Although you can find Medicare Advantage plans with a $0 monthly premium, Medigap is different.

There are no Medicare Supplement plans that do not have a monthly premium.

Medicare Supplement Insurance, more commonly known as Medigap, helps pay some of your out-of-pocket costs when you have Original Medicare (Parts A and B). While you can find Medicare Advantage plans with a $0 monthly premium, the same is not true of Medigap. This page explains how Medicare Supplement Insurance works, what each plan covers, and the average cost of a Medigap plan.

What is Medicare Supplement Insurance?

People began calling Medicare Supplement plans "Medigap" because they are said to "fill the gaps" in your Medicare coverage. This does not mean that a Medigap plan provides additional benefits the way many Medicare Advantage plans do. It also is not a type of health insurance plan, like the HMOs and PPOs many of us had through an employer. Instead, a Supplement plan helps pay your costs under Original Medicare, such as deductibles and coinsurance.

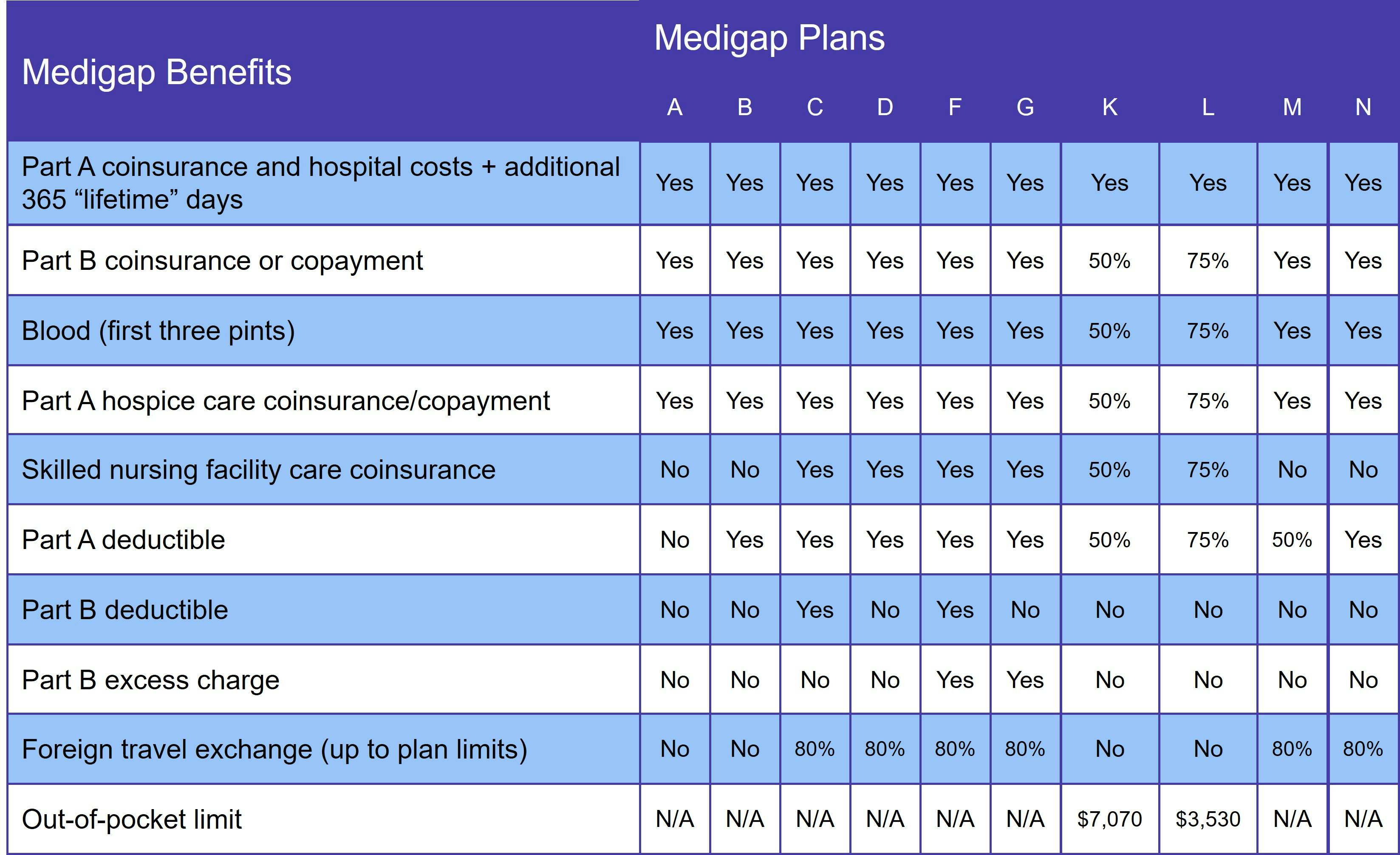

Although the program falls under the guidance of the Centers for Medicare & Medicaid Services (CMS), private insurance companies sell Medigap policies. There are 10 standardized Medigap plans (A, B, C, D, F, G, K, L, M, and N). That means that every Medigap Plan A (or B, D, etc.) has the same benefits no matter which insurance company you choose.

The coverage under each plan may be the same, but premiums vary. Medigap insurers must work within state and federal guidelines, however. For example, some states only allow Medigap insurers to use the community rating pricing method, which means your premium is never based on your age. (For more information, see the section Medigap Pricing Guidelines.)

Medigap is not available to Medicare beneficiaries who are enrolled in an Advantage plan. It also will not pay for your prescriptions. This is because Medigap only helps pay for covered services under Original Medicare, and that does not include prescription drug coverage.

How Medicare Supplement Insurance works in Massachusetts, Minnesota, and Wisconsin

The Medicare program allows three states to manage their Medicare Supplement program differently.

Click the state's link to learn more.

Each essentially offers a "basic" plan that covers the same things you'd get with Medigap Plan A as well as an expanded version with more robust benefits.

Is Medigap one of the "Parts" of Medicare?

Medicare has four parts, none of which are Medigap.

Original Medicare is made up of Part A and Part B. There is also Medicare Part C, more commonly known as Medicare Advantage. These resemble the group health plans many of us are familiar with. There is also Medicare Part D, which provides prescription drug plans.

What Does Original Medicare Include?

Medicare Part A covers inpatient care received in a hospital or skilled nursing facility (SNF). Most people don't pay a monthly premium for Part A, because they worked and paid Medicare taxes for the required 10 years to qualify for premium-free. If you or your spouse do not have the required work history, you'll pay up to $506 a month for Part A in 2023.

Additional Medicare costs for Part A include the deductible and coinsurance. The Part A deductible is $1,600 per benefit period, which begins the day you're admitted as an inpatient and ends once you got 60 consecutive days without receiving inpatient care.

Medicare Part A coinsurance is calculated according to how many days you spend as an inpatient.

- Days 1 through 60 have a $0 coinsurance

- You'll pay $408 per day for days 61 through 90

- Days 91 through your 60 lifetime reserve days cost $816 per day

All Medicare Supplement plans give you an additional 365 lifetime reserve days for inpatient care.

Skilled nursing facility care has a coinsurance rate of $0 for the first 20 days and $204 per day for days 21 through 100. After that, you are responsible for all SNF costs.

Medicare Part B helps pay for outpatient services like doctor visits, mental health care, and durable medical equipment (DME). Out-of-pocket costs for Part B include:

- Standard Part B premium: $174.40

- Deductible: $240

- Coinsurance: Typically 20% of the Medicare-approved cost

For most outpatient services, you must meet your Part B deductible before Medicare begins paying its share.

How to compare Medigap plans

Medigap plan benefits vary, but at a minimum, each includes:

- Medicare Part A deductible

- An additional 365 lifetime reserve days for inpatient care

- First 3 pints of blood in a transfusion

The chart below lists the benefits for each Supplement plan.

