Medicare Supplement Plan G, also called Medigap Plan G, is one of 10 Medigap options available in most states. Plan G, sold by private insurance companies, is a Medicare supplement plan you can purchase that covers 100% of many healthcare costs and helps fill gaps in Medicare Part A and Part B coverage. This includes paying for the Part A deductible, and Part A and Part B coinsurance and copayments.

Medigap Plan G can be a great option if you’re looking for additional assistance with out-of-pocket costs associated with Medicare, as well as additional benefits not covered by Original Medicare. However, to make the most informed decision, you should understand what Plan G is, what it does and doesn’t cover, how much it costs, and other options that may be available to you.

What is Medicare Plan G?

Plan G is one of the most popular Medicare Supplement plans available to Medicare participants. If you’re enrolled in Original Medicare, or receiving Part A and Part B coverage, you can purchase Plan G from a private insurance company that serves the zip code where you live.

All Medigap Plan G policies provide the exact same coverage and benefits. This is because these plans are “standardized” by the federal and state governments. While policy costs can differ from insurance company to insurance company, they cannot offer different (more or less) coverage or benefits.

With Medigap Plan G, you pay your monthly Medicare Part B premium, as well as the monthly premium for your Plan G policy. If you visit a healthcare provider or receive healthcare services, Medicare will pay its share of the Medicare-approved amount for covered treatments (typically 80%), and then your Plan G will pay the rest (after you reach the Part B deductible).

NOTE: Insurance companies don’t sell Plan G policies in Massachusetts, Minnesota or Wisconsin.

Medigap Plan G coverage

Plan G provides comprehensive coverage and pays 100% of many healthcare costs, including:

● Part A deductible

● Part A coinsurance

● Part A hospital costs up to an additional 365 days after your standard Medicare benefit ends

● Part A hospice care (coinsurance or copayment)

● Part B coinsurance and copayments

● Part B excess charge* (if applicable)

● Skilled nursing facility (SNF) care coinsurance

● Up to 3 pints of blood for medical procedures (each year)

*These are additional charges outside of the Medicare-approved charge. This can happen if there’s a difference between what Medicare will pay for medical services vs. what your doctor decides to charge for that service. Some doctors accept the full Medicare-approved rate for payment, while others do not, and they can charge up to 15% more than the approved rate.

Essentially, Plan G covers your share of any medical benefit that is covered by Original Medicare (except the Part B deductible). This includes inpatient hospital costs and outpatient medical services like doctor visits, lab work, durable medical equipment (DME), X-rays, ambulance transportation, outpatient surgeries and more.

Additionally, Plan G covers 80% of medical care received while traveling outside of the U.S. (up to your plan’s limits).

What is not covered by Plan G?

There are a few things, however, that Plan G does not cover, including:

● Part B deductible

● Prescription drugs*

● Dental care

● Eye care (including glasses, eye exams or other vision care)

● Hearing aids

● Long-term care

● Private-duty nursing

*While Medigap Plan G doesn’t cover outpatient prescriptions typically covered by Part D, it does cover the coinsurance on all Part B medications (typically used for treatment in a clinical setting).

Medigap policies also only cover one person. For example, if you and your spouse both want coverage from Plan G, you must both have separate Plan G policies.

Who qualifies for Plan G?

You qualify for Plan G if:

● You’re over age 65

● You’re enrolled in both Part A and Part B

● You’re not enrolled in a Medicare Advantage (MA) (Part C) plan

● You live within the plan’s service area

Note that even if you have Medicare coverage due to a disability, you will not qualify if you are under age 65.

Medigap policies are guaranteed renewable, which means regardless of whether or not you have health problems, your policy cannot be canceled for as long as you continue to pay your premiums and remain enrolled in Part A and Part B.

How to enroll in Plan G

If you’re enrolled in Medicare Part A and B, you can buy a Medigap Plan G policy. You can purchase a plan from any insurance company that’s licensed in your state to sell Medicare Supplement coverage.

You can compare plans using Medicare’s search tool, or by calling Medicare directly, contacting your state insurance department, or contacting your State Health Insurance Assistance Program.

You can buy a Medigap Plan G policy at any time (if you qualify), but the best time to buy is during the six-month Medicare Supplement Enrollment Period, which begins the month you turn 65 and after you enroll in Part B. After that period, you may have to participate in medical underwriting and could even be denied coverage.

Before enrolling, be sure to shop around. Even though the plans are standardized and will be the same regardless of the insurance company, the costs for the plan will vary.

Cost of Medicare supplement Plan G

The cost of Plan G can vary based on a number of factors including:

● The insurance company you purchase it from

● Where you live

● Your gender (typically men are charged more than women)

● Whether or not you smoke (smokers may have to pay more than non-smokers)

● Your age (some policies charge based on your age when you buy the plan, others increase the premium as you get older, and some charge everyone the same premium regardless)

● When you enroll

Insurance companies can price these Medigap plans however they want, so premiums, deductibles and copays can differ.

That said, you will have to pay at least the annual Part B deductible of $226 (in 2023). Then, you’ll have to pay 20% of the Medicare-approved amount for Part B services after reaching your Part B deductible. You’ll also have to pay the full cost for anything not covered by Medicare or the Plan G policy.

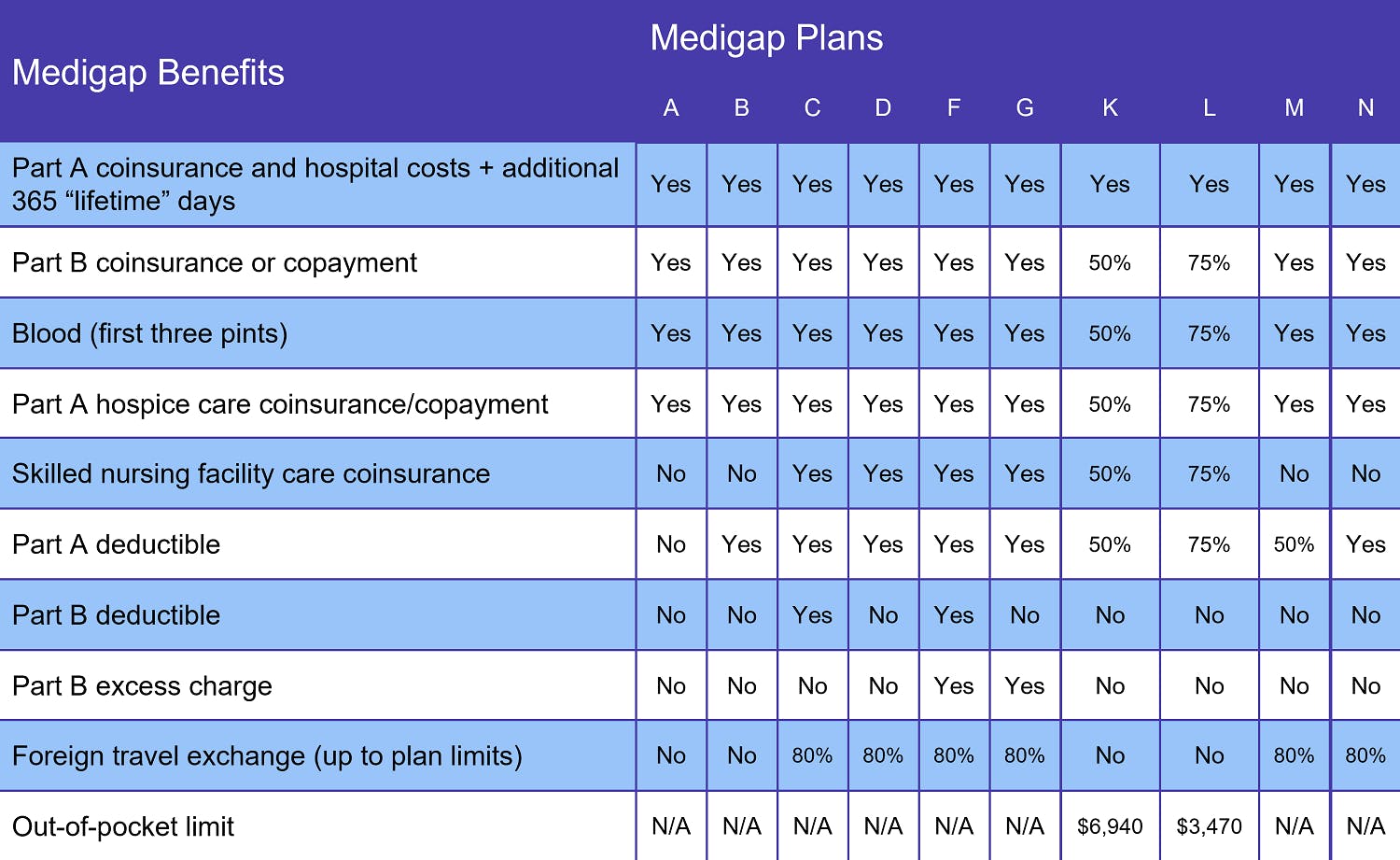

Medicare supplement plan types

There are 10 standardized Medicare Supplement, or Medigap, plans: A, B, C, D, F, G, K, L, M, and N. The primary purpose of these plans is to help reduce your costs of Original Medicare Part A and B, as well as fill “gaps” in services that Medicare doesn’t cover.

Each Medigap policy must follow federal and state laws that are designed to protect you. This also means they are standardized from state-to-state. That said, each insurance company decides which Medigap policies it wants to sell. They do not have to offer every Medigap plan, but they must:

● Offer Plan A if they offer any Medigap policy

● Also offer Plan C or Plan F if they offer any plan

NOTE: As of January 1, 2020, Medigap plans sold to new beneficiaries with Medicare are not allowed to cover the Part B deductible. This means that Plans C and F are not available to people new to Medicare. If you already have either of these two plans or were covered by one of them prior to January 1, 2020, you’ll be able to keep your plan, and if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to purchase one of these plans.