Whether we like it or not, we need to account for healthcare expenses during our golden years. Understanding how Medicare works is an important part of retirement planning.

As we age, healthcare becomes one of the biggest expenses we face. So, when you're budgeting for your retirement years, don't forget to factor in your Medicare costs. Of course, first you need to know what those costs are. This post explains your coverage options and helps you estimate what you'll pay for each one.

How do you qualify for Medicare?

There are only four ways to qualify for Medicare.

- Be aged 65 or older

- Collect disability benefits from the Social Security Administration (SSA) for 24 months

- Receive a diagnosis of end-stage renal disease (ESRD) that requires either dialysis or a kidney transplant

- Be diagnosed with amyotrophic lateral sclerosis (ALS, or Lou Gehrig's disease)

You must also be either an American citizen or permanent legal resident who has resided in the United States for at least 5 years (continuously).

The vast majority of beneficiaries – around 83% – qualify for Medicare based on their age.

What are your Medicare coverage options?

Medicare beneficiaries have two main options: Original Medicare or a Medicare Advantage (MA) plan.

There are two parts to Original Medicare.

- Medicare Part A: Sometimes called hospital insurance, Part A covers inpatient hospital services, such as surgical procedures and skilled nursing facility (NSF) care.

- Medicare Part B: Also known as medical insurance, Part B covers costs associated with outpatient healthcare services. This includes doctor visits, lab work, and durable medical equipment (DME).

Original Medicare does not include prescription drug coverage, hearing aids, or routine vision or dental care. To get this coverage through Medicare, you may purchase a standalone Part D prescription drug plan or a Medicare Advantage plan that provides additional benefits.

How much does Original Medicare cost?

Medicare uses a cost sharing model that includes monthly premiums, deductibles, and coinsurance.

Medicare Part A costs

Most people qualify for premium-free Part A because either they or their spouse paid Medicare taxes for the required 40 quarters (10 years). For everyone else, the monthly premium for Part A is either:

- $278 if you or your spouse paid Medicare taxes for 30 to 39 quarters

- $505 for anything less than 30 quarters

If you aren't sure whether you qualify for premium-free Part A, use the Eligibility & Premium Calculator provided by Medicare.gov.

Other out-of-pocket costs under Medicare Part A are calculated per benefit period. A benefit period begins the day you're admitted to the hospital as an inpatient. It ends once you go 60 consecutive days without receiving inpatient care. Your costs per Part A benefit period include:

- Deductible: $1,632

- Coinsurance days 1-60: $0 per day

- Coinsurance days 61-90: $4080 per day

- Coinsurance days 91 through 60 lifetime reserve days: $816 per day

Finally, if you delay enrollment in Medicare Part A AND you don't qualify for premium-free or a Special Enrollment Period (SEP), you face a late enrollment penalty.

- You pay 10% for every full year you delay enrollment in Part A

- The penalty lasts for twice the number of years you delayed enrollment (1-year delay = 2 years of late penalties, 2-year delay = 4 years, etc.)

