To help manage costs, Medicare uses a cost-sharing model that includes deductibles, coinsurance, and monthly premiums. The way you pay your Medicare premium depends in part on whether you collect retirement benefits from either the Social Security Administration (SSA) or the Railroad Retirement Board (RRB). This post answers the question, what is Medicare Easy Pay, and explains additional options for paying your monthly Medicare Part B premium.

How Do I Pay My Part B Premium?

Medicare beneficiaries who collect retirement from Social Security or the Railroad Retirement Board have their Part B premium payments automatically deducted from their monthly benefit.

If you have not retired yet, you receive a Medicare premium bill. You have four options to pay. As the name implies, Medicare Easy Pay is the easiest of the four.

How Do I Sign Up for Medicare Easy Pay?

You may sign up for Medicare Easy Pay if you receive one or more Medicare premium bills from the Centers for Medicare & Medicaid Services (CMS).

To sign up for Medicare Easy Pay, simply complete the Authorization Agreement for Pre-authorized Payments (form SF-5510). You then mail the completed form to:

Medicare Premium Collection Center, PO Box 979098, St Louis, MO 63197-9000.

It can take up to two months for Medicare to process your form. If CMS is unable to process your form, Medicare will notify you via U.S. mail.

Once Medicare accepts your form, you will receive a form called a Medicare Premium Bill. The form will explain that it is not a bill. It also lists the bank account you authorized Medicare to use for your Part B premium payments.

Medicare Easy Pay deductions are usually made on the 20th of every month. Your bank statement will reference the payment as an ACH transaction.

If your bank rejects or returns any deduction, you will receive a letter from Medicare that explains your options for making up the missed payment.

In the event the amount of your premium changes, Medicare Easy Pay automatically deducts the new amount from the bank account you authorized in Form SF-5510. To change or cancel your Medicare Easy Pay arrangement, simply complete Form SF-5510 again and mail it to the same address.

How to Pay Your Medicare Premium Bill Online with a Credit or Debit Card

Your MyMedicare.gov account makes it easy to pay your Medicare bill online with a credit or debit card. You will receive a confirmation number once you complete the payment. The payee on your statement will show as CMS Medicare.

How to Pay Your Medicare Premium with Online Bill Pay

You can also pay your Medicare premiums via online bill pay through your checking or savings account. All you need is the 11-digit Medicare ID number listed on your new Medicare card.

When setting up online bill pay, set the payee name to CMS Medicare Insurance. The address is:

Medicare Premium Collection Center; PO Box 790355; St Louis, MO 63179-0355

When scheduling a recurring payment, make sure you set the correct payment date (and amount). If your bank sends a paper check, you need to allow time for your payment to travel from the bank to the Medicare Premium Collection Center.

Also note that, while Medicare Easy Pay automatically updates your payment amount if your premium changes, you are responsible for this step when you use online bill pay.

How to Pay Your Medicare Premium Payments by Mail

If you don't sign up for Medicare Easy Pay or arrange for electronic payment of your premium, you should receive a payment coupon with your Medicare bill. Complete this coupon and return it to Medicare along with your preferred payment method.

When paying your Medicare premium by mail, your choices are:

- Check

- Credit card

- Debit card

- Money order

Mail the payment coupon along with your payment to:

Medicare Premium Collection Center, PO Box 790355, St Louis, MO 63179-0355

Paying Your Medicare Premium Through the Railroad Retirement Board

If the Railroad Retirement Board sends you your Medicare bill, mail your premium payment to:

RRB, Medicare Premium Payments; PO Box 979024; St Louis, MO 63197-9000.

How to Pay your Medicare Part D, Medigap, and Medicare Advantage Plan Premiums

Since private insurance companies contract with Medicare to provide Medicare Advantage (MA), Medigap, and Part D prescription drug plans, your payment options vary according to your plan provider. However, most insurance companies allow enrollees to pay via automatic debit, check, or credit card.

If you receive Social Security benefits, you may also choose to have your payment deducted from your monthly payment. It typically takes 2 months for Social Security to process this request. In addition, if you switch to a different plan during Annual Enrollment or the Medicare Advantage Open Enrollment Period (OEP), the Social Security Administration may continue paying your old plan for the 2 months it takes them to process the change. Until the change takes effect, you will need to pay your premium using one of the other methods listed above. Once SSA processes the change, it will reimburse you for the double payments.

Your Medicare Bill Explained

It can be confusing to receive a bill for a service for which you've already arranged payment. The following helps you understand what type of bill Medicare is sending you and whether you need to do anything.

In the upper righthand corner, you will see a box that describes the bill type. Categories include:

- This is not a bill: This indicates that you enrolled in Medicare Easy Pay. Your premium payment will be deducted automatically on the 20th. There is nothing you need to do.

- First Bill: This means it is either the very first bill you've received from Medicare OR that your last bill was paid in full. In either case, the total amount listed is due by the 25th of the following month. For example, if the billing date is March 27, your payment is due by April 25.

