Medicare Part B helps pay for medically necessary outpatient services.

Medicare Part B is sometimes referred to as medical insurance, as it helps to cover outpatient care and services. Along with Part A, Medicare Part B makes up what is known asOriginal Medicare.

What is Original Medicare?

Original Medicare is composed of Medicare Part A and Part B, and covers medically necessary inpatient and outpatient services. It does not, however, include self-administered prescription drugs.

- Medicare Part A: The hospital insurance half of Original Medicare, Part A covers inpatient hospital care, which means you must be formally admitted to a hospital as an inpatient. Any outpatient procedures done in a hospital are covered by Part B.

- Medicare Part B: This half of Original Medicare covers outpatient care such as preventive screenings, lab work, doctor appointments, and mental health care. It also covers some vaccines, including the COVID vaccine and flus shots. Though Part B generally helps with medications given in a medical setting, medication purchased from a pharmacy and taken at home is not covered.

Original Medicare does not cover most prescription drugs. For that, you need Medicare Part D prescription drug coverage. You can get Part D by joining either a standalone Medicare prescription drug plan or through a Medicare Advantage Prescription Drug plan (MA-PD).

If you are 65 or older and a natural-born U.S. citizen or a permanent legal resident who has lived in the U.S. for at least five years, you qualify for Medicare. People with qualifying disabilities or illnesses, such as ALS (also known as Lou Gehrig's disease) or end-stage renal disease are also eligible.

How do I enroll in Medicare Part B?

To enroll in Medicare and avoid late penalties, you must sign up during your Initial Enrollment Period (IEP). This starts three months before the month of your 65th birthday and lasts through the following three months. If you miss this period, you can sign up during the General Enrollment Period (GEP), which lasts from January 1 through March 31 every year. If your IEP includes January, February, or March, enrolling during this period would count only as your IEP.

The majority of people sign up for Medicare via the Social Security Administration. The easiest, fastest way to do so is through the online ssa.gov application, which is available 7 days a week, 24 hours a day and allows you to sign up for Part A and Part B. You can also speak to a Social Security representative by calling 1-800-772-1213 (TTY 1-800-325-0778) Monday through Friday, from 7 AM to 7 PM. Due to the COVID-19 pandemic, most Social Security offices have been closed to in-person enrollment, but you can check your local office here.

Social Security provides a checklist to help prepare for your Medicare application, but in general you will need:

- Current health insurance information (if applicable)

- Date and place of birth

- Medicaid number (if applicable)

Enrollment is automatic if you started collecting Social Security retirement benefits or Railroad Retirement Board (RRB) benefits at least four months before you turn 65. It is also automatic if you are diagnosed with ALS and at month 25 of receiving RRB or Social Security disability benefits.

How much does Medicare Part B cost?

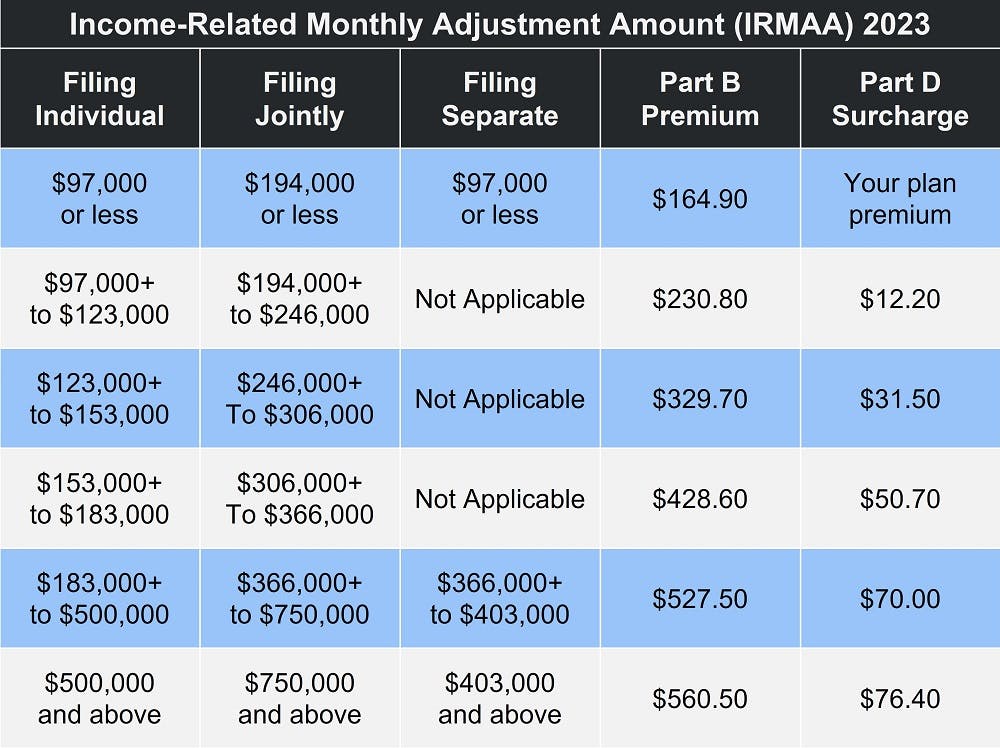

Medicare costs are made up of an annual deductible, coinsurance for most services, and a monthly premium. In 2023, the monthly premium for Medicare Part B is $164.90. Your premium gets automatically deducted from RRB or Social Security payments or, if you do not receive these payments, you get sent a bill. In addition to the standard premium, if your modified adjusted gross income (MAGI) from two years ago is above a certain amount, you must pay an Income Related Monthly Adjustment Amount (IRMAA).

