Although most people don't owe a monthly premium for Part A, there are still other out-of-pocket costs, such as deductibles and co-insurance.

No "part" of Medicare is completely free. However, most people qualify for premium-free Part A. And if you meet income and resource requirements, you may qualify for one of the Medicare Savings Programs (MSPs) that help cover some of your out-of-pocket Medicare costs.

This page explains what you'll pay for each part of Medicare, including premiums, deductibles, copayments, and coinsurance. We also explain Medicare late enrollment penalties and how to avoid them.

What Are the Parts of Medicare?

Medicare has four parts:

- Medicare Part A is sometimes called hospital insurance. It covers inpatient care received in a hospital or skilled nursing facility (SNF), as well as hospice care and some home healthcare services.

- Medicare Part B is also known as medical insurance. It helps pay for outpatient services like doctor visits, lab work, durable medical equipment (DME), and mental health care.

Together, Medicare Parts A and B are known as Original Medicare. The other two parts are:

- Medicare Part C is more commonly known as Medicare Advantage. These are private health insurance plans, similar to the group health plans many people have through an employer. They combine the benefits you get with Parts A and B, but most Medicare Advantage plans provide additional coverage as well, such as prescription drugs, routine vision and dental care, and fitness programs.

- Medicare Part D provides prescription drug coverage, which is not included with Original Medicare. These plans are also provided by private insurance companies that have contracted with the Centers for Medicare & Medicaid Services (CMS). You may join either a standalone Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD).

There is also Medicare Supplement Insurance. However, this is not one of the "parts" of Medicare. More commonly known as Medigap, these plans do not provide healthcare benefits. Instead, they help pay some of your out-of-pocket costs when you have Original Medicare. (You cannot have a Medicare Supplement plan if you have Part C).

Now, let's look at how much each Medicare part will cost you in 2023.

Medicare Part A Costs

There are three potential out-of-pocket costs for Medicare Part A:

- Monthly premiums

- Deductible

- Coinsurance

The vast majority of people who have Medicare do not have to pay a monthly premium for Part A. They or their spouse worked and paid Medicare taxes for the required 10 years (or 40 quarters) to qualify for premium-free Part A.

If you or your spouse did not pay Medicare taxes for the required 10 years, your monthly premium will be $506 per month. Those who paid Medicare taxes for 30 to 39 quarters will have a monthly premium of $278.

There is also a Part A deductible. This is the amount you have to pay out-of-pocket before Medicare starts paying. In 2023, the Medicare Part A deductible is $1,600 per benefit period. A benefit period begins the day you're admitted as a hospital inpatient and ends once you go 60 consecutive days without requiring inpatient care. You may have multiple benefit periods in a calendar year.

You'll have no coinsurance costs for your first 60 days of hospital care during each benefit period. Days 61 through 90 will cost you $400 per day. Beyond 90 days, you'll pay $800 per day, through your 60 lifetime reserve days. Once you use your lifetime reserve days, you are responsible for all costs.

If you're admitted to a skilled nursing facility after a qualifying hospital stay (3 days or more), you'll pay $0 for coinsurance for the first 20 days, and $200 per day for days 21 through 100. After that, you are responsible for all SNF costs.

Medicare Part B Costs

Medicare Part B also has a monthly premium, deductible, and coinsurance. Unlike Part A, though, nearly everyone pays the standard Part B premium of $164.90. You may pay less if you qualify for a Medicare Savings Plan (more on that in the final section).

