If you don't yet collect Social Security, you have multiple options for paying your Medicare premiums online.

For most people, paying Medicare premiums will be very easy. However, understanding how payment works is important to know, especially if something changes with your Social Security benefits, or you change the type of plan that you have. We’ll go through everything you need to know about how Medicare premiums work, and how you can pay them online.

How do Medicare premiums work?

Medicare premiums will function differently depending on a wide variety of factors. There are unique premiums for Part A and Part B of Original Medicare, as well as Part C plans and Part D prescription drug plans. Let’s take a look at them one by one.

Understanding Medicare Part A premiums

Most people will be eligible for something known as premium-free Part A. This is just what it sounds like: you will pay no monthly premium.

You can receive premium-free Part A under a few conditions. First, if you receive retirement benefits through Social Security, or the Railroad Retirement Board, or are eligible for these benefits but don’t receive them, then you can receive premium-free Part A.

If you or your spouse worked and paid the Medicare tax for more than 40 quarters (10 years) then you’ll receive premium-free Part A. If you or they worked for 30-39 quarters, then you’ll pay $278 per month for Part A in 2024. Finally, if you or your spouse paid the Medicare tax for under 30 quarters, you will pay $505 per month in Medicare premiums for Part A.

Medicare Part B premiums: How do they work?

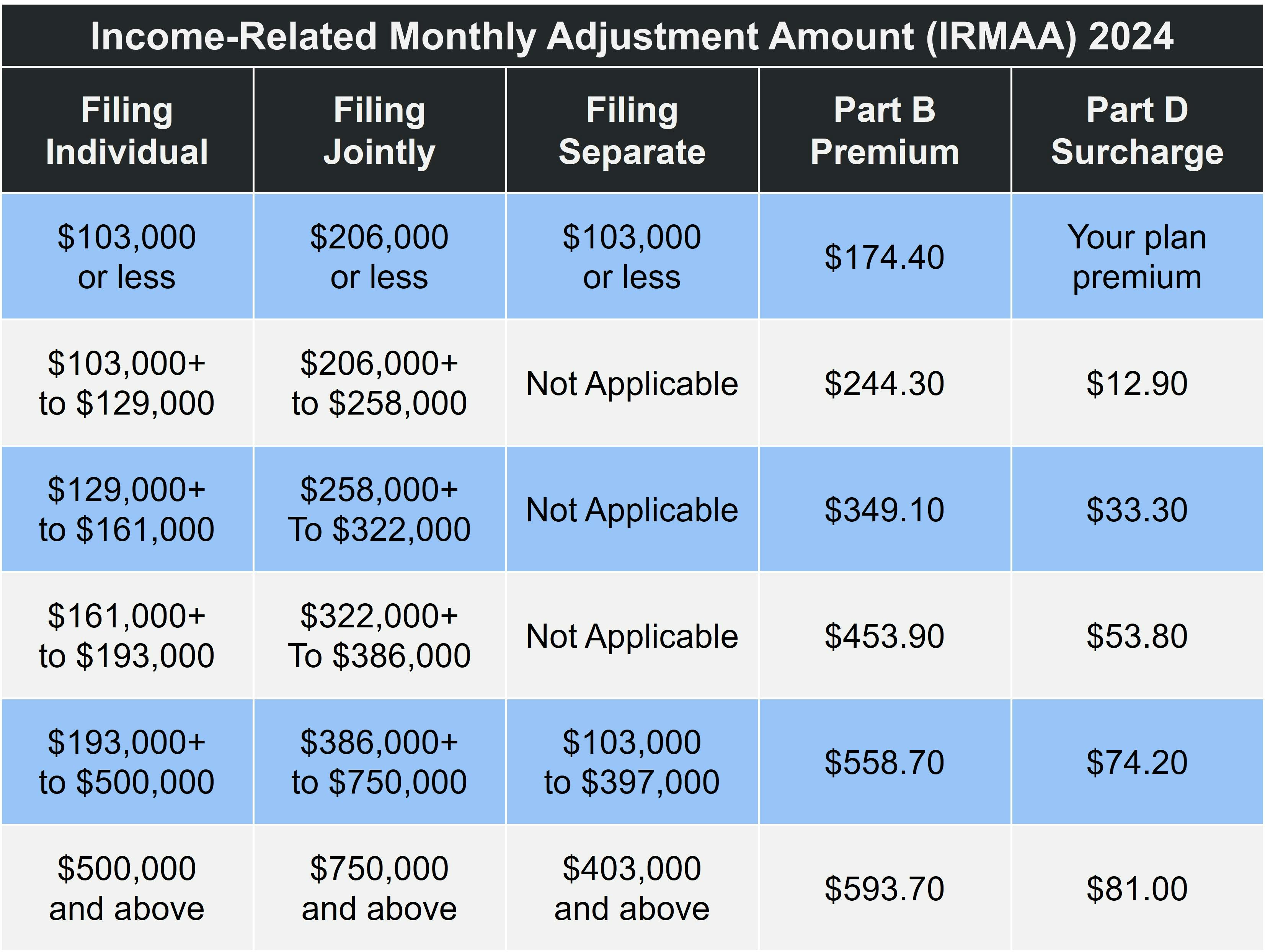

Unlike Part A, everybody must pay Part B premiums, which will vary depending on your income. Medicare Part B starts at $174.40 per month in 2024. If you made over $103,000 in 2022 ($206,000 if you're married filing jointly), then you may owe the Income-Related Monthly Adjustment Amount (IRMAA). The image below shows the amount for each income bracket for both Part B and Part D, based on your modified adjusted gross income on your income tax return.