- Second Bill: This indicates that Medicare did not receive your payment for the First Bill before sending the Second Bill. The full amount is due by the 25th.

- Delinquent Bill: This note indicates that Medicare did not receive payment for either the First Bill or the Second Bill. You must pay the entire amount by the 25th to keep your Medicare coverage.

Failure to pay the Delinquent Bill means that you lose your Medicare coverage. You will not receive another bill.

What Happens If You Don't Pay Your Medicare Premium on Time?

If you don't pay your Medicare premiums on time, you may lose your Medicare coverage. However, this may take up to 6 months.

The number of months depends on which Medicare premium is late.

- Medicare Part B: Your Part B premium billing is quarterly, meaning you receive a bill every three months. Six months will have passed before you receive a Delinquent Bill.

- Medicare Parts A and D: These are both billed monthly. Only 2 months of non-payment will pass before you receive a Delinquent Bill.

To avoid losing your coverage, you must pay the full amount owed. If you ever have trouble paying your Medicare premiums, call 1-800-MEDICARE (633-4227), TTY 1-877-486-2048. It's the best way to avoid a Delinquent Bill.

You may also qualify for a Medicare Savings Program or Extra Help. Contact your state's Medicaid office for assistance.

How Much Is the Medicare Part A Premium?

Most people qualify for premium-free Part A because they or their spouse worked and paid Medicare taxes for the 10 years (40 quarters) necessary to qualify. If you or your spouse did not pay Medicare taxes for 10 years, you must pay a monthly premium for Medicare Part A.

- The standard Medicare Part A premium in 2023 is $506 per month

- If you paid Medicare taxes for 30 to 39 quarters, the Part A premium is $278 per month

Medicare beneficiaries who buy Part A are billed monthly, with payments due by the 25th.

How Much Is the Medicare Part B Premium?

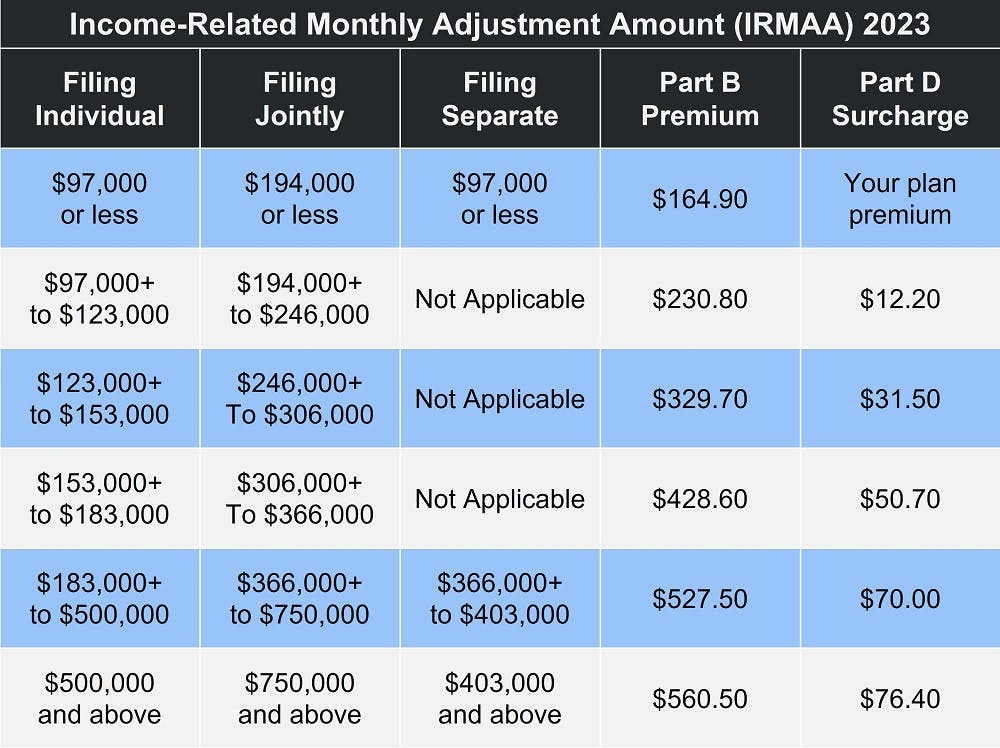

Most people pay the standard premium for Medicare Part B, which is $164.90 in 2023.

If your income exceeds certain thresholds, you may have to pay the Income Related Adjustment Amount (IRMAA). The amount varies depending on your adjusted gross income from 2 years ago.

You may appeal the IRMAA decision if you experienced a permanent income change.

The table below demonstrates the IRMAA thresholds for both Parts B and D.

How Much Is the Medicare Part D Premium?

Since private insurance companies sell Medicare Part D plans, premiums vary widely. However, as with Part B, adjust gross income levels dictate whether you have to pay the IRMAA surcharge. Unlike your monthly Part D premium, the IRMAA surcharge is billed by – and paid to – Medicare. Your payment options are the same as for paying your Medicare Part B premium.