Some Medicare mistakes can literally cost you. Learn how to avoid them.

Most of us make minor mistakes every day and few of them are life altering. Some mistakes, though, may cost you – literally. In this post, we share 10 costly Medicare mistakes and explain how to avoid them.

1. Delaying Medicare enrollment

The single most expensive mistake you can make with Medicare may be failing to enroll on time.

If you qualify for Medicare based on your age (65 or older), your Initial Enrollment Period (IEP) begins 3 months before your 65th birthday. It extends through the 3 months following your birth month, giving you a full 7 months to sign up for Medicare.

Unless you qualify for a Special Enrollment Period (SEP), failure to enroll during your IEP could leave you paying late fees for the rest of your life. The amount you owe varies according to the part and how long you delayed signing up.

You may also incur late fees if you fail to sign up for Medicare during the time specified in a Special Enrollment Period. Some SEPs give you as much as 8 months while others only give you 2 months. There are literally dozens of scenarios that qualify you for an SEP. Find the full list here.

Avoiding all of these late fees is simple as long as you register for Medicare when you become eligible.

The Medicare Part A late fee

Most people qualify for premium-free Part A. However, if you do not, and you go a full 12 months without enrolling in Medicare Part A, you pay a 10% penalty for twice the number of years you could have had Part A but did not. So, a 1-year delay means you pay for 2 years. If you go a full 24 months without enrolling, you pay the penalty for 4 years, and so on.

The Medicare Part B late fee

The late fee for Medicare Part B is 10% of your monthly premium for every year you delay enrollment. One year equals 10%, 2 years equals 20%, and so on. You pay this penalty for the entire time you have Medicare.

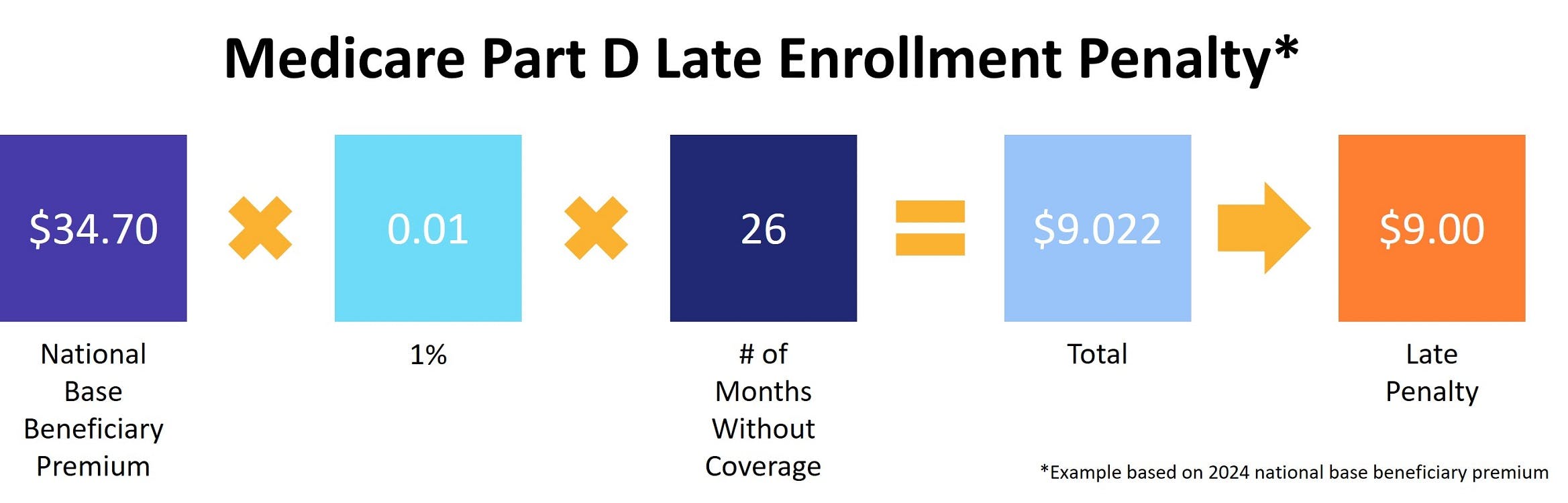

The Medicare Part D late fee

Any time you go 63 days or more without Medicare Part D prescription drug coverage, you incur late penalties. The amount changes every year, depending on changes to the national base beneficiary premium.

The Part D late penalty is 1% of the national base beneficiary premium times the number of months you went without prescription drug coverage. That number is then rounded to the nearest dime. The equation looks like this:

You pay this penalty for the entire you have Medicare Part D prescription drug coverage – even if that coverage is through a Medicare Advantage (MA) plan.

2. Not comparing your Medicare plan options

Not all Medicare plans are created equal. Benefits vary widely, as do costs. Therefore, comparing your Medicare plan options carefully is vital to ensure you get the best plan to meet your particular needs and budget.

When comparing Medicare Advantage plans, we recommend looking at the full cost of the plan as well as any additional benefits it offers. For example, a $0 monthly premium may hide higher copayments or deductibles. Or, the plan may offer few additional benefits. You'll usually find you pay less overall if you choose an Advantage plan that covers prescriptions and routine dental or vision care than you would for a standalone prescription drug plan or ancillary dental and/or vision insurance.

Compare Medicare plans in your area now

It's also important to consider whether you will use those extra benefits. There's no sense in paying for coverage you don't need.

If you're looking for a Part D plan (or an Advantage plan that covers prescription medications), make sure you review the drug formulary. After all, a drug plan that doesn't cover your medications won't do you any good.

