Unlike Part B, you can have more than one Medicare Part A deductible in a calendar year.

Like most insurance, Medicare beneficiaries have a variety of out-of-pocket costs. One of these is the Medicare deductible. Every benefit period, you must meet the deductible before Medicare begins paying its share of covered costs.

The Medicare Part A deductible

In 2024, the Medicare Part A deductible is $1,632 each benefit period.

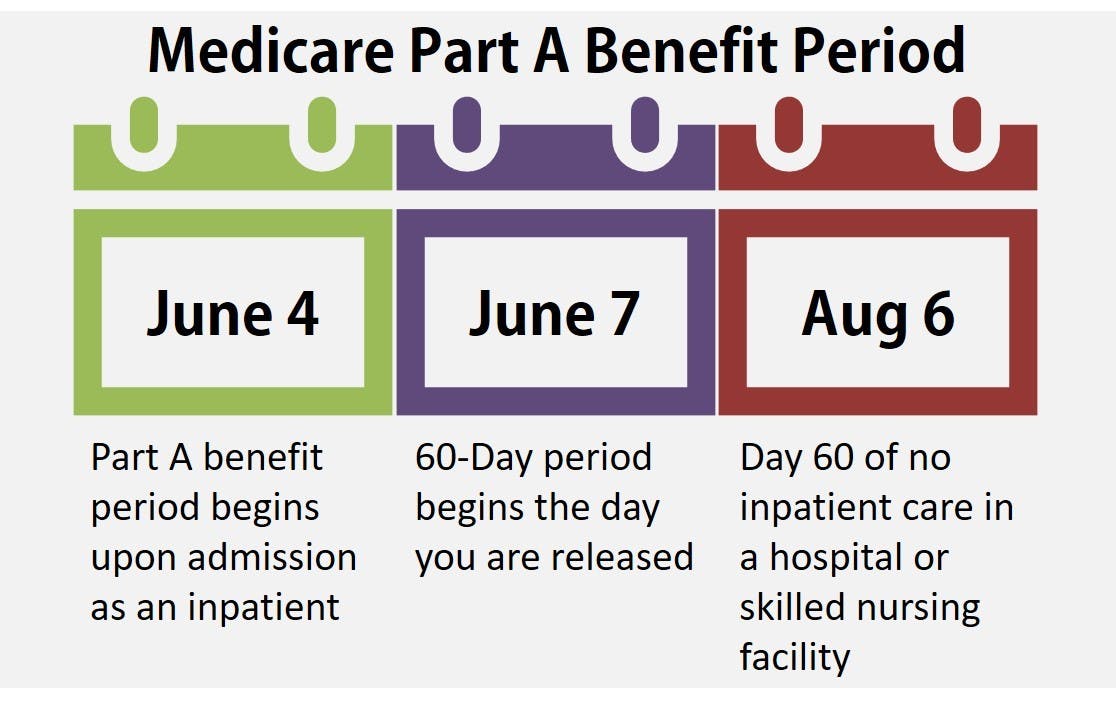

The benefit period begins as soon as you are admitted to the hospital or skilled nursing facility as an inpatient. It ends when you go 60 days without receiving covered care as an inpatient. Readmittance to the hospital at any point during that 60-day period – including on day 60 – is considered part of the same benefit period.

You owe the Part A deductible for each benefit period. You may have multiple Part A benefit periods during a calendar year.

The Medicare Part B deductible

The Medicare Part B benefit period is one calendar year. You must pay the Part B deductible every year. In 2024, the Medicare Part B deductible is $240. Once you pay this amount, Medicare begins paying its share of costs for covered services.

Medicare Advantage and Part D deductibles

If you have a Medicare Advantage (MA) or Part D plan, you may have additional deductibles. Details for these are determined by the private insurance company that provides your plan. Contact your provider to learn more about the deductible and benefit period under your Part D or MA plan.

The Centers for Medicare and Medicaid Services set the maximum deductible for Part D at $545, although most plans come in lower than that, with many having a $0 yearly deductible. Make sure you're comparing the full cost of plans when you review your options on our Find a Plan tool.

Medicare coinsurance

Under Original Medicare, your share of covered expenses is called coinsurance.

Medicare Part A coinsurance varies according to the number of days you spend as an inpatient. Each benefit period begins a new coinsurance calculation.

- Days 1-60: $0 per day

- Days 61-90: $408 per day

- Days 91 through lifetime reserve days: $816 per day

You get a total of 60 lifetime reserve days throughout the time you have Medicare. If you use all 60 of your lifetime reserve days, you pay 100% of inpatient care costs. However, if you have a Medigap plan, you get an addition 365 lifetime reserve days.

Most Medicare Part B services have a Medicare-approved cost. Assuming you receive care from a provider who accepts assignment, Medicare typically pays 80% of this amount. The remaining 20% is your coinsurance amount.

Medicare copays

Medicare Advantage and Part D beneficiaries typically pay a fixed dollar amount for services, otherwise known as copays. Some plans charge both copays and coinsurance, but these are rare.

Common copays for a Medicare Advantage plan may be $15 for primary care visits and $30 to see a specialist within your network.

Most Part D plans have tiered pricing as a means to control costs. Copays rise along with the tiers. For example, your copay for prescriptions on the lowest tier may be only $1 to $3. Copays on the next tier may range from $5 to $12, then $15 to $30, and so on.

Medicare out-of-pocket limits

Medicare Part D and Medicare Advantage plans all have maximum out-of-pocket limits. This means that, once you meet this threshold, you have no further out-of-pocket costs for the rest of the year.

Limits vary according to the plan and provider. However, Medicare set minimum guidelines for both MA and Part D plans.

- Medicare Advantage: $8,850 in-network max and $11,300 out-of-network out-of-pocket max in 2024

- Medicare Part D: $8,000 out-of-pocket max in 2024

There is no out-of-pocket maximum for Original Medicare. If you have multiple or lengthy hospital stays, your costs could be substantial. This is why we highly recommend Medigap plans for those enrolled in Original Medicare.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs

- Social Security Administration: Extra Help