Unlike most Medicare enrollment periods, you only get one Initial Coverage Election Period.

Your Initial Coverage Election Period (ICEP) is when you’re first able to select a Medicare Advantage (Part C) or prescription drug plan (Part D).

Medicare Advantage plans have the same coverage as Medicare Part A and Part B, but most offer additional benefits such as hearing, vision, dental, fitness memberships, prescription drug coverage, and more.

Standalone Medicare Part D plans can be added to either Original Medicare or Part C – assuming your MA plan doesn't include prescription drug coverage.

Your ICEP usually happens at the same time as your Initial Enrollment Period (IEP), which is when you’re first eligible to enroll in Medicare Part A and B, though your circumstances may dictate a different ICEP.

Even though the ICEP and IEP are very similar and often take place at the same time, there are slight differences. Read on to learn more about your Medicare ICEP and what you can do during it.

What is the initial coverage election period?

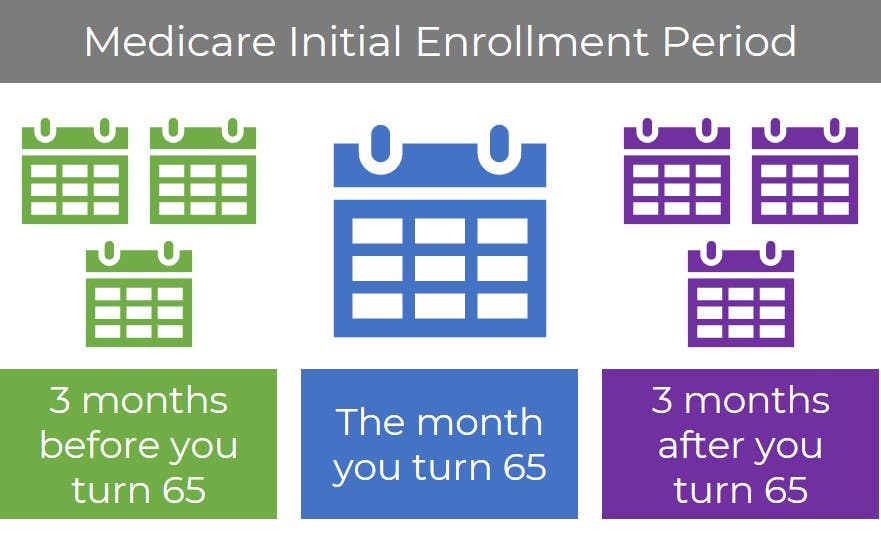

Your Initial Enrollment Period (IEP) is the seven-month period surrounding your 65th birthday when you first become eligible for Medicare and can enroll in Part A (hospital insurance) and Part B (medical insurance). This period begins three months before the month you turn 65, includes your birthday month, and ends three months after.

Your Initial Coverage Election Period (ICEP) is when you’re first eligible to choose and enroll in an MA plan.

Your ICEP will happen at the same time as your IEP if you enroll in both Part A and Part B when you turn 65. However, there may be instances when a beneficiary chooses to delay Part B enrollment, such as if they are still working and are covered by their employer’s health plan. In this case, the ICEP would start three months before their Part B coverage is scheduled to begin and terminate on the last day of the month before their Part B coverage starts.

For example, if you begin collecting Social Security benefits for at least four months before you turn 65, you will be automatically enrolled in Medicare Parts A and B the month you turn 65. The exception is if your birthday is on the first of the month, in which case you'll be enrolled the month before your birthday.

Let's say you turn 65 on June 15. In that case, your IEP begins March 1 and ends on September 30 (seven full months). Once you're enrolled in both Part A and Part B, your ICEP begins and you can then choose additional coverage, like a Medicare Advantage, Part D, or Medigap plan.

If you delay enrollment in either Part A or Part B – beyond the seven months of your IEP – you'll have to sign up for Medicare during a Special Enrollment Period. The "special circumstances" that qualify you for an SEP dictate how long you have to sign up for Medicare and then any supplemental coverage in the form of Part C, Part D, or Medigap.

If you turn 65 on June 1, your IEP runs from March 1 through September 30. You choose not to sign up for Part B because you’re still working and are covered by your employer. When you retire, you enroll in Part B. In this example, your Part B coverage begins on September 1. In this case, your ICEP would be in effect from June 1 through August 31 (the three months before your Part B coverage is scheduled to take effect). Then, your MA coverage would also begin September 1.

Learn more with 15 Ways to Qualify for a Medicare Special Enrollment Period.

Other Medicare enrollment periods

There are other times throughout the year when you can enroll in Medicare Part B and/or Part A (if you didn’t do so during your IEP) and don't qualify for a Special Enrollment Period.

The Annual Enrollment Period (AEP) runs from October 15 through December 7 each year and is a time you can join, switch, or drop an MA plan. Your coverage will begin on January 1.

If you missed your IEP and don't qualify for a Special Enrollment period, you can sign up for Part A and/or Part B during the General Enrollment Period (GEP), which runs from January 1 through March 31 each year. You then have from April 1 through June 30 to choose any supplemental coverage in the form of Medigap, Part C, or Part D.

The Medicare Advantage Open Enrollment Period also runs from January 1 through March 31 each year, but it's only available to people who are already enrolled in an MA plan. During this time, you may either change to another Advantage plan or return to Original Medicare. If making that change results in you losing prescription drug coverage, you may then sign up for a standalone Part D plan.

When does my coverage begin?

The date your coverage begins depends on which month you sign up during your IEP, but coverage always starts on the first of the month after enrolling.

- If you sign up before the month you turn 65, coverage begins on the 1st of the month you turn 65

- If you sign up the month you turn 65 or the three months after, your coverage effective date is the 1st of the next month

If you enroll in an MA plan during your ICEP, your coverage will start on the same day as your Original Medicare coverage. If you enroll during the GEP, you may have to pay a late enrollment penalty but your coverage will begin the month after you sign up.

Finding the right Medicare plan for you

Health insurance is not one-size-fits-all. The Medicare plan that works for your best friend or even your spouse may not be the right plan for you. That's where working with a licensed Medicare agent can help. They'll answer your questions and help you find the right coverage for your unique needs and budget. Or, do a bit more research first with our Find a Plan tool. Just enter your zip code to compare the costs and benefits of Medicare plans in your area.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: When Does Medicare Coverage Start?