Our ultimate guide to Medigap answers all your Medicare Supplement Insurance questions - plus a few you didn't even know you had.

Medicare Supplement Insurance, also known as Medigap, helps pay your out-of-pocket costs when you have Original Medicare. Which expenses are covered depends on which Medigap plan you choose. Picking the right Medigap plan can be confusing. We created this guide to help you compare Medicare Supplement plans to ensure you get the right coverage for your personal needs.

How does Medicare Supplement Insurance work?

Medicare Supplement Insurance earned the nickname Medigap because the plans "fill the gaps" left by Original Medicare. That means your Medicare costs, like deductibles and coinsurance, not benefits. You can't use a Medigap plan to pay for services not covered by Original Medicare, like prescriptions or dental care. However, some plans cover healthcare received in a foreign country, which Original Medicare doesn't cover.

Private insurance companies sell Medigap plans, which are standardized by the Medicare program. "Standardized" means that every Medigap Plan A (or B, D, etc.) has the same benefits, no matter where you live or your insurance company.

While benefits are standardized, premiums are not. Each Medigap insurer sets its rates, working within state and federal guidelines. Your Medigap premium is separate from your Medicare Part B and/or Medicare Part D premiums.

You may only pair a Medicare Supplement plan with Original Medicare. (This includes Medicare Part A, hospital insurance, and Medicare Part B, medical insurance.) If you have a Medicare Advantage plan, you cannot also join a Supplement plan.

Finally, Medicare Supplement plans are not standalone health insurance, such as Medicaid or private health plans. As the name implies, Medigap plans supplement your Medicare coverage; they don't replace it.