Paying premiums through Social Security

Although the focus of this article is to discuss online payment methods, it is also useful to discuss the most common way that Medicare premiums are paid. For most people, it will be easiest to have the cost of their Medicare premiums deducted automatically from their Social Security check that they receive each month. This way, you don’t have to take any specific action to get your premiums paid. There are also automatic payment methods that are electronic, which will be discussed later.

If you are eligible for this payment method, it will begin as soon as your enrollment begins.

Part D Premiums: Paying private insurance companies

Medicare Part D prescription drug plans are a popular way to get your drugs covered since this coverage isn’t offered by Original Medicare. Medicare prescription drug plans are offered by private insurance companies, not the federal government.

Part D plan premium costs will vary widely, much more than Original Medicare does. This is because companies charge for Part D directly; you will not be charged by the federal government.

The important thing that makes Part D premiums stick out is the Part D income-related monthly adjustment amount, or IRMAA. This refers to an additional amount that you will have to pay to the federal government for your Part D plan. This amount depends on your income. The table above shows the additional amount you'd pay on top of your Part D premium if you owe the IRMAA.

Part C plans: Paying for Medicare Advantage plans

Part C of Medicare, also known as Medicare Advantage, allows you to receive your Medicare coverage through private health insurance companies. This comes with some benefits as well as some complications. For some people, Part C plans may be a bit cheaper than Original Medicare.

Like Part D, Part C plans will have variable premiums. Most of the time, Part C premiums will be lower than Original Medicare but have higher out-of-pocket costs. This isn’t uniform but is a general trend you may notice when shopping for plans.

Speaking of shopping for plans, our Find a Plan tool makes that easy. Just enter your zip code to start reviewing Medicare plans in your area.

How to make electronic payments

Paying your premiums online will vary depending on if you have Original Medicare or Medicare Advantage. Let’s look at each option individually.

Paying Original Medicare Premiums Online

If you have received a Medicare premium bill in the mail, you can still pay it online. This form is known as Form CMS-500.

If you don’t have a Medicare account, you will need to make one. You will be able to use a debit card or credit card to pay any outstanding bills that you have, which will appear on your account. This is by far the easiest way to pay your bills online, and you should make sure to create a MyMedicare account if you do not already have one.

Make sure to always pay your premiums by their noted due date, or you can face penalties later on.

Automatic Bank Payments

The other way to pay for your Medicare premiums online is to set up automatic payments through your bank. This process varies depending on which bank you use, but you can probably do this through your bank's online bill payment service. You’ll have to contact your bank directly to find out which steps you need to take.

You will need to set the payee name as "CMS Medicare Insurance" and the address as:

Medicare Premium Collection Center

PO Box 790355 St. Louis, MO 63179-0355

What if I receive Railroad Retirement Board (RRB) benefits?

Unfortunately, if you receive RRB benefits, you won’t be able to use MyMedicare to pay your premiums. You will have to contact the Railroad Retirement Board directly for more information about how to pay, or send your check to

RRB, Medicare Premium Payments

PO Box 979024

St. Louis, MO 63197-9000

Medicare Easy Pay

If you want to automatically deduct your premiums from your bank account regularly, the best way to do this is to set up Medicare Easy Pay. This process can take up to 8 weeks to process but will result in fully automatic online payments from your checking or savings account. Once you set up Easy Pay, you'll receive a statement notifying you that you won't be billed on paper anymore and that your payments will all become electronic.

You can set up Easy Pay online, or you can call 1-800-MEDICARE (1-800-633-4227) (1-877-486-2048 for TTY users).

Paying for Part C and Part D online

Paying for Part C and Part D prescription drug plans online will vary more than Original Medicare. When it comes to Original Medicare, you can use MyMedicare or pay through your bank, but these other private plans may have other options available.

Usually, each private health insurance plan will have its own online bill payment system where you can make benefit payments. Especially if this is a one-time payment, it will likely be easier to go this route than it will be to set up automatic payments through your bank.

However, setting up automatic payments through your bank is also an option if you have Medicare Advantage or a Part D plan.

Paying your premiums online: You have options

As you can see, paying your premiums online is an easy process, whether you have Original Medicare or another medical insurance option. You have various options to choose from and can set things up to suit your needs and to make things most convenient for you.

Although paying online is fairly easy, setting up automatic payments through your Social Security benefits is still the easiest option for most people. We recommend exploring this option before you set up recurring online payments.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs