If you have guaranteed issue rights, you can't be turned down for a Medigap policy or charged a higher premium.

Medicare Supplement Insurance, better known as Medigap, helps pay your out-of-pocket Medicare costs. Unlike Original Medicare, there is no annual enrollment period for Medigap. There is also no requirement for an insurance company to sell you a Medicare Supplement policy unless you have a guaranteed issue right. Once your Medigap Open Enrollment Period (OEP) ends, there are only seven ways to qualify for guaranteed issue rights.

Please note that all of the following applies at the federal level. Some states offer these same protections to under-65 beneficiaries. Scroll to the bottom of our Medicare Supplement page to find the link for your state to learn whether it offers any additional Medigap protections.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans help cover some of your out-of-pocket costs when you have Original Medicare. Private insurance companies offer the plans, working under guidelines set by both the Centers for Medicare & Medicaid Services (CMS) and state governments.

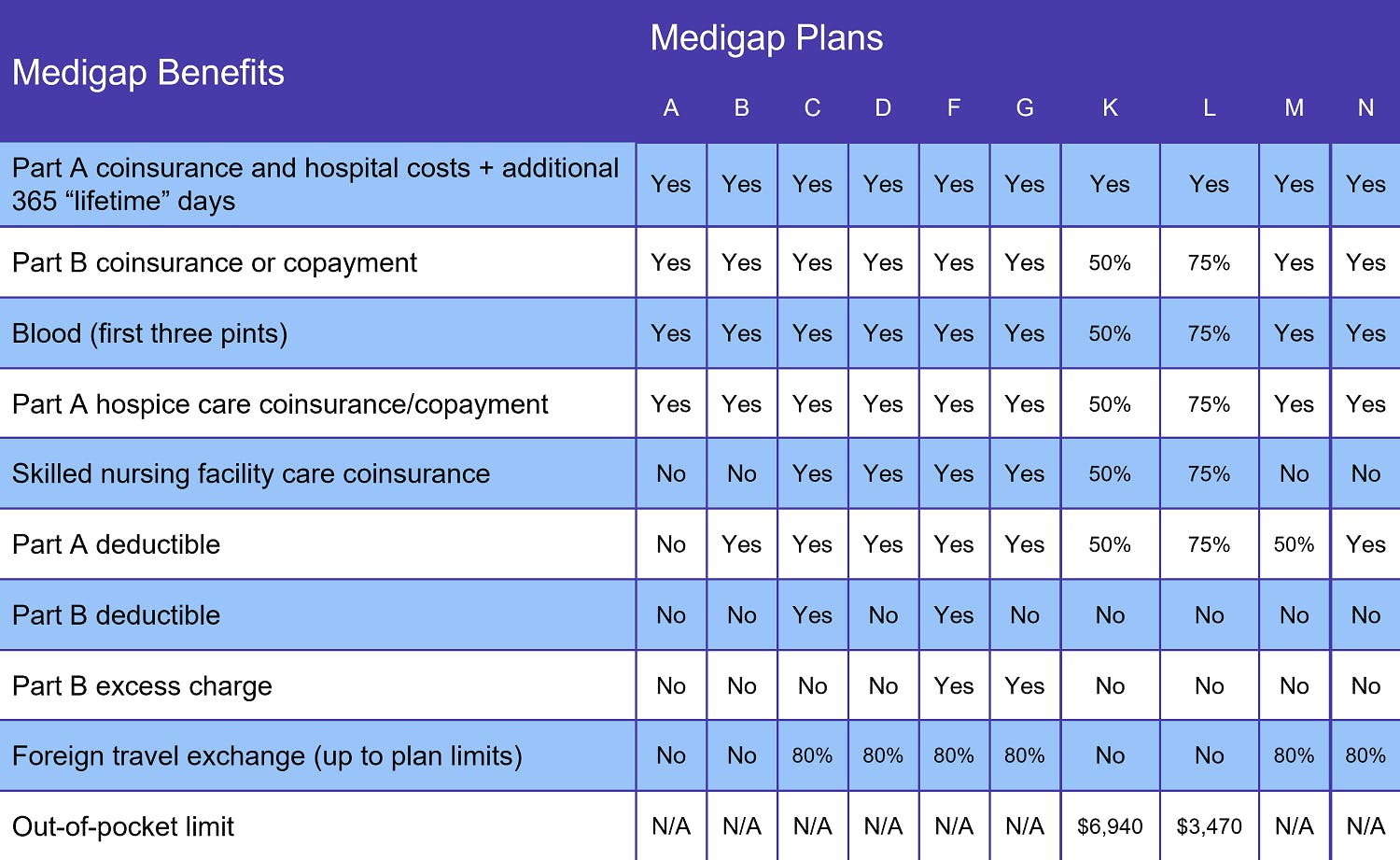

There are 10 standardized Medigap plans available: A, B, C, D, F, G, K, L, M, and N. In addition, some Medigap insurers offer high deductible versions of Plans F and G.

"Standardized" means that every Medigap Plan A (or B, C, etc.) provides the same coverage no matter which insurance company you choose. Rates, however, will vary.

When can you join a Medigap plan?

Federal law allows any Medicare beneficiary age 65 or older who is enrolled in both Medicare Part A and Medicare Part B (Original Medicare) to apply for a Supplement plan at any time. And, although federal law does not cover under-65 Medicare beneficiaries, the majority of U.S. states have similar protections for those who qualify for Medicare due to a disability.

