Nobody wants to spend more than they have to on their healthcare coverage (or anything else, for that matter). So, if you’re eligible for Medicare, make sure you’re enrolled in Part B (medical insurance) and Part D (prescription drug coverage). If you wait too long, you’ll end up paying more than you should.

Why there’s a penalty

It takes a lot of money and resources to run Medicare. But making sure that Medicare is available to everyone who needs it — today and in the future—is something from which many may benefit. That’s why enrolling in Parts B & D as soon as we’re eligible is so important.

The reason is simple — if everyone waited until they were sick to enroll in Part B or Part D, Medicare would never be able to sustain itself. The cost of paying for care for individuals who are ill and/or require expensive medications would far outstrip the amount of money taken in by Medicare in the form of premiums and taxes. That’s why Medicare needs everyone to begin paying their premiums for Parts B and D as soon as they’re eligible — so there’s enough money to care for everyone when they need it.

Understanding enrollment in Medicare Part D

Part D, Medicare Prescription Drug Coverage, is different from Part B in two important ways. First and foremost, enrollment in a Medicare Prescription Drug Plan (PDP) is never automatic. Secondly, the only way you can get a Medicare Prescription Drug plan is through a private insurance carrier. If you’re eligible for Medicare Parts A & B and don’t have creditable prescription drug coverage from an employer or other source, you’re eligible for Part D.

Unlike Part B, premiums for Medicare Prescription Drug Plans vary between different insurance carriers. One company may even have several different drug plans, all with different premiums and coverage levels. When you join a Medicare drug plan, the plan will tell you if you owe a penalty and what your premium will be. You may have to pay this penalty for as long as you have a Medicare drug plan.

If you had to pay a Part D late enrollment penalty before you turned 65, the penalty will be waived once you reach 65.

How much is the late enrollment penalty for Part D?

Calculating the late enrollment penalty for Part D is a bit more complicated, mostly because Part D premiums aren’t standard. In addition, you can be penalized anytime you go a period of 63 days or more without a Medicare prescription drug plan or some other creditable coverage (from a former employer, for example).

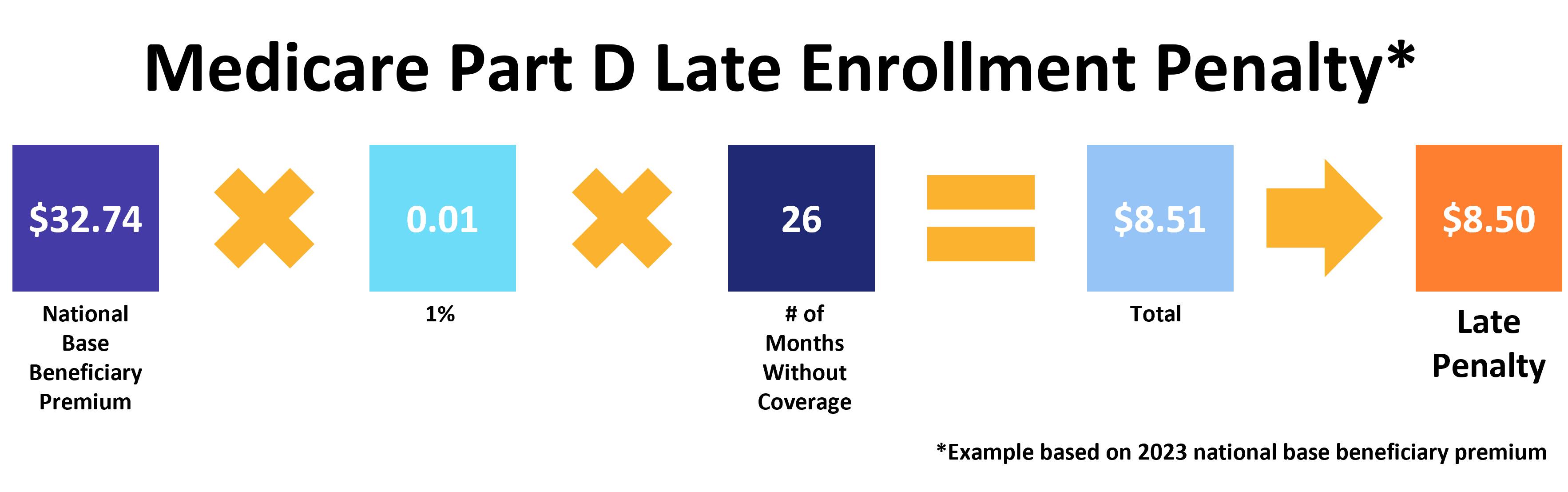

The penalty itself is calculated by multiplying 1 percent of the national base beneficiary premium by the number of full months you were eligible for coverage, but didn’t enroll. The final amount will be added to your monthly premium.

If you went 26 months without prescription drug coverage, the calculation looks like this:

Find the right Part D plan for you

Our Find a Plan tool makes finding the right prescription drug plan simple. Just enter your zip code and any prescription medications you take to review Medicare plans in your area.