The image below shows the adjustment amount at each income level:

Note that if you do not enroll in Medicare Part B when eligible, your monthly premium can increase up to 10 percent for each 12-month period you could have had Part B but did not. It increases the longer you go without coverage and lasts for as long as you have Part B.

Medicare Savings Programs

There are four Medicare Savings Programs:

- Qualifying Individual (QI) Program: This only covers Part B premiums and has a monthly income limit of $1,549 for individuals and $2,080 for married couples. Resource limits (checking and savings accounts, bonds, stocks) are set at $8,400 for individuals and $12,600 for married couples.

- Qualified Medicare Beneficiary (QMB) Program: The QMB program helps with Part A and Part B costs. Monthly income levels are set at $1,153 for individuals and $1,546 for married couples. The resource limits are the same as in the QI Program.

- Qualified Disabled and Working Individuals (QDWI) Program: Only covering Part A premiums, this program is designed for working people under 65 with a disability. People who receive Social Security disability benefits, and premium-free Medicare Part A, often lose their benefits when they return to work. The QDWI Program lets you keep premium-free Part A so long as you do not receive additional Medicare assistance from the state. The individual income limit is $4,615, with the limit for married couples being $6,189. Resource limits are $4,000 for individuals and $6,000 for married couples.

- Specified Low-Income Medicare Beneficiary Program: Though this also only covers Part B premiums, income limits are higher than the QMB program; $1,379 for individuals and $1,851 for married couples. Resource limits, however, are the same as the QMB and QI Programs. This covers less than the QMB program, so it is recommended to choose the QMB if you qualify for both.

Related reading: How to Qualify for a Medicare Savings Program

Can I opt out of Medicare Part B?

Though Medicare offers great coverage for most, you may find yourself wanting to cancel coverage. As long as you have creditable coverage elsewhere, you can disenroll from Medicare Part B without incurring late penalties. You simply need to fill out Form CMS-1763 and schedule an interview with a Social Security representative.

You can also defer your enrollment before your Medicare coverage starts; all you have to do is contact the Social Security Administration and let them know you do not want Medicare Part B. You want to do this as soon as possible to avoid paying any premiums for coverage you don't want.

Please note that deferring Medicare coverage may lead to lifelong late enrollment penalties if you don't have creditable coverage elsewhere or qualify for a Special Enrollment Period (SEP). When it comes to Medicare, "creditable coverage" depends mostly on two things:

- Having coverage through an employer with at least 20 employees

- Being actively employed with that employer

Employment can be your own or your spouse's. And pay attention to the "actively employed" part, as a retirement health plan or COBRA do not count as creditable.

Related reading: What Is Medicare Creditable Coverage?

Medicare Part B excess charges

Usually, Medicare Part B excess charges only apply if you see a provider that does not take Medicare or accept the Medicare-approved cost for care and services. Like all insurance, Medicare has an approved amount agreement, which is how much the plan will pay for a given service or procedure. If your healthcare provider does not accept this, you pay out-of-pocket. The following states do not allow doctors to charge excess charges:

- Connecticut

- Massachusetts

- Minnesota

- New York

- Ohio

- Pennsylvania

- Rhode Island

- Vermont

What is the Medicare Part B premium reimbursement?

As stated above, the Medicare Part B premium is $164.90 in 2023. The Part B reduction, or giveback benefit, is when a Medicare Advantage plan reduces the amount you pay toward that premium. It can be anywhere from less than $1, to the full premium amount. You don't technically get the money back; you pay the reduced amount, saving money in the process. If your Medicare payment comes out of your Social Security check, you will see the lower amount reflected there.

You might qualify for premium reduction if you:

- Do not already receive assistance for your Part B premium

- Are enrolled in Medicare Part A and Part B

- Enroll in a Medicare Advantage plan than provides the benefit

- Live in the zip code service area of a plan that offers the program

The quickest, easiest way to find and compare plans that may offer the giveback benefit is with our Find a Plan tool. You can also call us toll-free and speak to one of our licensed Medicare agents to have all your questions answered.

Additional resources

Social Security Office Locator

External Website Link

Checklist for Online Medicare, Retirement, and Spouses Applications

PDF Document - 886 KB