Medicare typically bills in 3-month increments, if you don't have your premiums automatically deducted from Social Security.

Medicare helps pay for a variety of healthcare services, but it isn't free. Beneficiaries are responsible for a variety of Medicare costs, including monthly premiums, deductibles, and coinsurance or copayments.

Most Medicare beneficiaries collect Social Security benefits. For these enrollees, Medicare premiums are deducted from their monthly Social Security check. But if you haven't retired yet, you have to pay your bill directly to Medicare. Or, if you're what Medicare terms a high earner, you may pay more for Medicare. This page looks at a number of reasons your first Medicare bill may be higher than you expected.

Who gets a Medicare Premium Bill?

The Medicare Premium Bill (CMS-500) goes to beneficiaries who pay Medicare directly for their Part A premium, Part B premium, or who owe the Part D Income-Related Monthly Adjustment Amount (IRMAA). Please note that, even if you collect Social Security, if you owe the Part D IRMAA, you must pay the surcharge directly to Medicare.

Billing for the Medicare Part B premium occurs every 3 months. You'll be billed monthly if you owe the Medicare Part A premium or the Part D IRMAA.

How much should your Medicare Premium Bill Be?

How much your Medicare premiums cost depends on which parts of Medicare you have and whether you qualify for premium-free Part A.

Most people (or their spouse) paid Medicare taxes for the required 10 years/40 quarters to qualify for premium-free Part A. If you or your spouse do not have the required work history, however, the Medicare Part A premium is up to $506 per month in 2023.

The standard Medicare Part B premium is $164.90 in 2023. If you pay your premium directly to Medicare instead of having it deducted from Social Security, then you'll owe $494.70 every 3 months for your Medicare Part B premium. But, if your income exceeds certain thresholds, you may have to pay the Part B IRMAA.

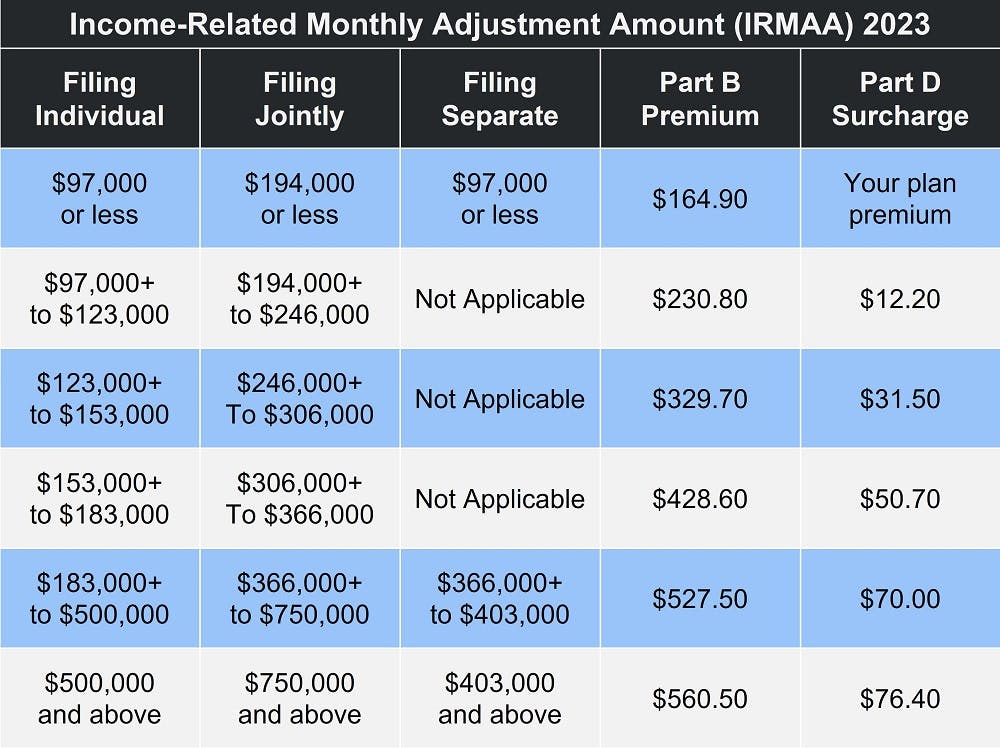

The Income-Related Monthly Adjustment Amount is based on your modified adjusted gross income (MAGI) from 2 years ago. That means that, in 2023, Social Security and the Centers for Medicare & Medicaid Services (CMS) look at your reported income from 2021. If it was over $97,000 (filing single) or $194,000 (married filing jointly), you likely owe the Part B IRMAA.