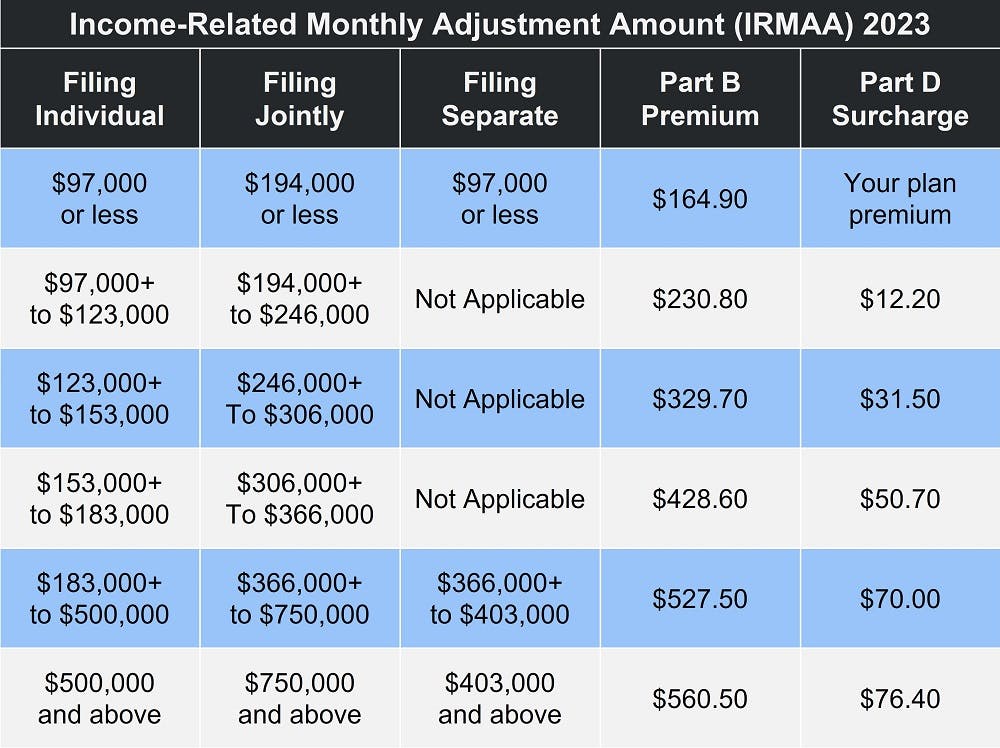

You may have a higher Part B premium if you're what Medicare calls a "high earner". The Income-Related Monthly Adjustment Amount (IRMAA) applies to anyone whose individual income exceeds $97,000 per year ($194,000 if you're married and file a joint tax return). For more details, please see our article Medicare Premiums: Rules for Higher Income Beneficiaries. The chart below details the adjustment amount at each income bracket.

The Part B deductible is $226 in 2023. Once you mThe Part B deductible is $226 in 2023. Once you meet your annual deductible, you're responsible for coinsurance, typically 20 percent of the Medicare-approved cost for covered services. There are, however, some preventive care screenings and services that have no out-of-pocket costs – including the yearly deductible. Annual wellness exams, screening mammograms, flu shots, and more carry zero out-of-pocket cost. Find the full list of preventive services on Medicare.gov.

Medicare Part C Costs

Medicare Part C costs vary depending on the coverage provided. Also, the plans are provided by private insurance companies, which are allowed to set their own rates as long as they work within the guidelines established by the CMS. There may be an annual deductible, monthly premium, and copays or coinsurance, which are payable at the time of service.

Many Advantage plans have no monthly premium. However, the average for all Part C plans is around $18 per month. Those that include prescription drug coverage have an average monthly premium of around $40 per month. Please note that you will still be responsible for the Medicare Part B premium, even if your Advantage plan also has a monthly cost. In addition, if your Medicare Advantage plan includes prescription drug coverage, it may have separate out-of-pocket costs.

One of the "advantages" of a Part C plan is that they have an annual max out-of-pocket (MOOP). The out-of-pocket max for 2023 is $8,300 for in-network care and $11,300 for out-of-network. Please note, though, that some Advantage plans have a lower MOOP. This is one of the metrics you should consider when comparing your Medicare Advantage plan options.

Our Find a Plan tool makes comparing plans easy. Just enter your zip code to see which Medicare plans are available in your area and compare benefits, costs, and more.

