Medicare encourages timely sign-up by imposing late fees on those who delay enrollment.

If you do not have creditable coverage and do not enroll in Medicare when you are first eligible (whether when you turn 65 or you qualify due to a disability), you may face late enrollment penalties.

Creditable coverage is healthcare coverage that is at least as good as what Medicare provides. For most people, this is coverage offered by your employer.

Late enrollment penalties are extra charges you must pay on top of your monthly premium, and the longer you go without Medicare, the faster these fees will add up and you could end up paying a significantly higher amount for Medicare.

The good news is there are ways you can avoid late enrollment penalties. Read on to learn more about what late enrollment penalties are and how to prevent them.

What are late enrollment penalties?

Late enrollment penalties are extra charges you must pay if you don’t enroll in Medicare when you’re eligible. These penalties are added to your monthly premium and are typically charged for as long as you have that type of coverage (though the Part A penalty is different).

These penalties are not a one-time late fee: For most people, it’s a lifetime penalty. The longer you go without signing up for Medicare and without other creditable coverage, the greater the penalty will be.

The purpose of late enrollment penalties is to help guide Medicare beneficiaries to enroll at the right time, which can ensure they have coverage when they need it and help keep Medicare costs down overall.

Medicare Part A late enrollment penalty

Most people automatically qualify for premium-free Part A because they or their spouse have worked enough years and paid Medicare taxes. However, there are some who must buy Part A because they don’t qualify for the premium-free Part A.

If you don’t buy Part A when you’re first eligible, your monthly premium may increase 10%. You’ll have to pay that penalty for twice the number of years you didn’t sign up when you could have.

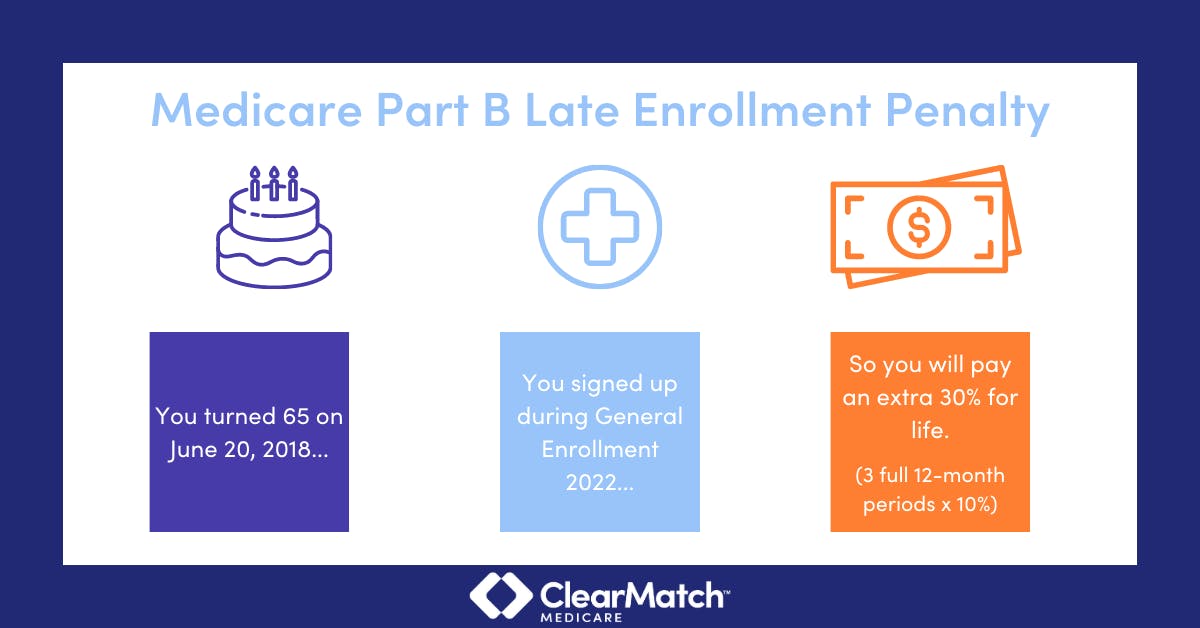

Medicare Part B late enrollment penalty

In most cases, if you don’t sign up for Part B during your Initial Enrollment Period, you must pay a late enrollment penalty for as long as you have Part B. This penalty takes the standard monthly premium amount ($164.90 in 2023) and increase it by 10% for each year (12 months) you could have had Part B but didn’t.

If you have a higher Part B premium due to the income-related monthly adjustment amounts (IRMAA), you may have a greater penalty.

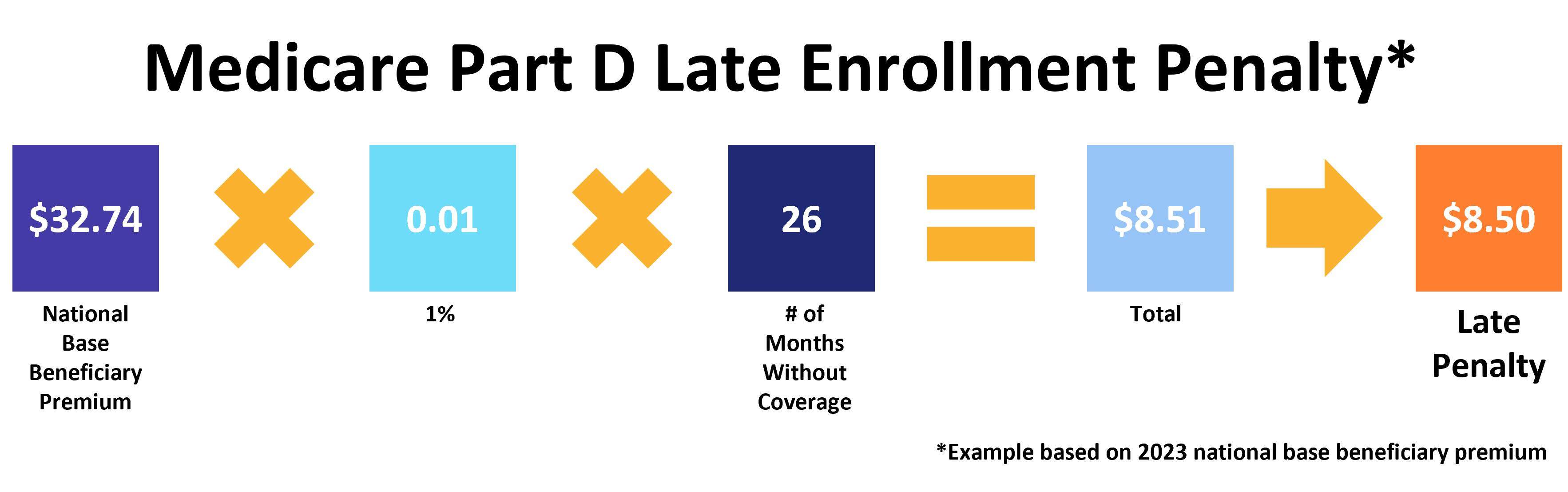

Medicare Part D late enrollment penalty

If you have creditable drug coverage or you qualify for Extra Help, you won’t have to pay a late enrollment penalty.

However, if not, you’ll pay an extra 1% for each month (12% per year) if you don’t join a Medicare Part D drug plan when you first get Medicare and/or you go 63 days or more without creditable drug coverage. You’ll pay this penalty for as long as you have Part D coverage.

If you pay a higher Part D premium because of IRMAA, you may also have a higher penalty.

Your Part D plan will tell you if you must pay a late enrollment penalty and how much that penalty will be.

If you were to go a full 26 months without prescription drug coverage, the calculation looks like this:

What if I don’t agree with the late enrollment penalty?

If you’re charged a late enrollment penalty and don’t agree that you should be paying it, you may be able to ask for a reconsideration. Your plan will send you information about how to request it, and you must complete the form and return it within 60 days from the date on the letter telling you that you owe a late enrollment penalty. Also include any proof that supports your case.

You’ll then receive a decision within 90 days. Keep in mind that you must pay the penalty with your premium even if you don’t agree with it, and even if you’ve asked for a reconsideration.

If Medicare’s contractor agrees that the penalty is wrong, your plan will remove or reduce the penalty and you may get a refund. Otherwise, you must continue paying the penalty.

How to avoid late enrollment penalties

The best way to avoid late enrollment penalties is to enroll in Medicare when you are first eligible, whether that’s when you turn 65 or lose other creditable drug coverage.

One exception to paying late enrollment penalties is if you qualify for a Special Enrollment Period. This is a special time during the year where you can make changes to your Medicare coverage if you meet certain qualifying circumstances, such as you moved, you lost your current coverage (such as Medicaid or employer coverage), your current plan changed its contract with Medicare, or others.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Special Enrollment Periods