3. Paying your deductible before Medicare processes the claim

Both Medicare Part A and Part B have deductibles. Part B's is annual while Part A is a bit more…complicated (see the link in the previous sentence). In both cases, though, the Medicare process states that the medical provider bills Medicare first and then the patient pays the deductible.

The reason for this is simple. The first provider to bill Medicare is the one that has the deductible taken from their payment. That provider will then bill you for the deductible. And it won't matter if you already paid the deductible to another provider. You still have to pay it to whoever billed Medicare first. The first provider you paid should reimburse you, but getting your money back can be an uphill battle.

This happens most often with Medicare Part B, especially when it's your annual wellness visit.

Here's a common scenario: You finish your checkup and the doctor sends you to the lab for bloodwork. Before heading over to the lab, you stop at the front desk to pay your coinsurance. Then, when the clerk asks you for the deductible, you go ahead and pay that, too. Unfortunately for you, the lab sends its bill to Medicare first. And that's where you get hit with the double deductible.

The solution here is simple. When the front office person asks you to pay the deductible, remind them that procedure says they have to bill Medicare first.

4. Ignoring the Annual Notice of Change

We've talked about this before, but it is really important you don't ignore the Annual Notice of Change (ANOC). As a reminder, the ANOC is sent to anyone who has a Part D or Medicare Advantage (MA) plan. And it lists every change expected by your plan next year.

Common changes listed in the ANOC include:

- Providers leaving your plan's network

- Drugs leaving your plan's formulary

- Premiums, copayments, and other out-of-pocket costs changing

You get the ANOC a month before the Annual Enrollment Period (AEP) begins specifically so you can review it and make any necessary changes for next year's coverage. Failure to read it is not an excuse if you suddenly find your doctor no longer accepts your MA plan. Or that your Part D plan no longer covers one of your medications.

This mistake is also easy to avoid, since all you have to do is read the ANOC and then act accordingly.

5. Assuming Medicare covers your spouse

If your main experience of health insurance is the group health plans you get through an employer, you may assume your Medicare coverage extends to your spouse. It does not.

Unless your spouse is age 65 or older, has collected Social Security disability benefits for at least 24 months, or has end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease), he or she does not qualify for Medicare.

This is also true for Medicare Supplement Insurance. Even if you both qualify for Medicare, you must each purchase your own Medigap policy.

6. Not paying your Part B premium

Once you begin receiving Social Security benefits, your Medicare premium is deducted without you having to do anything. But, if you're one of the millions of Americans who enrolled in Medicare before signing up for Social Security, you're billed quarterly. Missing a payment means you may lose your Part B coverage. You'll also lose your Medicare Supplement Insurance or Advantage plan, if you have one of those.

If this happens, the only coverage you'll have left is your Part A hospital insurance. Unless, of course, you don't qualify for premium-free Part A. In that case, you lose Part A coverage as well.

You can't enroll again until the Open Enrollment Period that runs from January through March. And you'll have to wait until July 1 for coverage to begin. Depending on how long you've been without coverage, you may even wind up with late penalties. And, of course, you're responsible for any medical bills you have during this time.

7. Forgetting to notify Medicare when your employer coverage ends

Many people who qualify for Medicare already have coverage through an employer. Maybe they're still working when they turn 65. Or, their spouse may still be employed and they enjoy healthcare coverage that way.

In either case, if your employer-sponsored insurance ends, someone must notify Medicare. Typically, the employer's benefits administrator completes this step. But mistakes happen (see paragraph 1 of this article). And this is one of those mistakes that can cost you.

Until someone says differently, Medicare thinks it's your secondary insurance. That means it will deny any claims received that didn't first go through your old carrier. Even if you're confident the employer will notify Medicare, we always recommend calling them yourself. It's simple. Just call 1-800-MEDICARE and tell the person who answers that you need to make sure they know your former coverage ended (or is about to end).

8. Failing to get preventive screenings via your primary care physician

Your Medicare Part B benefits cover numerous preventive screenings, starting with your Welcome to Medicare visit. However, Medicare only covers preventive care when it's provided by your primary physician.

In addition, secondary services received at the same time may not be covered. The most common surprise charge here is for the anesthesiologist who sedates you before a colonoscopy. If you aren't sure whether a service is covered, ask your provider.

9. Using the wrong Medicare card

In addition to your red, white, and blue Medicare card, you may also have cards for your Part D, MA, or Medigap plan. Presenting the wrong one could result in denied claims, which leaves you paying 100 percent of the bill.

You'd think this wouldn't present a problem – surely the person accepting payment would notice you used the wrong Medicare card. Unfortunately, it does happen. Really, the only solution here is to be careful. Remember that Part D only covers prescriptions you receive at the pharmacy. If you have an MA plan, store your red, white, and blue Medicare card someplace safe.

10. Not buying a Medigap policy during your Medigap Open Enrollment Period

Medicare Supplement Insurance helps cover many of your out-of-pocket costs under Original Medicare. But, unless you purchase a Medigap policy during your Medigap Open Enrollment Period (OEP), or qualify for guaranteed issue rights, your application goes through a process called medical underwriting. It works like this:

When you apply for a Medigap plan, the insurance company asks you various health-related questions. Your answers to these questions reveal how likely you are to make an insurance claim. For example, if you are overweight or have a chronic health condition like diabetes, statistics say that you're more likely to file a claim. The insurance company uses your answers to determine your monthly premium. They may even decide it's too risky to sell you a policy at all.

By applying for a Medigap plan during your OEP, you avoid medical underwriting completely. Carriers can neither deny you a policy nor charge you more for it.

Our Find a Plan tool makes comparing Medicare plans fast and easy. Just enter your zip code to compare costs and benefits today.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs