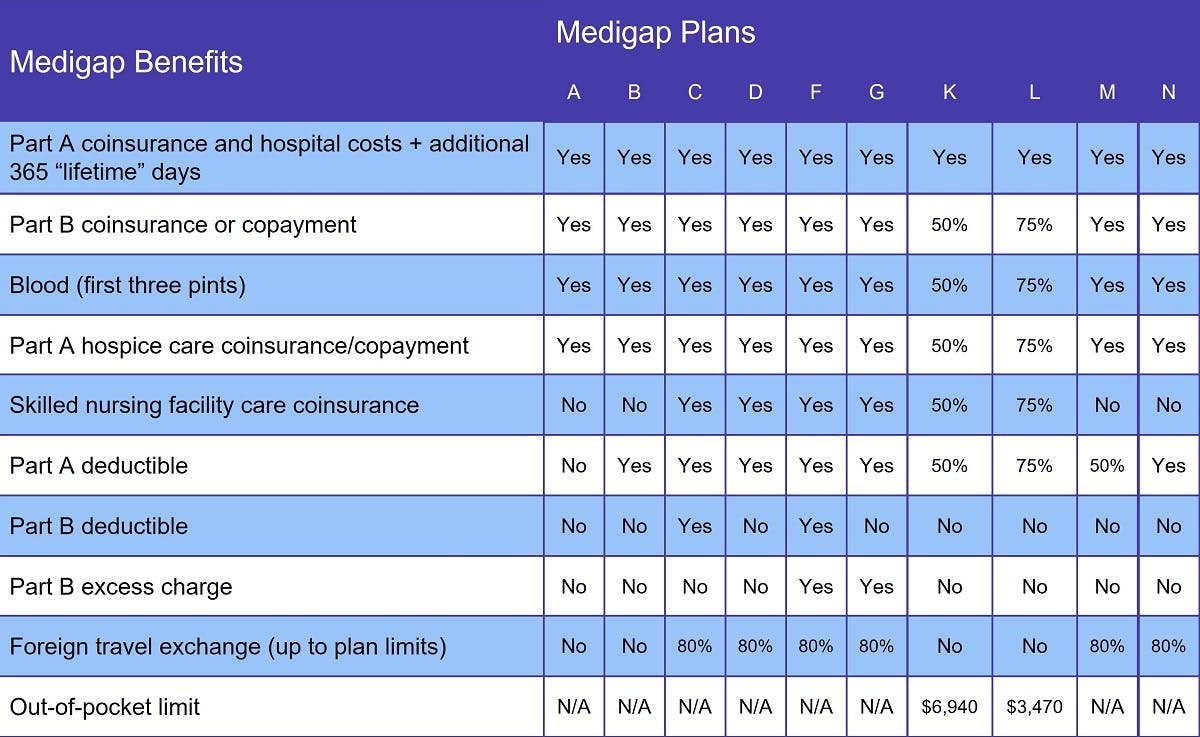

You can click on any of the plan letters below to learn more about the specific plan. Please also see the following notes below the chart when referencing the plans.

2023 Data – Table Source

- Plan F also offers a high-deductible plan which means before your Medigap plan pays anything, you will pay for Medicare-covered costs up to the deductible of $2,700 in 2023.

- The out-of-pocket limit is the amount you must pay in addition to your yearly Part B deductible before your Medigap plan kicks in and pays 100% of covered services for the rest of the year.

- Out-of-pocket limits reflect 2023 costs.

- Plan N does not pay for the co-payment of up to $20 for some office visits, or up to $50 co-payments for some emergency room visits.

- Medigap plans are standardized in a different way in Massachusetts, Minnesota, and Wisconsin.

What Is Medigap?

Medigap is Medicare supplement insurance, which can help pay for healthcare costs that Medicare Parts A and B don’t cover. You will usually have to have Medicare Part A and Part B to buy a Medigap policy. Medigap policies cannot be obtained with Medicare Advantage. Medigap insurance is provided by private health insurance companies such as Blue Cross and Blue Shield, HealthNet, and Humana. A Medicare supplement policy must follow Federal and state laws. In most states, there are 10 different, standardized Medigap plans available, labeled with letters: A, B, C, D, F, G, K. L, M, and N.

What Are the Eligibility and Enrollment Requirements?

Medicare applicants who are eligible for a Medigap policy must also enroll in Medicare Part A and Part B to receive the benefits of a Medicare supplement health insurance plan. Medigap policies contain an additional monthly premium on top of Medicare Part B. You can discuss your Medicare supplement insurance plan options with one of our licensed sales agents. They can help you sort through the choices to find a plan that best fits your needs.

Is it a Family or Group Plan?

Medigap policies and other Medicare supplement insurance plans are not considered family or group plans. If you’re married, both you and your spouse will need to obtain a Medicare supplement insurance policy to receive the benefits.