Original Medicare doesn't cover prescription drugs. For that, you need Part D.

Part D prescription drug coverage is the coverage you'll need for prescription drugs. All plans must cover a wide range of drugs people with Medicare take, and you can find the plan's list of covered drugs in their formulary.

If you have Original Medicare, you must enroll in a stand-alone Part D plan during the appropriate enrollment period. Or, some Medicare Advantage plans offer Part D coverage along with their other benefits.

Since you must have Part D coverage, it's important to know how and when to enroll in a plan to avoid penalties or gaps in coverage.

How to enroll in a Part D plan

There are two ways you can get Medicare Part D coverage:

- Through a Medicare Drug Plan, which adds Part D coverage to Original Medicare, some Medicare Cost Plans, some Private Fee-for-Service plans, and Medical Savings Account plans. To be eligible, you must have Part A and/or Part B

- Through a Medicare Advantage (Part C) plan or other Medicare Health Plan with drug coverage. You'd get all your Part A, Part B, and Part D drug coverage through these plans. Not all Medicare Advantage plans offer drug coverage, so you must choose one that does

Our Find a Plan tool makes comparing Part D plans easy – and there's no need to give us your contact information! You just enter your zip code and prescription medications to start reviewing available plans. Click here to start reviewing Medicare plans in your area.

Please note you must enroll during one of the Part D enrollment periods.

Medicare Part D enrollment periods

There are several different periods when you can enroll in a Part D prescription drug plan:

Initial Enrollment Period

Your Initial Enrollment Period (IEP) occurs when you turn 65 and lasts for seven months. It begins three months before your birth month and extends through the three months following your birth month.

Or, if you're younger than 65 but qualify for Medicare due to a disability, your coverage begins 24 months after you receive Social Security or Railroad Retirement Board (RRB) benefits. You can sign up for Medicare Part D starting three months before your 25th month of getting these benefits, during the 25th month, or for three months after the 25th month.

You first get Medicare when:

- You're newly eligible because you turned 65

- You're newly eligible due to a disability

- You're already eligible for Medicare due to a disability and turn 65

- You don't have Medicare Part A, and enrolled in Part B during the General Enrollment Period

- You have Part A and enrolled in Part B during the General Enrollment Period

During this time, you can enroll in a Medicare Part D plan or Medicare Advantage (MA) plan with Part D coverage. You must have Medicare Part A to enroll in Part D.

Annual Open Enrollment Period

From October 15 through December 7 each year, you're able to make changes to your Medicare Part D prescription drug plan during Medicare's Annual Open Enrollment Period. This includes:

- Changing from Original Medicare to a Medicare Advantage (MA) plan

- Changing from a MA plan back to Original Medicare

- Switching from one MA plan to another

- Switching from a MA plan that doesn't offer drug coverage to one that does

- Switching from a MA plan that does offer drug coverage to one that doesn't

- Joining a drug plan

- Switching from one drug plan to another

- Dropping Medicare drug coverage completely

If you enroll in a Part D drug plan during this time, your coverage will begin January 1.

Special Enrollment Period

Under certain circumstances, you could qualify for a Special Enrollment Period (SEP). During this time, you can make changes to your Medicare Advantage and Medicare prescription drug coverage without penalty. Examples of qualifying circumstances include (but are not limited to):

- You moved to a new address that isn't in your plan's service area

- You moved to a new address that is in the service area, but have new plan options in your new location

- You moved back into the U.S. after living outside the country

- You just moved into, currently live in, or just moved out of an institution

- You're no longer eligible for Medicaid

- You left coverage from your employer or union

- You involuntarily lost other drug coverage that's as good as Medicare drug coverage

- You left a Medicare Cost Plan that had drug coverage

- You dropped your coverage in a PACE plan

- Medicare terminated your plan's contract

- You become eligible for both Medicare and Medicaid

- You qualify for Extra Help

Rules about when you can make changes and the type of changes you can make are different for each SEP. For full information, please see our article, 15 Ways to Qualify for a Medicare Special Enrollment Period.

General Enrollment Period

The General Enrollment Period happens each year between January 1 and March 31, with coverage beginning July 1.