Our Find a Plan tool makes comparing your Medigap plan options easy. Just enter your zip code to start reviewing Supplement plans in your area.

What about Medigap Plan C and Medigap Plan F?

Medigap Plan C and Medigap Plan F are no longer available to beneficiaries who qualified for Medicare on or after January 1, 2020. Both plans cover the Medicare Part B deductible, which is no longer allowed due to a new federal law. Medigap Plan D and Medigap Plan G provide the same coverage as C and D respectively, minus coverage for the Part B deductible.

If you qualified for Medicare BEFORE that date, you may still sign up for Plan C or Plan F. However, we do not recommend it. Once a Medigap plan is discontinued, premiums begin to rise. Even before Plans C and F were discontinued, we typically recommended Plan G, since the lower premium usually led to a lower overall out-of-pocket.

How much does Medigap cost?

Estimating Medigap plan costs is challenging, because many factors go into determining Supplement plan premiums. This includes:

- Where you live, since each state has its own guidelines regarding pricing methods

- What insurance company you choose, since each insurer sets its own rates

- Whether you had a guaranteed issue right or had to undergo medical underwriting (more on that in the next section)

- Which plan you choose, including whether you choose a high deductible version

Nationwide, the average Medigap premium is around $150 per month, but that includes high deductible plans, which have lower monthly premiums. National averages for each plan are:

- Medigap Plan A: $250 per month

- Medigap Plan B: $130 per month

- Medigap Plan C: $250 per month

- Medigap Plan D: $150 per month

- Medigap Plan F: $175 per month

- Medigap Plan G: $130 per month

- Medigap Plan M: $225 per month

- Medigap Plan N: $120 per month

Again, though, these are national averages. Costs vary widely according to you live. For example, the average cost of Medigap Plan G is $210 in Florida and $270 in New York, but only $120 in Texas.

Medigap pricing guidelines

The two factors that play the biggest role in what you'll pay for Medigap are whether you have a guaranteed issue right and the pricing method the insurer uses to set rates.

Guaranteed issue rights mean you do not have to go through medical underwriting. This is the process insurance companies use to determine how likely you are to make a claim. But if you have a guaranteed issue right, you don't have to go through underwriting.

The best time sign up for Medicare Supplement Insurance is during your Medigap Open Enrollment Period (OEP). This is the first 6 months you are both age 65 or older AND enrolled in Original Medicare. During your Medigap OEP, you cannot be denied coverage or charged more for your plan just because you have preexisting conditions.

There are other ways to qualify for guaranteed issue rights. Find the full list on Medicare.gov.

If you do not have a guaranteed issue right, your Medigap application goes through the underwriting process. This involves you answering a series of health-related questions, such as age, weight, medical history, and tobacco use. Depending on your answers, you may be denied coverage or charged a higher rate.

Medical underwriting is why we generally encourage Medicare beneficiaries to sign up for Medigap during their OEP. In addition, we recommend getting the best coverage you can afford, since most states require you to undergo medical underwriting if you want to change your plan later.

Next we have pricing methods. Medigap insurers set their rates based on one of the following pricing methods:

- Attained-age rating: Your premium is based on how old you are at the time you apply. You'll typically pay less under this method in the beginning. Over time, though, these plans usually cost the most since your premiums increase as you get older.

- Community rating: Everyone within a certain geographic area pays the same rate, which does not increase as you get older. Over time, you pay less for a community rated plan, although they usually cost more in the beginning. This is the least common pricing method.

- Issue-age rating: Monthly premiums are determined by your age at the time you apply for coverage. They won't rise with your age, but they may go up due to inflation.

Most insurers use either attained-age or issue-age rating. Guidelines vary by state, though. Our Medicare Supplement page describes the Medigap program in detail. For state-specific information, just scroll to the bottom of the page and choose your state.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- ClearMatch Medicare: The Ultimate Guide to Medigap