The Medicare program is completely funded by the Medicare Payroll Tax plus the monthly premiums and co-insurance paid by beneficiaries.

Medicare tax is automatically taken out of your paycheck to cover Medicare Part A, which is Medicare's hospital insurance. Employers and employees split the tax amount, both paying 1.45% of an employee's income. People who are self-employed pay the tax during quarterly filings and high-income earners pay a higher percentage (an additional 0.9% if your income exceeds $200,000 per year).

What is Medicare tax?

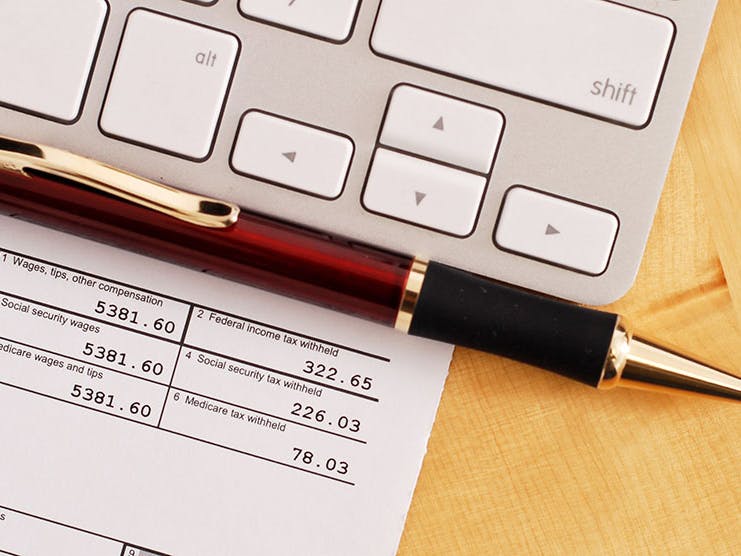

Medicare tax is a federal payroll tax that is automatically deducted to pay for Medicare Part A. Typically, all workers in the U.S. have to pay this wage tax. It is grouped under the Federal Insurance Contributions Act (FICA) so you may see Medicare and Social Security taxes as a single FICA deduction on your paycheck.

Established in 1966, the Medicare tax is meant to combat the issue many face of declining income and increased health care needs as we age. Pre-Medicare, insurance costs grew too high to successfully manage and some even had policies canceled based on age.

How does the Medicare tax work?

The Medicare tax is made up of two portions: the half you pay, automatically taken from each check, and the half your employer pays. The tax is calculated using your gross pay, minus any pre-tax healthcare deductions (insurance, health savings plan, etc.) which leaves your Medicare taxable wages.

Collecting this tax is required of all employers and they must regularly deposit both portions to the IRS. Self-employed people pay Medicare tax through their self-employment tax, so it is paid quarterly instead of on each check. If you are self-employed, you are responsible for paying both halves of the Medicare tax.

Though the Medicare tax rate has not changed since 1986, an Additional Medicare Tax for high-income earners was implemented as part of the Affordable Care Act (ACA) in 2013.

What is the Medicare tax for?

The Medicare tax covers Medicare Part A, which provides hospital insurance for Medicare beneficiaries. This covers inpatient hospital stays, some home health services, hospice care, and skilled nursing care. Medicare tax makes up 88% of Part A's total revenue.

All the revenue for Medicare Part A goes to the Hospital Insurance trust fund, a fund that is losing money as health care expenses outgrow the amount brought in each year. The Congressional Budget Office estimated in 2021 that the Hospital Insurance trust fund would be empty by 2026.

Though it has Medicare in the title, the Additional Medicare Tax paid by high-income earners is actually used to help offset some of the costs of the ACA. Funds go towards provisions such as health insurance tax credits, making insurance more affordable for millions of people.

What is the current Medicare tax rate?

In 2023, the Medicare tax rate is set at 1.45%, which is matched by an additional 1.45% from employers, for a total of 2.9%. High-income individuals pay an additional 0.9% on any wages above the annual earning threshold (in 2022 $200,000 for individuals, $250,000 filing jointly).

Self-employed individuals have to pay the full 2.9% themselves, as well as the Additional Medicare Tax for any earnings above the threshold. All taxable income, including bonuses, overtime, paid time off, salaries, and tips are subject to Medicare tax.

While pre-tax deductions such as medical insurance payments are excluded from Medicare wages, Medicare tax is charged on premiums for life insurance and any funds contributed to a retirement account. You must also pay Medicare tax in investment income; 3.8% on whichever is less, your adjusted gross income over the annual maximum or your net investment income.

Frequently asked questions

What kind of tax is Medicare?

Medicare tax is a federally required tax automatically deducted from your paycheck to pay for Medicare Part A.

What does the Medicare deduction on my paycheck mean?

The deduction simply means your employer is fulfilling their responsibilities. All employers must deduct this tax and make regular deposits to the IRS.

What happens if my employer did not withhold Medicare and/or Social Security taxes?

If you do not see these deductions, your employer is not following tax laws and could be hit with civil and criminal sanctions. Make sure there hasn't been an error, or that you did not accidentally claim exempt status.

What is a Medicare benefit tax statement?

Also called a 1095-B, this is proof of coverage that shows you are enrolled in Medicare Part A and your health insurance meets ACA requirements.

Additional reading

How Much Does Medicare Cost?

Internal Website Link

Are Medicare Premiums Tax-Deductible?

Internal Website Link

Do You Pay Taxes on Social Security?

Internal Website Link

What Income Is Used to Determine Medicare Premiums?

Internal Website Link