Medicare Part D premiums are different because private insurance companies provide Part D prescription drug plans. That means your payments go directly to the plan provider. However, if you owe the Part D IRMAA, you'll receive a Medicare Premium Bill for that amount.

Income thresholds for Part D IRMAA are the same as for Part B. To see what your payments will be, see the table below.

How Do You Know if You Owe the Income-Related Monthly Adjustment Amount?

Using data from the Internal Revenue Service (IRS), the Social Security Administration (SSA) determines who owes the Income-Related Monthly Adjustment Amount. SSA will notify you if you owe IRMAA. This notification will include information about appealing the IRMAA decision.

If you're new to Medicare, you may be charged the standard Part B premium in the beginning, with the IRMAA determination coming once SSA receives your MAGI information from the IRS. Once you receive your Initial Determination Notice, you have 10 days to contact Social Security if you believe the determination was made in error.

You may appeal the IRMAA decision if you've experienced a permanent income reduction in the past 2 years. This is very common for Medicare beneficiaries who retired recently.

Visit SSA.gov for more information about IRMAA.

Did you delay signing up for Medicare?

If you delayed Medicare enrollment and did not qualify for a Special Enrollment Period (SEP), your monthly premiums may be higher due to late enrollment penalties.

American citizens qualify for Medicare when they turn 65. You may also qualify before turning 65 if you have a disability, end-stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS, more commonly known as Lou Gehrig's disease). Your Initial Enrollment Period (IEP) begins 3 months before your eligibility month and ends 7 months later. So, if your birthday or 65th month of collecting disability is in June, your IEP begins March 1 and ends September 30.

The only people who are automatically enrolled in Medicare are those who were collecting either Railroad Retirement Board (RRB) or Social Security benefits at least 4 months before their 65th birthday. Everyone else has to apply for Medicare.

In addition, even those who are automatically enrolled in Medicare must choose to join a Medicare Part D prescription drug plan. If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

What is the Medicare late enrollment penalty?

You may owe the late enrollment penalty for Part A, Part B, or Part D – or all three. How much you owe and how it's calculated depends on the part and how long you went without Medicare coverage.

Very few people pay the Medicare Part A late enrollment penalty, because nearly everyone gets premium-free Part A. But, if you delayed enrollment for a full 12 months AND you don't get premium-free Part A, you may owe the penalty.

The Part A late penalty is 10 percent of your premium for twice the number of years you could have had Part A but didn't. So, if you delay for 12 full months, you pay the penalty for 2 years. A 24-month delay leaves you owing the late fee for 4 years, and so on.

The Medicare Part B late enrollment penalty is also calculated in 12-month increments. However, you owe the late fee for the entire time you have Medicare. In addition, every year you delay enrollment adds another 10 percent to your late fee. In this case, that means 12 months equals 10 percent, 24 months equals 20 percent, and so on.

Part D's late fee is different, since you can only go 63 days without creditable prescription drug coverage before you begin accruing the penalty. "Creditable" means that your prescription drug plan is comparable to Medicare in terms of both costs and coverage. That means that prescription savings clubs do not qualify as creditable.

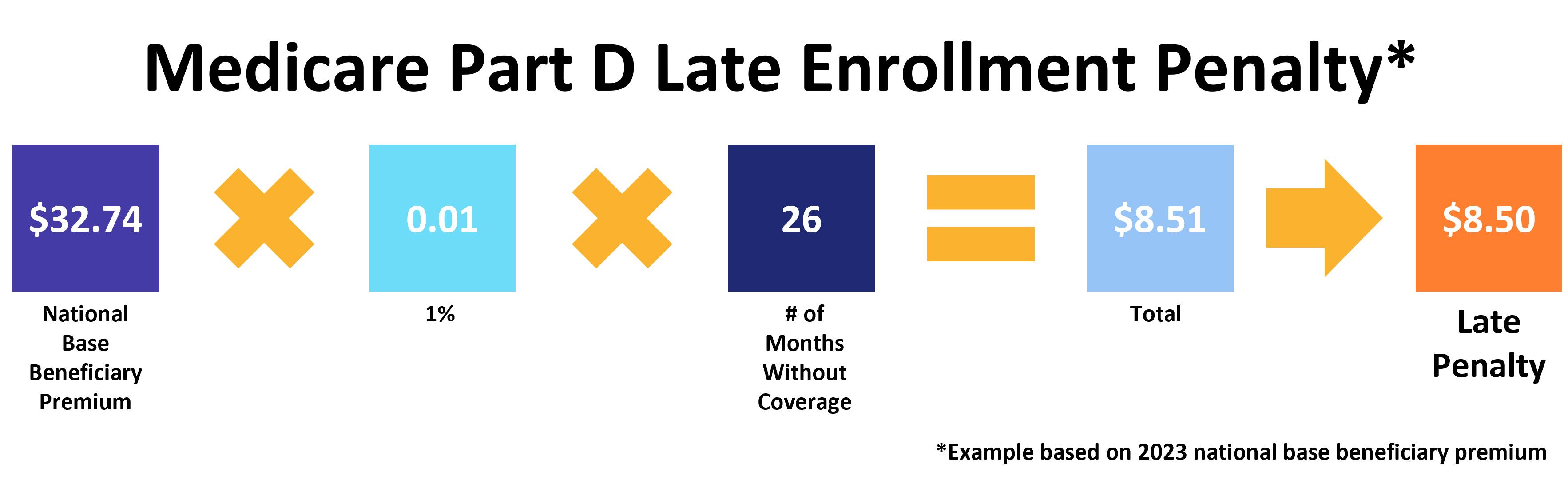

Since private insurance companies provide Part D plans, the late enrollment penalty is based on the national base beneficiary premium. This changes every year. In 2023, the base beneficiary premium is $32.74. The late fee is 1 percent for every month you went without prescription drug coverage. If you go 26 months without coverage, the calculation looks like this:

Like Part B, you owe the Part D late enrollment penalty for the entire time you have Medicare.

Ways to pay your Medicare Premium Bill

There are four ways to pay your Medicare Premium Bill:

- Sign up for Medicare Easy Pay, which allows Medicare to automatically deduct your premiums from your personal savings or checking account.

- Through your MyMedicare.gov account. If you don't have one, create one here. This is the easiest way to make sure Medicare always has your most up-to-date information and answer common Medicare questions.

- Use your personal checking or saving account's online bill pay service.

- Pay your bill via U.S. mail, using the payment coupon included with your Medicare Premium Bill. Payment options include check, money order, credit card, or debit card.

For more information on paying your Medicare premiums, go to Medicare.gov.

What about Medicare Advantage?

Medicare Part C, more commonly known as Medicare Advantage, is similar to Part D in that the plans are provided by private insurance companies. That means your monthly premiums vary depending on your plan and provider. However, Part C is optional. You will never owe late enrollment penalties for a Medicare Advantage plan.

However, signing up for an Advantage plan does not exempt you from the Medicare Part B premium. You're also still responsible for any late enrollment penalties and the Income-Related Monthly Adjustment Amount, if either of those apply.

If you have a Medicare Advantage Prescription Drug plan and owe the Part D IRMAA, premium payments go to your plan provider; you pay the surcharge to Medicare.

Compare your Medicare Advantage, Medigap, and Part D plan options with our Find a Plan tool. Just enter your zip code to begin reviewing Medicare plans in your area.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Log in or Create Your MyMedicare Account

- Medicare.gov: Pay Part A & Part B Premiums

- SSA.gov: Initial IRMAA Determination Notices