Unfortunately, just because you can apply for a Medigap plan does not mean your application will be approved. Nor does it mean you won't be charged more if your application is accepted, especially if you have pre-existing conditions. That’s because, unless you have a guaranteed issue right, your Medigap application goes through a process known as medical underwriting.

Medical underwriting involves answering a series of health-related questions about age, weight, medical history, personal habits like tobacco use, and more. Insurance companies use underwriting to estimate how likely you are to file a claim. If you're deemed high risk, the company may charge you a higher rate or refuse to sell you a policy altogether.

You avoid medical underwriting if you apply for a Supplement plan when you have guaranteed issue rights. Under Medicare Supplement guaranteed issue, you cannot be denied a policy nor charged a higher rate for coverage.

When do you have Medigap guaranteed issue rights?

There are eight situations where you qualify for guaranteed issue Medicare Supplement coverage, starting with the Medicare Supplement Open Enrollment Period.

On the federal level, your Medigap OEP lasts for 6 months, beginning the day you are both age 65 or older AND enrolled in Medicare Parts A and B. If you qualified for Medicare before turning 65 due to illness or disability, you'll have the same Medigap OEP after your 65th birthday.

The other seven guaranteed issue situations are:

- You lose your Medicare Advantage plan because you move outside the plan's service area, the plan leaves the Medicare program, or it stops serving people in your area. If you make the decision to return to Original Medicare, you may apply for a Medigap policy starting 60 days before your Medicare Advantage coverage is scheduled to end. The guaranteed issue window closes within 63 days of your coverage ending. Your Medigap plan options may include A, B, C, D, F, G, K, and L. (More on Plans C and F in a moment.)

- If you currently have Original Medicare and secondary insurance like COBRA, retiree insurance, or a group health plan, you may apply for a Medicare Supplement plan when your secondary coverage ends. You have up to 63 days to apply. The clock starts ticking on the latest of three dates: when your secondary coverage ends, the date on the notice that said coverage is ending, or the date on a claim denial, if this is how you learned your coverage ended.

- You are enrolled in both Original Medicare and a Medicare SELECT policy but move outside your SELECT plan's service area. The guaranteed issue period starts 60 days before your coverage will end and lasts for up to 63 days after the end date.

- You join either a Medicare Advantage Plan or Programs of All-inclusive Care for the Elderly (PACE) in your first year of having Medicare AND decide to switch back to Original Medicare within 12 months. You may join any Medicare Supplement plan offered in your state, with your application window opening 60 days before your plan's scheduled end date and closing 63 days after coverage ends.

- You had a Medicare Supplement plan but left it to join a Medicare Advantage or SELECT plan FOR THE FIRST TIME and want to switch back to Original Medicare within 12 months. This falls under what Medicare calls trial rights and it allows you to buy the same Medigap policy you had before leaving it to join either an Advantage or SELECT plan, assuming the same insurance company you had before still sells it. If that plan is no longer available, you may join Plan A, B, C, D, F, G, K, or L.

- Your current Medigap coverage ends through no fault of your own, such as your Medigap insurance company going bankrupt. You have up to 63 calendar days to apply for a new Supplement plan.

- You leave an Advantage plan or drop your Medigap policy because your plan failed to follow the rules or misled you in some way. You'll have up to 63 days to apply for a new Medicare Supplement plan.

These are the only situations in which you have guaranteed issue rights at the federal level. Again, some states offer additional protections. Your State Health Insurance Assistance Program (SHIP) provides the most up-to-date information.

If you don't already have one, create a healthcare folder to store notifications, mailings, and any other written communications from your Medicare insurance providers. This includes mailings from CMS, your Medigap insurer, and Part D or Medicare Advantage plan providers. You may need these communications to support your guaranteed issue rights.

Changes to Medigap Plan C and Medigap Plan F

A change to federal law now forbids Medicare Supplement policies that pay the Part B deductible. Medigap Plan C and Medigap Plan F both include this benefit. Anyone whose Medicare eligibility date falls on or after January 1, 2020 may no longer join either Plan C or Plan F. If you already had one of these Medigap plans, you may keep your coverage. And if you were eligible for Medicare BEFORE 2020 but delayed enrollment, you may still join Plans C and F. We do not recommend this, however, as premiums tend to rise quickly once a Supplement plan is discontinued.

There are two other Medigap plans that offer the same benefits as C and F, minus the Medicare Part B deductible. These are Medigap Plan D (in place of C) and Medigap Plan G (in place of F).

You can review Medigap plans in your area by entering your zip code in our Find a Plan tool.

What does Medigap cover?

Medigap plan benefits vary according to the plan you choose. At a minimum, every Medicare Supplement plan covers at least half the following costs:

- Medicare Part A coinsurance

- Medicare Part B coinsurance or copayments

- First 3 pints of blood in a transfusion

- Medicare Part A hospice coinsurance or copayment

You also get an additional 365 lifetime reserve days for inpatient hospital care (Original Medicare only includes 60 lifetime reserve days). The chart above displays the benefits of each plan.

Three states standardize their Medigap policies differently (although they include the same basic coverage). They are:

The link for each state takes you to the appropriate Medicare.gov page.

Additional resources

Local Medicare Help

External Website Link

Medicare Supplement Insurance

Internal Website Link

The Ultimate Guide to Medigap

Internal Website Link