Medicare reimbursement refers to the payments Medicare makes to providers, not to its beneficiaries.

For the most part, if you have Medicare, you don't need to file reimbursement claims. Like other health insurance, you pay your coinsurance at the time of service and your provider bills Medicare for the rest.

There may be times, though, that you have to request payment from Medicare. This page explains how Medicare reimbursement works, when you need to file a claim, and how to do so.

What costs do you have to pay with Medicare?

To understand Medicare reimbursement, you first need to understand what your out-of-pocket costs are.

Original Medicare includes two parts.

- Medicare Part A covers inpatient services, such as you'd receive in a hospital or skilled nursing facility (SNF).

- Medicare Part B covers outpatient services, including doctor visits, durable medical equipment (DME), and lab work.

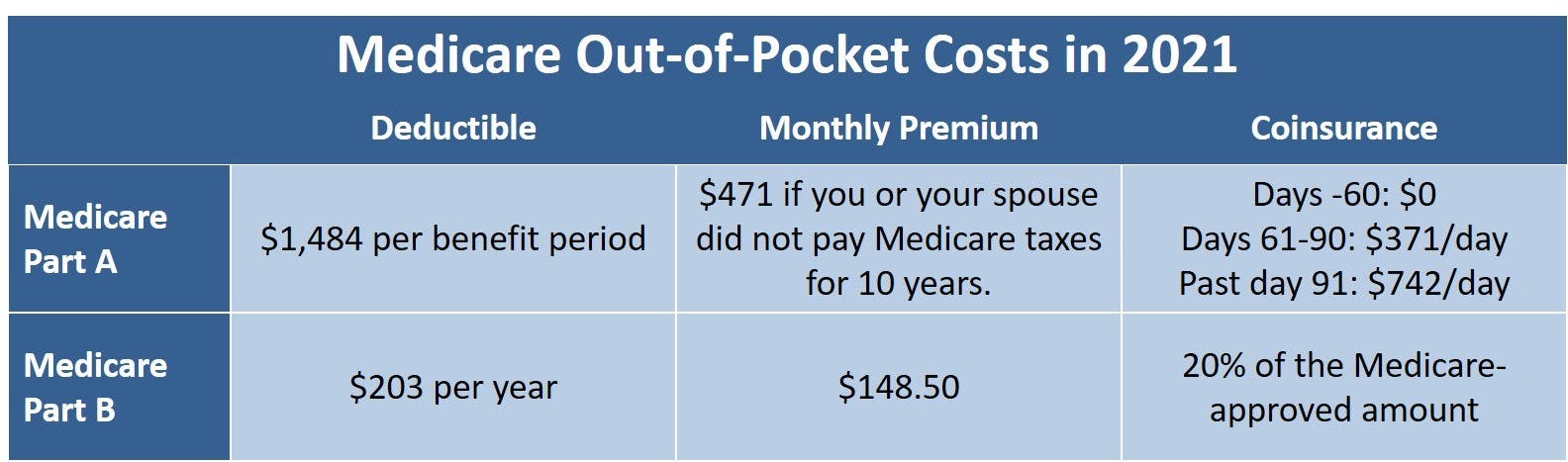

Your out-of-pocket costs for these services may include deductibles, premiums, and coinsurance.

The following table describes your out-of-pocket costs with Original Medicare:

Nearly everyone gets Medicare Part A premium-free. But please note that, even if you have a Medicare Advantage plan, you still owe the Medicare Part B premium.

What is Medicare reimbursement?

Medicare reimbursement is how healthcare providers are paid for their services to Medicare beneficiaries. The Centers for Medicare & Medicaid Services (CMS) determines the rates it pays for each service based on a variety of cost factors. This is reflected in the CMS Physician Fee Schedule (PFS).

The Medicare-approved rate is usually significantly lower than what private insurance companies and people without health insurance pay for the same services.

What is a Medicare Participating Provider?

A Medicare participating provider is one who fully accepts the Medicare program and its reimbursement rates. Over 90 percent of primary care physicians (who are not pediatricians) are participating providers.

Are there non-participating Medicare providers?

Yes. Non-participating Medicare providers may accept assignment for certain services but are not under contract with Medicare. If you choose a non-participating provider, you likely have to pay the entire bill at the time of service. The provider should then submit a reimbursement claim to Medicare on your behalf.

When using a non-participating provider, make sure to ask whether they accept assignment for your procedure or service. If not, they cannot bill you more 15 percent higher than the Medicare-approved rate. For example, if the Medicare rate for a service is $100, the provider cannot charge you more than $115 for that service.

Can providers opt-out of Medicare?

Yes, providers can opt-out of Medicare, but very few do (less than 1% of non-pediatric doctors). Providers who opt-out will not accept any amount of Medicare reimbursement. CMS provides information on doctors who choose to opt out.

Will you ever need to file a Medicare claim?

If you choose a non-participating provider, you may need to file a Medicare reimbursement claim. However, this is usually only necessary if your provider failed to file in a timely manner (claims must be filed within 12 months of the date of service).

Medicare will pay 80 percent of the approved amount. If the provider accepts assignment for the service, that leaves you with the 20 percent coinsurance. However, if your healthcare provider does not accept assignment, you'll still only be reimbursed for the 80 percent Medicare covers.

To make sure your doctor participates in Medicare, check Medicare's physician directory. You can filter search results so that they only show participating providers who accept assignment.

If it's a question of medical equipment, non-participating providers are not always limited to the 15 percent cap. Always ask DME suppliers to verify that they are participating providers and accept assignment. Medicare.gov provides this information in its Supplier Directory as well.

How to file a claim for Medicare reimbursement

It's always best if the provider files the claim, since they have the requisite information regarding the rates and coding. However, if the provider refuses or fails to file in time, you may submit your own Medicare reimbursement claim.

The process is simple. Go to CMS.gov to download the Patient Request for Medical Payment (Form CMS-1490S). Follow the instructions on the form and submit it to Medicare for payment.

If you have any questions, call 1-800-MEDICARE (633-4227) or TTY 1-877-486-2048.

Reimbursement with Medicare Advantage

If you have Medicare Part C, commonly known as Medicare Advantage, you should not need to file a claim for reimbursement. Private insurance companies provide Medicare Advantage plans, though, so check your plan's details for more information and to make sure you operate within your insurer's guidelines. For example, if you belong to a health maintenance organization (HMO), you may be responsible for 100 percent of the cost if you go outside the provider network.

Reimbursement with Medicare Part D

Medicare Part D prescription drug plans are also provided by private insurance companies. Whether you have a standalone Medicare Part D plan or belong to a Medicare Advantage Prescription Drug plan (MA-PD), you should not request reimbursement from Original Medicare.

If your doctor prescribes a medication not included in your Part D plan's drug formulary, you may need to file an appeal. But it's a good idea to first talk to your doctor to see whether a covered medication would be an effective substitute.

No matter which "part" of Medicare you're dealing with, if you aren't sure whether a service or medication is covered, ask. Talk to your doctor. Talk to your plan. Talk to Medicare. By asking a simple question, you could save a lot of money and frustration.

Additional resources

Primary Care Physicians Accepting Medicare: A Snapshot

External Website Link

Opt Out Affidavits

External Website Link

Care Compare

External Website Link

Medicare Forms

External Website Link

How Do I File a Medicare Appeal?

Internal Website Link