The 10 Medigap plans

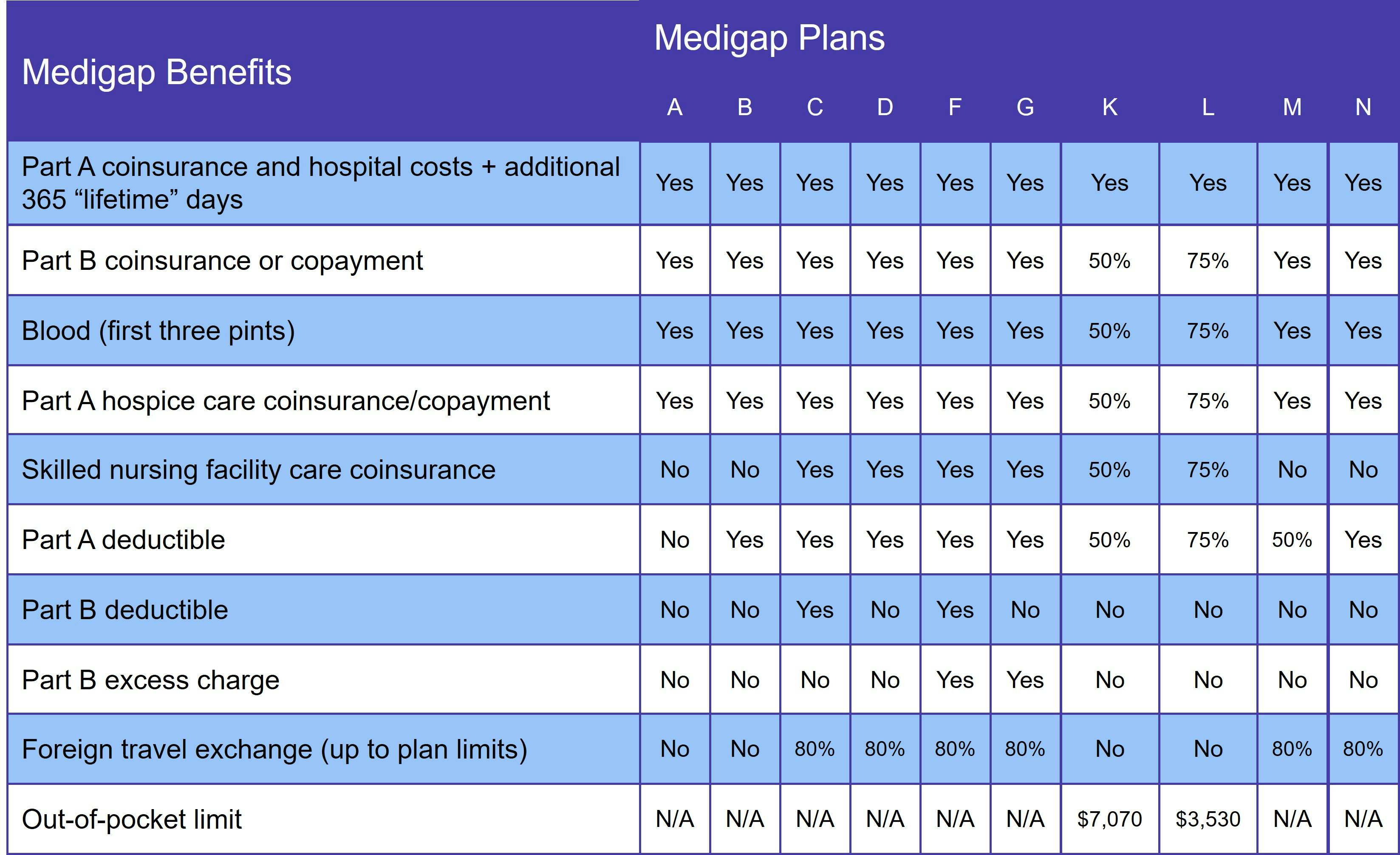

There are 10 standard Supplement plans (A, B, C, D, F, G, K, L, M, and N), but you may also find high-deductible options for one or more of these plans.

Not every Medigap insurer offers every plan.

Why it's important to choose the right Medigap plan

Medigap insurers use medical underwriting to determine whether to sell you a policy and at what rate. Applicants answer a series of health-related questions, such as age, tobacco use, and medical history. Your answers to those questions may result in you being denied a policy or charged a higher rate for it if you don't have a guaranteed issue right.

If you have guaranteed issue rights, the insurance company can neither deny your application nor charge you a higher rate, even if you have preexisting medical conditions or a history of tobacco use. Unfortunately, guaranteed issue rights are relatively rare. Unless you experience special circumstances, the Medicare program promises only one: your Medigap Open Enrollment Period (OEP).

The Medigap OEP begins the day you are both age 65 or older AND enrolled in Original Medicare (Parts A and B). It lasts for 6 months. If you do not enroll in a Medigap plan during your OEP and you don't qualify for guaranteed issue rights, your application goes through medical underwriting.

The underwriting process is why we recommend everyone who chooses Original Medicare join the best Medigap plan they can afford during their OEP. Waiting until you have health problems may make it impossible to get a Supplement plan.

Is Medigap better than Medicare Advantage?

Whether your needs are better served with Medigap or a Medicare Advantage plan depends entirely on your unique situation. If you do a lot of interstate traveling, for example, you're probably better off with Original Medicare and a Medigap plan, since your coverage travels with you. It's also a good idea if you have any chronic health conditions or visit the doctor frequently.

Comparing Medigap plans

Our Find a Plan tool makes it easy to compare Medigap, Medicare Advantage, and prescription drug plan options. Just enter your location and coverage start date to review Medicare plans in your area.

A note about Medigap Plan C and Medigap Plan F

On January 1, 2020, a new federal law took effect that bans Medigap plans that cover the Medicare Part B deductible. Two plans provide this coverage: Medigap Plan C and Medigap Plan F. Anyone who attained Medicare eligibility on or after January 1, 2020 is prohibited from joining Plan C or F.

If you already had one of these Medicare Supplement Insurance plans, you may keep it. If you were eligible for Medicare before 2020 but delayed enrollment, you can sign up for Plan C or F. However, we do not recommend it. Monthly premiums tend to rise sharply once Medigap plans are discontinued.

We recommend Medigap Plan D or Medigap Plan G instead. They provide the same benefits as Plans C and F, respectively, minus the Part B deductible.

