Original Medicare's out-of-pocket costs include premiums, deductibles, and co-insurance.

Between premiums, deductibles, and coinsurance, you have quite a few out-of-pocket costs with Medicare. But keeping up with what you pay can be confusing, since it changes every year. So, how much does Medicare cost in 2024? Keep reading to find out.

What are your Medicare costs in 2023?

We first look at how cost sharing works under the Medicare program.

Original Medicare includes Part A, hospital insurance, and Part B, medical insurance. You also need Medicare Part D prescription drug coverage. For each of these, your potential out-of-pocket costs include:

- Deductible

- Premium

- Coinsurance or copayments

- Late penalties

If you decide to join a Medicare Advantage (MA) plan instead, you still have to pay your Medicare Part B premium. And, if that Advantage plan does not include drug coverage, you'll also need Medicare Part D.

How much does Medicare Part A cost in 2024?

Most people – 99% – only have to pay the Medicare Part A deductible and coinsurance. That's because they paid Medicare taxes for the required 40 quarters (10 years) to qualify for premium-free Part A.

If you or your spouse did not meet this requirement, the monthly premium for Medicare Part A is $505 in 2024. Those who paid Medicare taxes for 30 to 39 quarters pay a slightly lower Part A premium of $278.

How much is the Medicare Part A deductible in 2024?

Under most health insurance plans, deductibles are paid yearly. But the Medicare Part A deductible is charged per benefit period. The 2024 Medicare Part A deductible is $1,632 per benefit period.

A benefit period begins the day you are admitted as an inpatient to a hospital or skilled nursing facility (SNF). It ends once you go 60 consecutive days without receiving inpatient care.

You can have multiple benefit periods in a calendar year.

How much is Medicare Part A coinsurance in 2024?

Medicare Part A coinsurance varies according to the type of care received and for how long. As with the deductible, these charges are per benefit period.

Medicare Part A coinsurance as a hospital or mental health inpatient:

- Days 1-60: $0

- Days 61-90: $408 per day

- Days 91 through your 60 lifetime reserve days: $816 per day

If you buy a Medigap plan, you get an extra 365 lifetime reserve days. It will also cover the cost of your Part A coinsurance.

Medicare Part A coinsurance for skilled nursing facility stays:

- Days 1-20: $0

- Days 21-100: $204 per day

- Days 101 and beyond: You pay 100% of costs

The Part A coinsurance for hospice care is $0. However, your copayment for prescription medications while in hospice care may be up to $5 per medication. In addition, if your primary caregiver needs time to rest, you may be responsible for 5% of the cost for inpatient respite care.

Part A coinsurance for home healthcare is also $0. You will, however, pay 20% of the Medicare-approved amount for durable medical equipment (DME). This is covered under your Medicare Part B benefits.

How much is the Medicare Part A late enrollment penalty?

Since nearly everyone qualifies for premium-free Part A, it's rare anyone would have to pay a late enrollment penalty. However, if you don't have the necessary work history AND you delay Part A enrollment, you may face late fees when you do finally sign up.

The Medicare Part A late enrollment penalty is 10% of your monthly premium for twice the number of years you could have had Part A but did not. It looks like this:

- 1-year delay = 2 years paying the penalty

- 2-year delay = 4 years paying the penalty

And so on. The amount of the penalty will change every year, since the Part A premium changes every year. In 2024, it would be $50.50 (10% of $505). The amount is automatically added to your monthly Part A premium.

A full 12 months must pass between the time you became eligible and the time you enrolled before you start earning late fees.

How much does Medicare Part B cost in 2024?

Your 2024 costs for Medicare Part B are:

- Annual deductible: $240

- Standard monthly premium: $174.40

- Coinsurance: Typically, 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment

You must meet your yearly deductible before Medicare begins paying its share for covered services.

How much is the Medicare Part B premium surcharge in 2024?

The Medicare Part B premium is based on your household income. Most people pay the standard premium (hence the term "standard"). But, if your adjusted gross income from 2 years ago exceeds certain thresholds, you may pay more. This is known as IRMAA: Income Related Monthly Adjustment Amount. It applies to Medicare Part D as well (more on that below).

Social Security will mail you an Initial IRMAA Determination Notice if you owe the Part B premium surcharge. This notification also includes information on how to appeal this decision. To appeal, you must prove you have experienced a permanent reduction in income.

How much is the Medicare Part B late enrollment penalty?

As with Part A, you may owe a late enrollment penalty if 12 or more months pass where you could have had Part B coverage but did not. Unlike Part A, however, you pay this penalty for the entire time you have Medicare Part B coverage.

The Medicare Part B late enrollment penalty is 10 percent for every year you could have had Part B coverage but did not. It looks like this:

- 1-year delay = 10%

- 2-year delay = 20%

And so on. As the penalty is a percentage of your monthly premium, it typically changes every year. The amount owed is automatically added to your Medicare bill.

How much does Medicare Part D cost in 2024?

Medicare Part D costs vary according to the plan and provider you choose. However, there are some basic costs we can share.

- Part D deductible: This varies by plan, but the maximum Part D deductible in 2024 is $545.

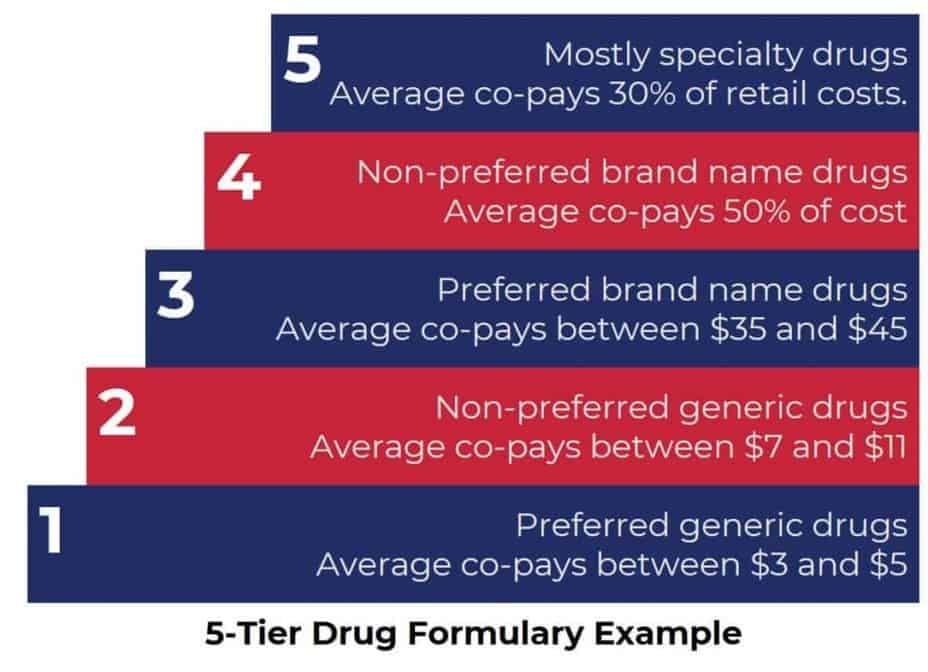

- Part D premium: This also varies, but most states have plans that start at $15 to $40 per month. As with Part B, your Part D premium is based on your income (see the IRMAA infographic above). Medicare Part D costs also include coinsurance and/or copayments. These vary according to which drug tier your medications are on. Drugs on the lower tiers cost less than those on the higher tiers.

How much is the Medicare Part D late enrollment penalty?

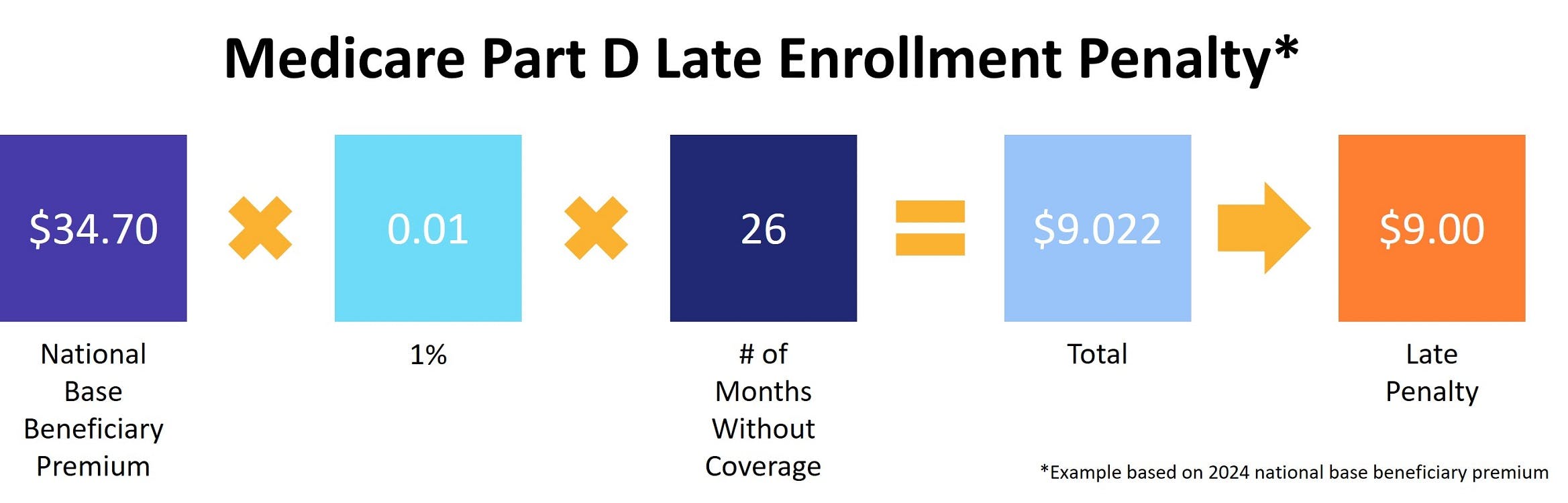

If you go more than 63 consecutive days without creditable prescription drug coverage, you may owe the Part D late enrollment penalty. It is based on the national base beneficiary premium. You pay 1% of this premium for every month you did not have creditable drug coverage, rounded to the nearest dime. Assuming you go 26 months without Part D coverage, the calculation looks like this:

You pay the Part D late enrollment penalty for the entire time you have prescription drug coverage through Medicare.

To be considered creditable, your plan must be equal to what you get with Medicare in terms of both price and coverage. Your plan will notify you every year whether your coverage is creditable or not.

How much does Medicare Advantage cost in 2024?

There are no set costs for Medicare Part C, more commonly known as Medicare Advantage, as these plans are provided by private insurance companies. Your out-of-pocket costs under Medicare Advantage may include:

- Monthly premium

- Yearly deductible

- Copayments

According to Kaiser Family Foundation, the average Medicare Advantage premium going into 2024 is $18.50. However, premiums range from $0 to nearly $300. That's why it's so important to review the list of covered services carefully when comparing your Medicare Advantage plan options. You may decide the plan is worth the higher premium if it includes benefits like prescription drug coverage, dental, and vision.

Please note that, even if your Advantage plan has a monthly premium, you will also have to pay your Medicare Part B premium, including any late penalties.

How much does Medicare Supplement Insurance cost in 2024?

Medicare Supplement Insurance, more commonly known as Medigap, is also offered by private insurance companies. Policy prices vary according to which plan and provider you choose. Averages range between around $40 per month for the less robust plans to around $150 for the ones with more well-rounded coverage, such as Plan G.

Prices also vary widely according to where you live. The same plan that costs $150 in one city may cost $300 in another - or less than $100. Please note that while premiums vary, the benefits offered by these plans are standardized so that every Plan A (or B, C, etc.) offers the same benefits as every other Plan A.

Medicare costs FAQ

Answers to the most frequently asked questions we get about Medicare costs.

How do you get premium-free Medicare Part A?

To get premium-free Medicare Part A, you or your spouse had to pay Medicare taxes for 10 years or 40 quarters. As long as you or your spouse worked for 10 or more years in the United States, you should qualify for premium-free Part A. (Around 99% of Medicare beneficiaries get premium-free Part A.)

Does anyone pay less than the standard Part B premium?

If you receive Social Security benefits, your Part B premium may be lower if the cost of living adjustment (COLA) you receive each year is not enough to offset the rise in your Medicare Part B premium. In other words, if your COLA increase is $5 but Part B goes up $10, you won't have to pay the full premium.

Don't worry about doing the math on this one. Social Security does it for you and will notify you if you have to pay more or less than the standard Part B premium. Remember, all communication from both Medicare and Social Security is via U.S. mail. Nobody will ever call you unless you've requested a phone call.

Can I deduct my Medicare premiums on my taxes?

It's always a good idea to talk to your tax accountant to know for sure. However, the basic rule of thumb is that, if your yearly medical expenses are more than 10 percent of your adjusted gross income, you may deduct them on your taxes. This includes your Medicare premiums.

Does Social Security deduct my Medicare premiums from my check?

If you receive Social Security benefit then yes, Social Security deducts your Medicare premiums from your monthly payment.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs

- Social Security Administration: Extra Help