Medicare Part B costs

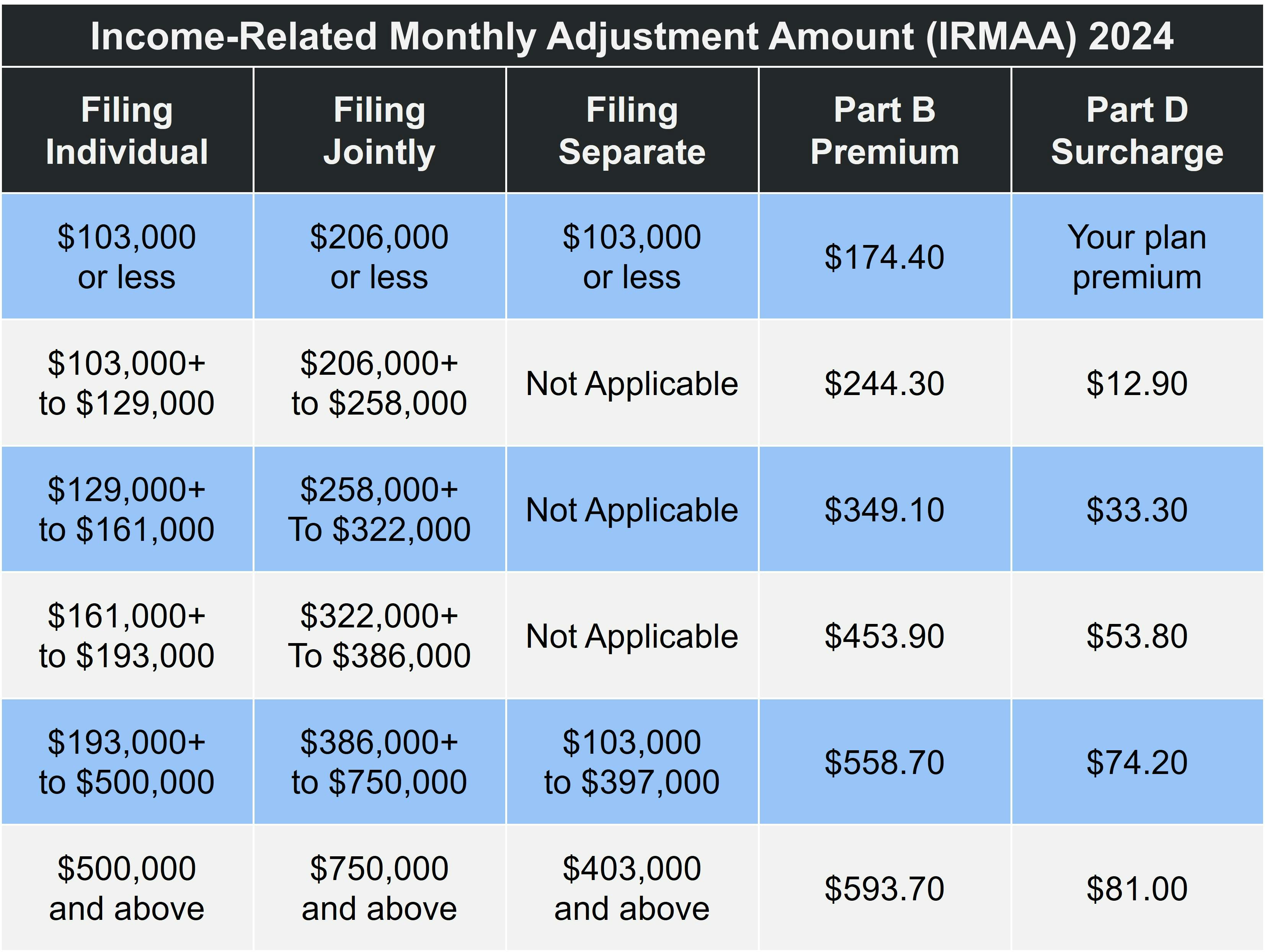

The standard premium for Medicare Part B in 2024 is $174.40.Your premium may be higher if your income exceeds $103,000 per year (filing single) or $206,000 (married filing jointly). The table below shows the adjustment amounts for each income bracket for both Part B and Part D.

Medicare Part B also has a yearly deductible of $240. Once you meet your yearly deductible, Part B begins covering 80% of most Medicare-approved services, leaving you responsible for the remaining 20%. Part B covers 100% of the cost of some preventive screenings, such as the Annual Wellness Visit.

The late enrollment penalty for Part B is also calculated according to how long you delayed enrollment. However, there are two main differences.

- You pay 10% for every year you delay enrollment, so 1 year = 10%, 2 years = 20%, and so on

- You pay this penalty for the entire time you have Medicare Part B

If you qualify for an SEP, present your notification of creditable coverage when you apply for Part B to avoid paying the late fee.

What is Medicare Advantage (Medicare Part C)?

Medicare Advantage plans offer the same coverage as Original Medicare does. However, the vast majority – over 90% – provide additional benefits, such as prescription drug coverage, hearing aids, fitness programs, or routine vision and/or dental care.

Also known as Medicare Part C, MA plans are sold by private insurance companies. Costs and coverage vary according to the plan and provider, so compare your options carefully.

- Look at the full cost of the plan – not just the monthly premium. This includes copayments, coinsurance, and deductibles.

- Consider the plan's benefits to make sure you're comparing apples to apples. An Advantage plan that has a monthly premium and covers prescription medications and routine dental care may be a better deal than a $0 MA plan with no extra benefits.

- Remember that you still have to pay your Part B premium, even if your MA plan has one.

Our Find a Plan tool is an easy way to compare Medicare plans. Just enter your location to review Medicare Advantage, Part D, and Medigap plans in your area.

What is Medicare Part D?

Medicare Part D is how beneficiaries get prescription drug coverage.

You can add a standalone Medicare Part D prescription drug plan to Original Medicare or an MA plan that doesn't cover medications. Like Medicare Advantage, Part D plan costs vary widely. You may also join a Medicare Advantage Prescription Drug plan (MA-PD), which, as the name implies, include prescription drug coverage. Most Medicare Advantage plans include Part D coverage.

When comparing prescription drug plans, look beyond the monthly premium to determine the true cost of the plan. You should also review the plan's drug formulary. This is the list of prescription medications covered by the plan. If the formulary doesn't include one or more of your medications, it probably isn't the right plan for you.

Medicare Part D Costs

Although we can't tell you what you'll pay per month for a Part D plan, we can explain late fees and IRMAA.

We'll start with IRMAA, which stands for income-related monthly adjustment amount. As with the Part B premium, Part D beneficiaries whose income exceeds certain guidelines pay a little extra, as demonstrated in the table above (under Part B costs).

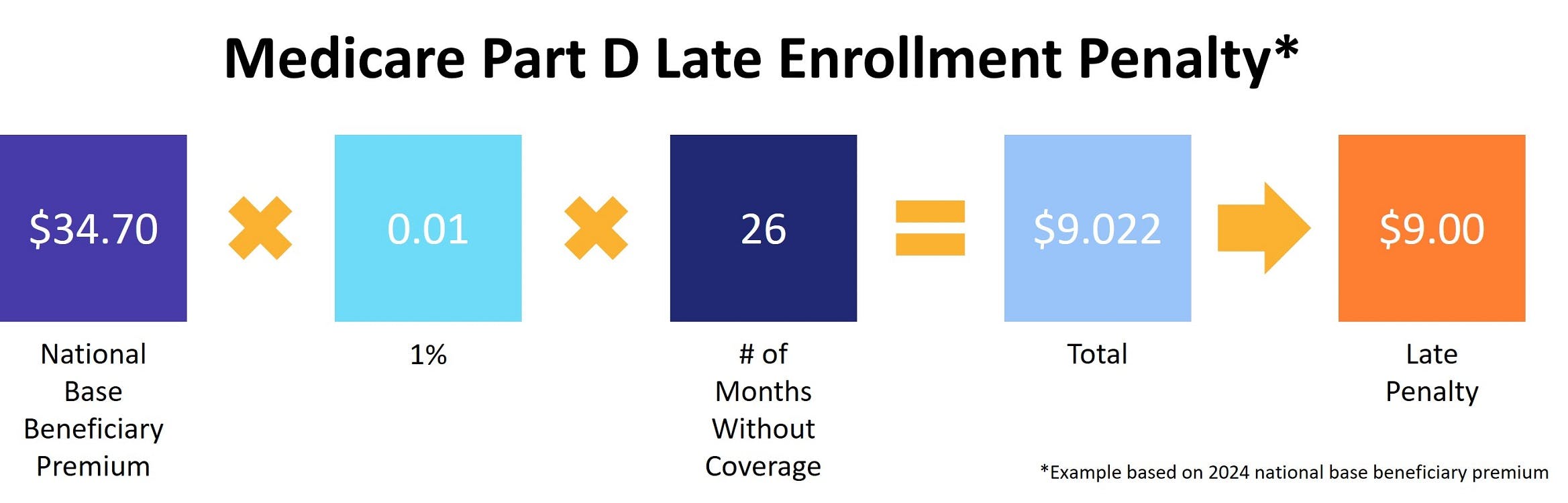

Medicare Part D also has a late enrollment penalty. Unlike Parts A and B, you can only go 63 days without creditable prescription drug coverage before you start earning late fees. If you go 26 months without creditable prescription drug coverage, the calculation looks like this:

As with Part B, you pay the late enrollment penalty for the entire time you have Medicare Part D.

What is Medigap?

Medicare Supplement Insurance, commonly known as Medigap, helps pay some of your out-of-pocket costs under Original Medicare.

Costs and coverage vary, but all Medigap plans reimburse you for the Part A deductible and give you an extra 365 lifetime reserve days. All Medigap plans also cover at least half of your Part B coinsurance (with most Supplement plans paying 100%).

If you choose Original Medicare, we recommend supplementing your coverage with both a Part D and Medigap plan, preferably when you first become eligible. This is known as your Medigap Open Enrollment Period (OEP).

There are no late fees for delaying enrollment in a Medicare Supplement plan. However, Medigap OEP is one of the only times you have guaranteed issue rights. At any other time, you have to go through a process called medical underwriting. Your Medigap application includes a series of health-related questions. Your answers to any of these questions may result in higher premiums or even a refusal to sell you a policy.

You cannot pair Medigap with an Advantage plan.

How to apply for Medicare

If you aren't already collecting Social Security when you turn 65 (technically, three months before you turn 65), you have to apply for Medicare.

Your Initial Enrollment Period (IEP) lasts for seven months. It begins three months before the month you turn 65 and ends three months after. If you delay Medicare enrollment and don't qualify for a Special Enrollment Period, you may owe late penalties for the entire time you have Medicare.

If you or your spouse are still employed when you turn 65, you may qualify for an SEP. Our post, What Is Medicare Creditable Coverage, explains which types of employer-sponsored plans qualify.

You apply for Medicare via the Social Security website here.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs

- Social Security Administration: Extra Help