Medicare Part D Costs

As with Part C, Medicare Part D costs vary according to which plan and provider you choose. Again, you should expect to pay a premium, deductible, and copays or coinsurance.

High earners may also have to pay IRMAA for Part D. The chart above shows how much you'll pay at each income bracket.

The maximum Part D deductible is $505 in 2023. And while copays vary, you'll generally pay around 25 percent of your plan's cost for covered prescriptions.

Once you and your plan spend a combined total of $4,660, you enter the coverage gap. Although your out-of-pocket costs remain the same during this time, it's an important stage of your Part D coverage because your spending here counts toward reaching the catastrophic coverage stage. You reach this stage once your total out-of-pocket (not counting monthly premiums) for prescription drug costs reaches $7,400. At this point, your cost for covered prescriptions drops to whichever is greater: 5 percent or $3.95 for generic prescriptions and $9.85 for name brand drugs.

Late Enrollment Penalties

Medicare late enrollment penalties are designed to help ensure those who qualify for Medicare sign up when they become eligible.

Few people owe the Medicare Part A late fee, because relatively few people have to pay a monthly premium for Part A. However, if you do not qualify for premium-free AND you allow 12 months to pass from your eligibility date to the date you sign up for Medicare Part A, you will likely have to pay the late penalty. It is 10 percent of your monthly premium for twice the number of years you could have had Part A but did not. So, a one-year delay equals two years paying the late enrolment penalty, two years equals four years paying it, and so on.

The Medicare Part B late enrollment penalty is different. It is also figured in 12-month increments. However, you have to pay this penalty for the entire time you have Medicare. In addition, it goes up for every year you could have had Part B but did not. The calculation looks like this:

- 12 months without Part B = 10 percent fee

- 24 months without Part B = 20 percent fee

And so on. The fee is based on the Medicare Part B premium, which means it will change every year as the monthly premium changes.

You'll also owe the Part D late enrollment penalty for the entire time you have Medicare. But you begin accruing this late fee after only 63 days without creditable prescription drug coverage. Creditable means a prescription drug plan that is comparable to Medicare Part D in terms of both cost and benefits. In other words, a prescription savings program like GoodRx does not count.

Because Part D premiums vary, the late enrollment penalty is based on the national base beneficiary premium, which is $32.74 in 2023. You pay 1 percent of this amount for every month you went without prescription drug coverage and then round the total to the nearest dime. If you went 9 months without a prescription drug plan, the calculation would look like this:

($32.74 x 1%) x 9 = $2.9466

Rounded to the nearest dime, you'd pay an extra $3 for your prescription drug plan every month for the entire time you have Medicare Part D.

You can avoid the late enrollment penalties by signing up for Medicare as soon as you're eligible. The best time is during your Initial Enrollment Period, which covers the 7 months surrounding your Medicare eligibility month. This article walks you through how to sign up for Medicare.

Can a Medicare Savings Plan Help?

There are four different types of Medicare Savings Programs.

- Qualified Medicare Beneficiary Program: QMB helps pay premiums for Parts A and B plus the deductible, coinsurance, and copayments under Part B.

- Specified Low-Income Medicare Beneficiary Program: SLMB helps pay your Part B premium as long as you're enrolled in Part A and meet income and resource requirements.

- Qualifying Individual Program: QI is a state-run program that helps cover your monthly Part B premium.

- Qualified Disabled and Working Individuals Program: QDWI is for people who qualify for Medicare due to a disability and are not yet 65 years old. Income and resource limits are slightly higher, as most of these individuals have returned to work.

- Extra Help: If you need assistance paying your prescription drug costs, you may qualify for Extra Help. There are varying degrees of help available. Find your level here.

Eligibility for these programs depends on your income and resources. We provide full details on qualifying for a Medicare Savings Program here.

Additional Resources

Your Medicare Costs

External Website Link

What Is Original Medicare?

Internal Website Link