When you enroll in either Part A or Part B during the General Enrollment Period, you have from April 1 through June 30 to choose your drug coverage. However, unless you qualify for an SEP, you may owe a late enrollment penalty if you enroll during this time.

Medicare Advantage Open Enrollment

From January 1 to March 31, you can switch from one MA plan to another (with or without drug coverage), or you can drop your MA plan and return to Original Medicare. In this case, you'll also be able to join a standalone drug plan if making that change results n you losing your prescription drug coverage.

You cannot:

- Switch from Original Medicare to an MA plan

- Join a Medicare drug plan if you're in Original Medicare

- Switch from one drug plan to another (if you're in Original Medicare)

Coverage would start the first day of the month after you ask to join the plan.

Part D late enrollment penalty

You may owe a late enrollment penalty if at any time after your IEP is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other creditable prescription drug coverage.

The penalty is permanently added to your Part D premium, and you'll have to pay the penalty for as long as you have Medicare drug coverage.

The cost of the penalty depends on how long you went without Part D or creditable drug coverage:

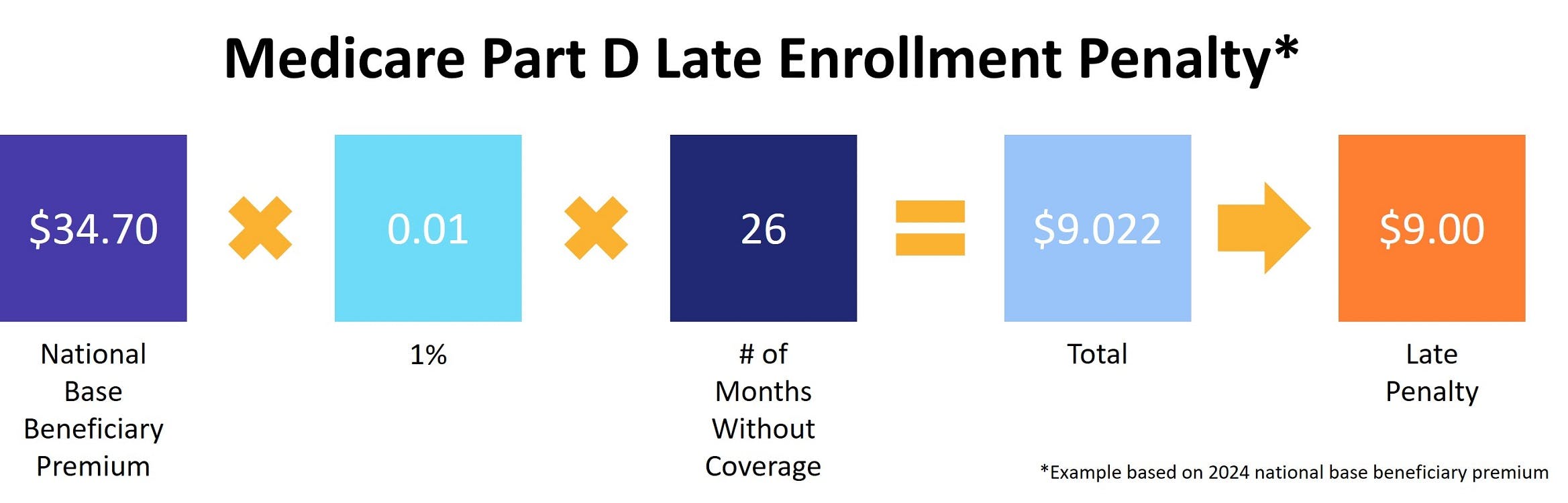

- Multiply 1% of the "national base beneficiary premium" ($34.70 in 2024) times the number of full, uncovered months

- Round to the nearest $0.10

- Add to your monthly premium

If you go 26 months without creditable drug coverage, the calculation looks like this:

Note that the national base beneficiary premium can change each year, so your penalty amount can also change each year.

If you join a drug plan, the plan will tell you if you owe a penalty and what your premium will be.

Avoid the Part D late enrollment penalty by enrolling in Medicare drug coverage when you're first eligible, enrolling in drug coverage if you lose other creditable coverage, and keeping records showing when you had other creditable drug coverage so if your plan asks, you have documentation.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs

- Social Security Administration: Extra Help