People with a modified adjusted gross income over $97,000 per year ($194,000 if you're married) may pay a surcharge on their Part B and Part D premiums.

If you are what Medicare calls a higher income beneficiary, your Medicare premiums may be higher thanks to the Income-Related Monthly Adjustment Amount (IRMAA). Fewer than 5 percent of Medicare beneficiaries owe the IRMAA surcharge.

IRMAA only applies to two parts of Medicare: Part B and Part D.

How much is the Income-Related Monthly Adjustment Amount?

The Income-Related Monthly Adjustment Amount varies according to your income. IRMAA is based on the modified adjusted gross income (MAGI) that you report to the IRS when you file your income taxes.

Most beneficiaries pay the standard Part B premium, which is $194.90 per month in 2023. This represents around 25 percent of the premium cost, with the Medicare program paying the remaining 75 percent. Higher income beneficiaries, however, pay a higher portion of the Medicare Part B premium, depending on their MAGI: 35, 50, 65, or 80 percent.

There is no standard monthly premium for Medicare Part D prescription drug plans (PDPs), as private insurance companies sell these plans. Instead, the IRMAA surcharge is based on the national base beneficiary premium, which is $32.74 in 2023.

The Part D IRMAA comes out of your monthly Social Security benefits, even if you pay your Part D premiums another way. If you do not collect Social Security, you will receive a bill from the relevant federal agency, such as the Railroad Retirement Board (RRB) or Centers for Medicare & Medicaid Services (CMS).

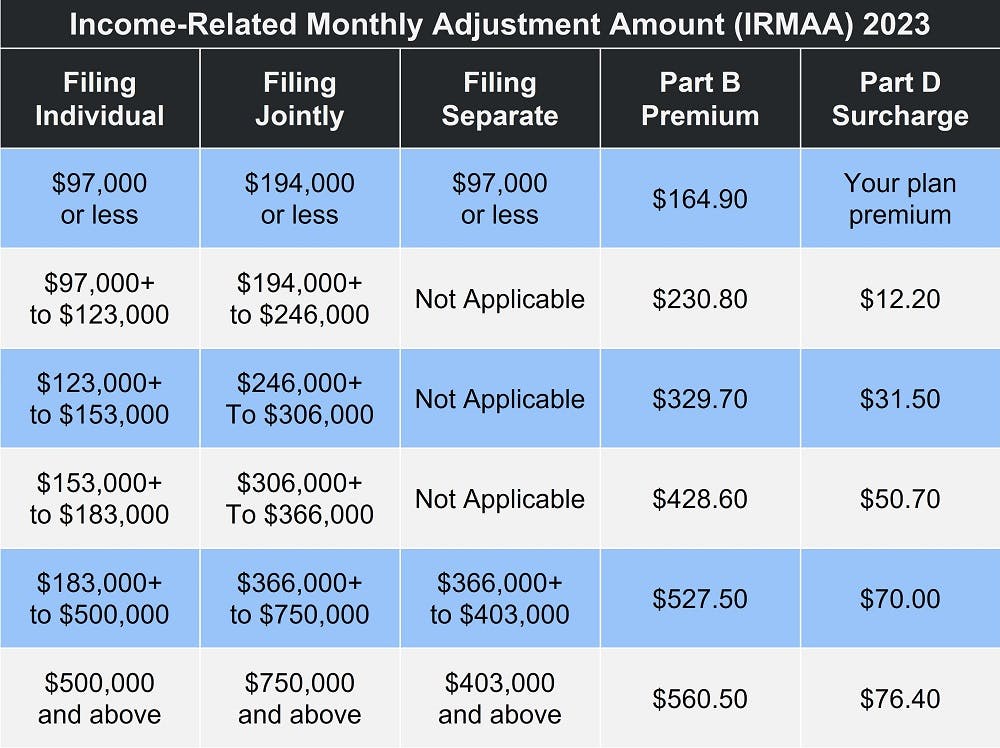

The chart below details the IRMAA rate at each income level.

IRMAA only effects monthly premiums. It does not apply to deductibles, coinsurance, copayments, or any other out-of-pocket Medicare costs. If you have a Medicare Advantage plan, you still have to pay the Part B premium, so the surcharge still applies. And if you have Medicare prescription drug coverage – whether it's through a standalone Part D plan or a Medicare Advantage Prescription Drug plan, you still owe the Part D IRMAA fee.

Who decides whether you have to pay the IRMAA surcharge?

The Social Security Administration (SSA) determines whether you owe the IRMAA surcharge, based on your federal tax return from 2 years ago. So, in 2023, the IRMAA decision uses the modified adjusted gross income you reported to the IRS for tax year 2020 (that you filed in 2021).

You only owe the Income-Related Monthly Adjustment Amount if your MAGI is over $97,000 (filing an individual tax return) or $194,000 (married filing a joint tax return).

If Social Security determines you owe the Medicare premium surcharge, they'll send you a letter explaining what your premium is and how they came to their decision. If you filed an amended tax return that reduced your MAGI, contact Social Security. They'll need a copy of the amended tax return as well as the receipt that it was received by the IRS.

You only have to pay the surcharge for the parts of Medicare that you have. If you have both Medicare Part B and Medicare Part D, you'll owe both. But if you only have one, you only pay the surcharge for the part that you have.

What can you do if your income changes?

Because Social Security uses your income from 2 years ago (the most recent tax return available to them), it's quite possible your income changed in the interim – particularly if you retired. Social Security will consider an adjustment when there's a permanent change to your income.

The following situations are special circumstances that the Social Security Administration recognizes may have led to a reduction in your MAGI:

- A change in marital status, such as marrying, divorcing, or becoming widowed

- You or your spouse had a reduction in work hours or stopped working

- You or your spouse lost an income-producing property through no fault of your own (such as a natural disaster)

- An employer pension plan underwent a scheduled cessation, reorganization, or termination

- You or your spouse received a settlement from a current or former employer due to bankruptcy, closure, or reorganization

As long as you can provide documentation of the special circumstance that led to a reduction in your income, Social Security should work with you to lower your IRMAA surcharge. The documentation should, of course, support your claims. For example, if you got divorced, you need to submit a copy of the divorce decree.

Can you appeal the Medicare Income-Related Monthly Adjustment Amount?

If you disagree with Social Security's decision, you may file an appeal. Complete the Request for Reconsideration, i.e., Form SSA-561-U2. You then send the completed form (keep a copy for your records) to your local Social Security Office. Find it here.

Due to COVID-19, local SSA offices have been closed since March of 2020. However, if you need to talk someone at Social Security, you may do so by calling 1-800-772-1213 or TTY 1-800-325-0778. Representatives are available Monday through Friday from 7 AM until 7 PM.

If you disagree with the MAGI reported by the IRS, you must first correct the information with the IRS. For those who receive notification that they owe the Part D IRMAA surcharge but do not have Medicare prescription drug coverage, you need to call CMS at 1-800-MEDICARE (633-4227) or TTY 1-877-486-2048.

Additional resources

Request for Reconsideration (Form SSA-561)

External Website Link

Social Security Office Locator

External Website Link

Your Medicare Costs

External Website Link

How Much Does Medicare Cost?

Internal Website Link