies, “guaranteed issue” means that your application cannot be denied for any reason, even if you have pre-existing conditions. You also cannot be charged a higher premium.

Medical underwriting

Outside of your Medigap OEP, your Medigap application goes through a process called medical underwriting, during which the insurer assesses how likely you are to make an insurance claim. They do this by asking you a variety of health-related questions, such as:

· Age

· Weight

· Whether you have a history of smoking tobacco

· Drug and alcohol history

· Medical history

Your answers to these questions determine how much you’ll pay in premiums and even whether the company will sell you a Medigap plan. Of course, if you sign up for Medigap during your OEP, your application won’t go through underwriting since you’ll have guaranteed issue rights.

Which is better, Advantage or Medigap?

Answering which option is better, a Medicare Advantage plan or Original Medicare plus Medigap coverage, is impossible in an article like this. What’s right for you may not be right for the next person – or even your partner

If you need extra benefits, like prescriptions and vision, and don’t mind using a provider network, you might like a Medicare Advantage plan. But, if you travel a lot or have significant healthcare expenses, Original Medicare with a Part D and Medigap plan may suit you better.

This is where working with a licensed ClearMatch Medicare agent can help. They’ll answer your questions and explain your options to help you choose the right Medicare plan for you. Call us toll-free at 888-992-0738.

You can also compare your Medicare plan options on your own with our Find a Plan tool. Just enter your zip code to review the costs and benefits of Medicare plans in your area.

Additional resources

Find a Medicare Plan

Internal Website Link

Medicare.gov: Medicare Costs

External Website Link