If you collect RRB or Social Security benefits, your Part B premium is deducted automatically.

One of the main perks of Medicare is that you can have your Medicare premiums automatically taken out of your Social Security or Railroad Retirement Board benefits. This makes managing your finances much simpler, since you can never forget payments, and can easily forget about your premiums.

However, there are various ways that your payments can be deducted, and this depends on when you start receiving Social Security benefits, and when you start receiving Medicare coverage. We’ll go over all of your options, so you know what to expect when you transition to Medicare health insurance.

What is Medicare Part B?

Medicare Part B offers medical insurance to cover medically-necessary outpatient health care. This health coverage is used for most of your non-urgent care, such as ordinary doctor’s visits. Part B also covers other things, such as durable medical equipment and home health care in some instances. Notably, Part B doesn’t cover prescription drug coverage, dental, or vision. Prescription drug coverage is offered by Part D plans, but vision and dental are only covered by some Part C plans, and are less common.

Part B is one of the core insurance plans that makes up Medicare. Together with Medicare Part A, which covers your hospital insurance, it’s known as “Original Medicare”. Medicare Parts A and B of Medicare are the only parts of Medicare that are directly covered by the federal government. Part C plans, also known as Medicare Advantage Plans, and Medicare Part D prescription drug plans are offered by private insurance companies instead.

Part A and B are also the only parts of Medicare that Medigap plans cover. Medigap plans, also known as Medicare supplement plans, provide extra help and coverage for your Part B out-of-pocket expenses, like deductibles and coinsurance. Most Part B expenses will be the same for everybody since they’re mandated at the federal level.

How much is the Medicare Part B premium each month?

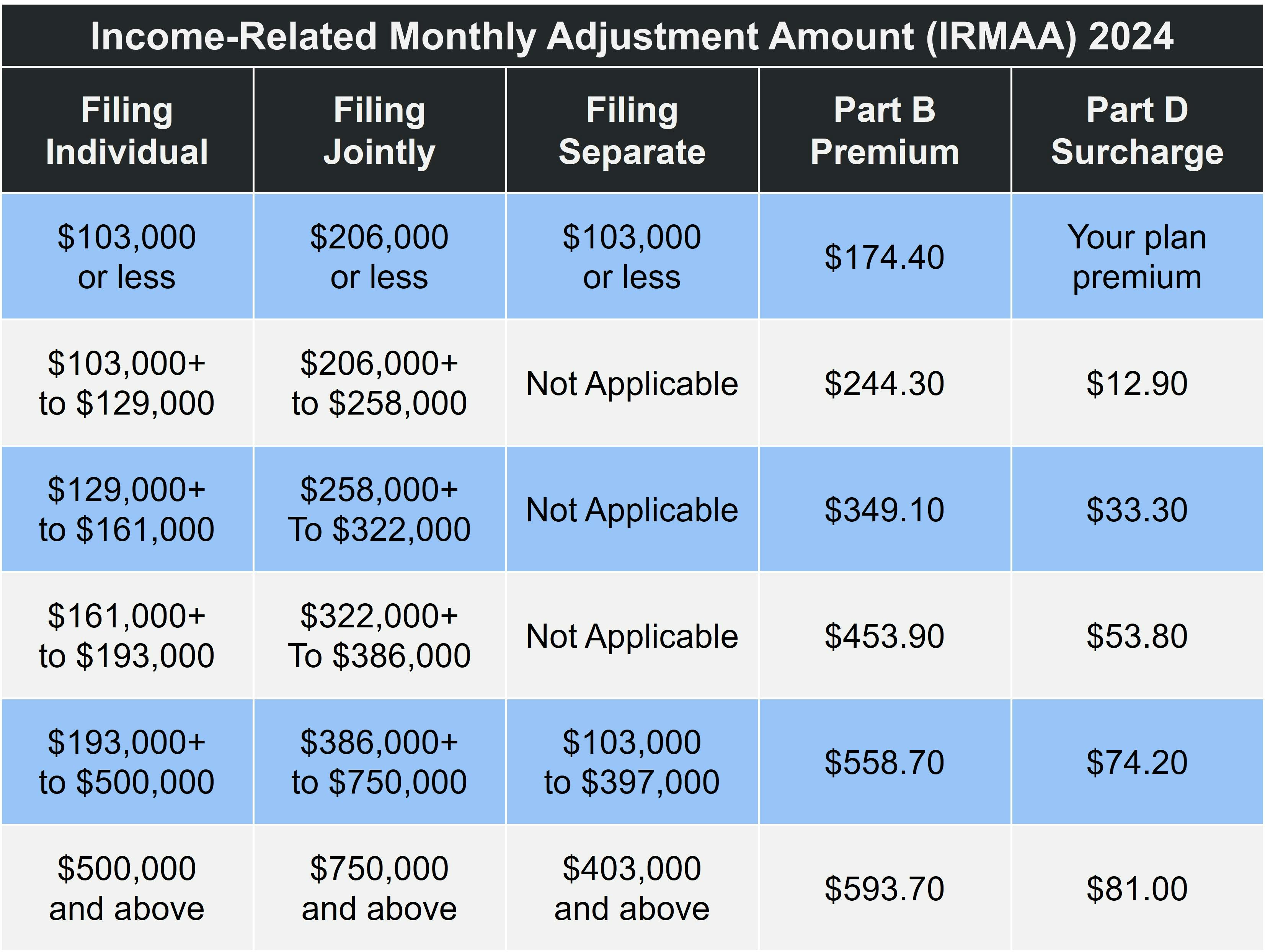

The Part B monthly premium is determined by the Centers for Medicare & Medicaid Services, also known as CMS. In 2024, the base monthly premium for Medicare Part B is $174.40. However, your exact premium will be based on the Income-Related Monthly Adjustment Amount (IRMAA). This means that you will pay higher premiums if you had higher income in the relevant tax year. For 2024, the relevant tax year is 2022.

The table below shows IRMAA at each income level:

People with a limited income can also apply for Medicare Savings Programs. These programs can provide additional help for Medicare beneficiaries who need it, and can help reduce or in some cases eliminate your Medicare costs.

How does Social Security relate to Medicare Part B?

Medicare and Social Security are both federal benefit programs, so it makes sense that they’re linked. This is done to lighten the administrative burden. Basically, it’s easier to manage your monthly premiums together with your monthly Social Security benefits, both for you and for the government.

The link actually goes beyond Social Security. If you receive benefits from the Railroad Retirement Board or the Office of Personnel Management, then much of the same things will be true. These benefit programs can also automatically deduct your Part B premium in much the same way that Social Security does.

What if I’m already receiving Social Security benefit payments?

You become eligible to receive Social Security benefits at age 62. Because the Medicare initial enrollment period starts at 65 for most people, many people receive Social Security before they’re eligible for Medicare.

It’s very important to remember that if you receive Social Security benefits when you become eligible for Medicare, you will be enrolled automatically. If you do nothing at all, then you’ll simply start receiving Part B coverage and have your premiums deducted from your Social Security check.

What if I don’t want Part B coverage?

It is possible to defer your Part B coverage to a later date. This is quite rare to do, because you may end up paying more for late enrollment. If you don’t want your Part B Medicare plan, you’ll have to get in contact with Medicare directly. It also makes sense to double-check with Social Security, so you can be sure that the Part B premium won’t be deducted from your check.

It’s also possible to be covered by your employer group plan at the same time as Part B if you’re still working when you become eligible. However, this can end up not being worth it for some people, as your group health insurance will have to provide most of your coverage in most instances. This may be worth it for some to avoid the late enrollment penalty, but there’s no way to tell without looking at your individual scenario.

What if I’m not receiving Social Security benefits?

If you become eligible for Medicare and aren’t receiving Social Security benefits, then you’ll be billed for Part B as you would for any other insurance health plan. Medicare will bill you every three months for your coverage. If you don’t pay your bills up to the point that they get delinquent, you can lose your Part B coverage.

This is one reason why having your Part B premiums taken out of your Social Security payments is such a big benefit. If you have your payment taken out of your check each month, you don’t have to run this risk at all.

How to set up automatic Social Security payments

If you have Part B and receive Social Security payments but don’t have your payment automatically deducted, the solution is simple. You need to contact Social Security Administration (SSA) directly here to have these payments taken out of your monthly benefit check. If you receive Railroad Retirement Benefits instead of Social Security, you can contact the Railroad Retirement Board at their website here.

It may take an additional month for your payment to start being taken out of your benefit check, so make sure that you keep checking for the bill and making your premium payments.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs

- Social Security Administration: Extra Help