Because your health needs change over time, Medicare has dedicated enrollment periods every year.

The Medicare Advantage Open Enrollment Period (OEP), formerly known as the Medicare Advantage Disenrollment Period (MADP), occurs every year from January 1 through March 31.

This is different from the Annual Enrollment Period (AEP) that runs each year from October 15 through December 7. AEP is for everyone who is currently enrolled in Medicare. The Medicare Advantage OEP is only for people who are currently enrolled in a Part C plan (more commonly known as Medicare Advantage).

What Happened to the Medicare Advantage Disenrollment Period?

The Centers for Medicare and Medicaid Services (CMS) changed the name to the Medicare Advantage Open Enrollment Period in 2019. The new name gives you a better idea of what you're allowed to do during OEP, since it isn't just about leaving a Medicare Advantage (MA) plan.

During Open Enrollment, you have two options. You may either leave your current Advantage plan to return to Original Medicare or switch from one MA plan to another. There is a third option for beneficiaries who lose their prescription drug coverage when making that change. Namely, they may then enroll in a standalone Medicare Part D plan if they leave a Medicare Advantage Prescription Drug plan for either Original Medicare or an MA plan that doesn't cover prescriptions.

You cannot have both an MA-PD and a standalone Part D plan. If you join a Part D plan when you're already enrolled in a Medicare Advantage Prescription Drug plan, you will be automatically disenrolled and returned to Original Medicare.

How is Annual Enrollment different from Medicare Advantage Open Enrollment?

The Annual Enrollment Period (also known as the annual election period) is your chance to make any changes you like to your Medicare coverage – even if you don't have an Advantage plan. Options include:

- Leaving Original Medicare to join an Advantage plan

- Switching from one MA plan to another

- Leaving your Medicare Part C plan to return to Original Medicare

- Joining a prescription drug plan (PDP)

- Switching from one Medicare Part D plan to another

If you choose to leave a Part D plan without joining another (or an MA-PD), you won't be able to until next year's AEP. Unless you had creditable prescription drug coverage in the interim, you'll likely have to pay the Part D late penalty. Click here for more information.

The changes that you make during Annual Enrollment take effect on January 1 of the following year.

When else can you join Medicare?

The Medicare program offers beneficiaries a number of enrollment periods, starting with your Initial Enrollment Period (IEP).

Your IEP is the 7-month period surrounding your Medicare eligibility date. If you age into the program, this is your 65th birthday, with your enrollment window opening 3 months before your birth month and closing 3 months later. So, if you turn 65 on June 22, your IEP begins on March 1 and ends on September 30. However, if your birthday falls on the first, move those dates ahead by one month. In this case, a June 1 birthday gives you an IEP window from February 1 through August 31.

Medicare enrollment at age 65 is only automatic if you began collecting Social Security benefits at least 4 months before your 65th birthday. Everyone else must apply for Medicare. You do this through the Social Security Administration (SSA) here. You may also call SSA at 1-800-772-1213 or TTY 1-800-325-0778.

If you prefer to speak directly with someone at Medicare, you may do so by calling 1-800-MEDICARE (633-4227) or TTY 1-877-486-2048. However, signing up is only through Social Security.

For those who qualify for Medicare due to disability, your 25th month of collecting disability benefits from either Social Security or the Railroad Retirement Board (RRB) is your Medicare eligibility month. Your IEP begins in month 22 and closes at the end of month 28. You will be enrolled in Medicare automatically. However, your IEP still applies, as this is your opportunity to sign up for a Medicare Part D prescription drug plan, Advantage plan, and possibly a Medigap plan. Check our Medigap state pages to see whether your state offers Medigap protections for under-65 Medicare beneficiaries. Just click here and scroll to the bottom of the page to find your state.

If you're under 65 when you join Medicare, you'll have a second IEP when you turn 65.

The Medicare General Enrollment Period

If you failed to sign up for Medicare Part A (hospital insurance) and/or Medicare Part B (medical insurance) during your Initial Enrollment Period AND you don't qualify for a Special Enrollment Period (SEP), you'll have to wait for the General Enrollment Period (GEP). This occurs every year from January 1 through March 31.

During General Enrollment, you may sign up for Parts A and B. You then have from April 1 through June 30 to join a Part D or Advantage plan. All of your Medicare coverage choices will take effect the month after you make your selections.

Medicare Part A late enrollment penalty

Most people get Medicare Part A premium-free. If you or your spouse do not have the required work history, though, you may have to pay a monthly premium ($506 in 2023). If a full 12 months pass from when you become eligible for Part A and sign up, you'll owe the penalty, which is 10 percent for twice the number of years you delayed enrollment. So, one full year equals two years paying the penalty, two years equals four, and so on.

Medicare Part B late enrollment penalty

The Medicare Part B late enrollment penalty is also on a 12-month basis. It differs, though, in the fact that you have to pay the penalty for the entire time you have Medicare. For every 12-month period you delay enrollment, you pay an extra 10 percent for your Part B premium. In 2023, the monthly premium is $164.90, giving you a late fee of $16.49 for every full year you went without coverage.

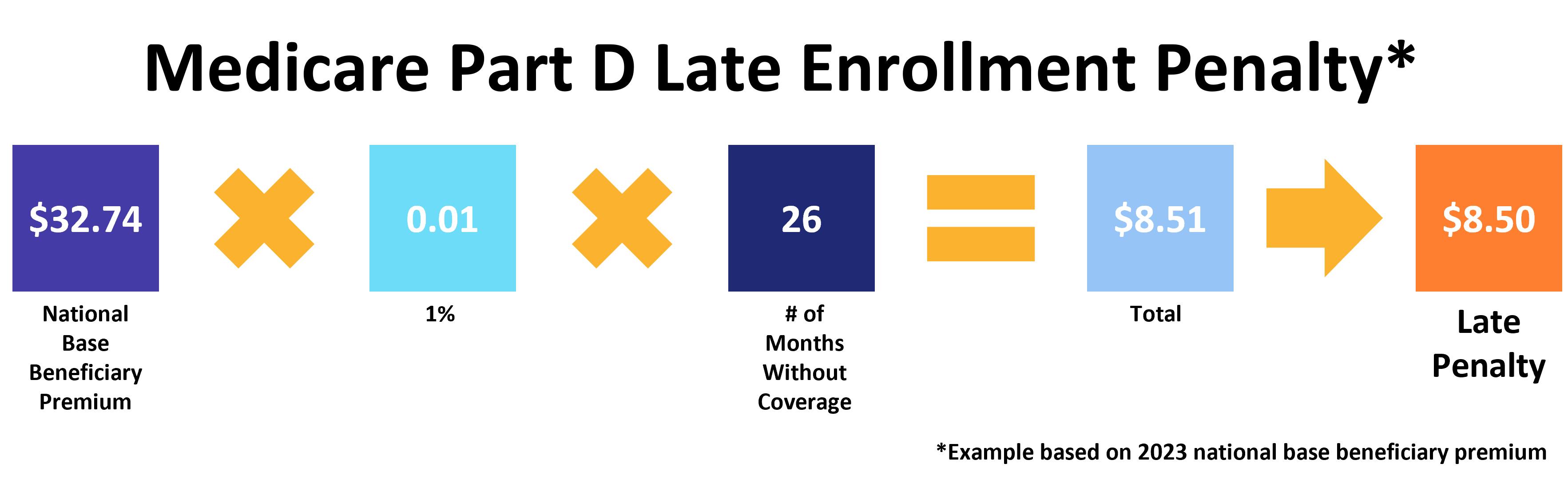

Medicare Part D late enrollment penalty

Part D's penalty is different. You start accruing late fees once you go 63 consecutive days without creditable drug coverage (i.e., insurance that's comparable to Medicare in terms of both price and coverage). The penalty is based on the national base beneficiary premium, which changes a little every year. You pay 1 percent of that amount for every month you didn't have coverage. Like Part B, you owe this penalty for the entire time you have Medicare Part D. See the image below for the calculation.

What are Special Enrollment Periods?

Medicare offers Special Enrollment Periods for beneficiaries who experience certain life events. For example, if you already have a health plan when you qualify for Medicare, you may delay enrollment until that coverage ends without incurring any penalties.

There are dozens of ways to qualify for an SEP. Find the full list on Medicare.gov here.

When can you join a Medicare Supplement Plan?

Medicare Supplement Insurance, commonly known as Medigap, is a popular option for beneficiaries enrolled in Original Medicare (Parts A and B). This is because, unlike Medicare Advantage, there is no annual out-of-pocket maximum with Original Medicare.

Medigap plans help pay a variety of out-of-pocket costs. Coverage varies according to which plan you choose, but all Supplement plans pay the Part A deductible and give you an additional 365 lifetime reserve days for inpatient hospital care.

The best time to join a Medicare Supplement plan is during your Medigap Open Enrollment Period. It lasts for 6 months, beginning the day you are both age 65 or older AND enrolled in Medicare Parts A and B.

You cannot have an Advantage plan as well as a Supplement plan.

When can you disenroll from a Medicare Advantage Plan?

If you want to leave an Advantage plan to return to Original Medicare, you have four options:

- The Medicare Annual Enrollment Period from October 15 through December 7

- The Medicare Advantage Open Enrollment Period from January 1 through March 31

- During your first year of joining an Advantage plan as part of your trial rights

- If you qualify for a Special Enrollment Period

If you belong to a Medicare Advantage Prescription Drug plan, you'll be immediately disenrolled and returned to Original Medicare simply by signing up for a standalone Medicare Part D plan.

Our Find a Plan tool makes it easy to compare your Medicare plan options. Just enter your zip code to get started.

Additional resources

ClearMatch Medicare: Find a Medicare Plan

Medicare.gov: Special Circumstances