Medigap in Massachusetts, Minnesota, and Wisconsin

Three states have permission to manage Medigap policies in their own way: Massachusetts, Minnesota, and Wisconsin. (Click the links to see each state's guidelines.)

All three states essentially offers basic and expanded coverage options. At a minimum, each has the same benefits as Medigap Plan A (see the next section). Additional basic benefits vary by state.

Medigap Plan A

Medigap Plan A provides the core benefits included with every Supplement plan. It pays your Part A coinsurance for hospital stays as well as hospice care. It also gives you an additional 365 lifetime reserve days for hospital care.

Plan A also pays your Part B coinsurance or copayment and covers your first 3 pints of blood.

You must meet both the Medicare Part A deductible and Medicare Part B deductible before Medigap starts paying.

Medigap Plan B

Medigap Plan B covers everything Plan A does:

- Medicare Part A hospital coinsurance

- Additional 365 lifetime reserve days

- Medicare Part B coinsurance or copayment (for office visits, lab work, and other healthcare costs)

- Hospice care coinsurance

- Three pints of blood

In addition, Plan B also covers the Medicare Part A deductible.

Medigap Plan C

Medigap Plan C covers everything you get with Plans A and B. Additional benefits include:

- Skilled nursing facility care coinsurance

- Medicare Part B deductible

- Foreign travel exchange of 80%

As explained above, Medigap Plan C is no longer available to new Medicare beneficiaries.

Medigap Plan D

With the exception of the Medicare Part B deductible, Medigap Plan D provides the same Medicare benefits as Plan C does.

Medigap Plan F

Thanks to its robust coverage, many people referred to Medigap Plan F as the "Cadillac" of Supplement plans. The plan covers:

- Part A coinsurance for hospital care, hospice care, and skilled nursing facility care

- Part B coinsurance

- Three pints of blood

- Deductible for Parts A and B

- Part B excess charge

- Foreign travel exchange of 80%

There is also a high-deductible version of plan F. You pay your share of all Medicare benefits until you hit the yearly deductible ($2,800 in 2024).

Plans F and C are no longer available to new Medicare beneficiaries.

Medigap Plan G

Medigap Plan G provides the same coverage as Plan F, minus the Part B deductible. It also has a high-deductible plan option.

We've been recommending Plan G for years. It offers great coverage and usually costs less than Plan F because monthly premiums are lower.

Medigap Plan K

Medigap Plan K employs a different cost-sharing model until enrollees meet a yearly out-of-pocket limit ($7,070 in 2024). Plan K pays 100% of your Part A coinsurance for hospital care. Everything else is covered at 50%:

- Part B coinsurance

- First 3 pints of blood

- Part A coinsurance for hospice and skilled nursing facility care

- Part A deductible

Once you meet your yearly max, Plan K pays 100% of costs. You also need to meet your Part B deductible before your Medigap plan pays those costs.

Medigap Plan L

Plan L is similar to Plan K in that beneficiaries must reach a yearly out-of-pocket limit and meet their Part B deductible before the plan starts paying 100% of costs. That limit is lower – only $3,530. Plan L covers 75% of costs before you reach the yearly limit:

- Part B coinsurance

- First 3 pints of blood

- Part A coinsurance for Hospice and skilled nursing facility care

- Part A deductible

As with Plan K, your Part A coinsurance is covered at 100% even before you reach the yearly out-of-pocket limit.

Medigap Plan M

Medigap Plan M covers the Part A coinsurance for hospital, skilled nursing facility, and hospice care. It also pays 50% of the Part A deductible. Your Medicare Part B coinsurance is covered 100%, and healthcare received in a foreign country is covered at 80%.

Medigap Plan N

Medigap Plan N covers the following:

- Part A coinsurance

- Part B coinsurance

- 3 pints of blood

- Part A deductible

- 80% of foreign travel emergency care

It's important to note that, although Plan N covers the Part B coinsurance, you may have a copayment for some office visits. In addition, if you have an emergency room visit that doesn't result in an inpatient admission, you may have a $50 copay.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs