Medicare costs vary widely depending on the type of coverage you have and how healthy you are.

Medicare cost per person per month can depend on a number of factors, including how you receive your benefits (Part A and Part B) and how much you use them each month.

Costs associated with Medicare include monthly premiums, deductibles, copays and coinsurance. And, if you don’t enroll in Medicare when you’re eligible, you may be subject to late enrollment penalties for as long as you’re enrolled in Medicare.

Most people are eligible for premium-free Part A, but must pay a deductible and coinsurance. Part B has a monthly premium, deductible and copays/coinsurance costs as well.

Private insurance companies offer other ways to receive your benefits, such as through a Medicare Advantage plan (Part C) or Medigap policy, which can vary in price. Part D prescription drug plans can also vary in price, but typically have a premium and copays/coinsurance for prescription drugs.

Understanding the costs associated with Medicare, and roughly calculating how much you may spend on healthcare, can help you budget and prepare for the year appropriately.

Medicare costs

The out-of-pocket expenses you may have with Medicare (or any health insurance plan) include:

- Premium: A monthly payment you must make in order to have the plan

- Deductible: The amount you must pay out-of-pocket before Medicare starts to cover costs

- Copay: A flat fee you pay for covered services

- Coinsurance: The percentage of costs you pay after reaching your deductible

How much does Medicare Part A cost?

Part A (hospital insurance) covers most inpatient hospital needs, skilled nursing facility (SNF) care, nursing home care, hospice care, and home health care (if you qualify). When you apply for Medicare, you’re automatically enrolled in Part A.

Monthly premium

Most people don’t pay a monthly premium for Part A. This is often called “premium-free Part A.”

You qualify for premium-free Part A when you turn 65 if:

- You already get retirement benefits from Social Security or the Railroad Retirement Board (RRB).

- You are eligible to get Social Security or RRB benefits, but haven’t filed for them yet.

- You or your spouse had Medicare-covered government employment.

If you’re under the age of 65, you qualify if:

- You’ve received Social Security or RRB disability benefits for 24 months.

- You have end-stage renal disease (ESRD) and meet certain requirements.

If you don’t qualify for premium-free Part A, you can purchase it. You’ll pay a premium of either $278 per month if you paid Medicare taxes for 30-39 quarters, or $505 per month if you paid Medicare taxes for less than 30 quarters.

To be able to purchase Part A, you must also have Part B and pay the monthly premiums for both Part A and Part B.

Part A deductible

In 2024, you’ll pay $1,632 for your Part A deductible. This is the amount you have to pay out-of-pocket before Medicare begins to pay for services and supplies.

Part A coinsurance - hospital stay

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $408 coinsurance per day of each benefit period

- Days 91 and beyond: $816 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime)

- Beyond lifetime reserve days: you pay all costs

Part A coinsurance - SNF stay

- Days 1-20: $0 coinsurance for each benefit period

- Days 21-100: $204 coinsurance per day of each benefit period

- Days 101 and beyond: you pay all costs

Part A late enrollment penalty

If you’re not automatically enrolled in Part A and you don’t sign up for Part A during your initial enrollment period, you must pay a late enrollment penalty when you do sign up.

The enrollment penalty is 10% of the cost of the monthly premium. You’ll have to pay this cost each month for twice the number of years you’re eligible for Part A, but didn’t sign up.

For example, if you waited for 24 months (2 years) to sign up, you’ll pay the penalty each month for 4 years.

How much does Medicare Part B cost?

Part B (medical insurance) covers most medically necessary services or supplies you need to diagnose or treat a medical condition, as well as preventive services to help you stay healthy longer.

Monthly premium

In 2024, the standard premium amount for Part B is $74.40. This will be automatically deducted from either:

- Social Security,

- Railroad Retirement Board (RRB), or

- Office of Personnel Management

If you don’t receive any of these payments, you’ll get a bill.

You receive the standard premium amount if:

- You enroll in Part B for the first time in 2024

- You don’t get Social Security benefits

- You’re directly billed for your Part B premiums

- You have Medicare and Medicaid, and Medicaid pays your premiums

If your modified adjusted gross income (MAGI) as reported on your IRS tax return from two years ago is more than $103,000 ($206,000 if you're married and file a joint tax return), you’ll have to pay the standard premium plus an Income Related Monthly Adjustment Amount (IRMAA).

Part B deductible

In 2024, you’ll pay $240 for the Part B deductible. This is the amount you have to pay out-of-pocket before Medicare begins to pay for services and supplies.

Part B coinsurance

Once you meet your deductible, you’ll typically pay 20% of the Medicare-approved amount for:

- Most doctor services

- Outpatient therapy and services

- Durable medical equipment (DME)

Medicare will pay the other 80%.

Other costs for Medicare-approved services include:

- $0 for clinical laboratory services

- $0 for home health care services

- $0 for covered annual preventive screenings

- 20% for outpatient mental health services, including visits to your doctor to diagnose or treat your condition (though additional copayments or coinsurance may apply if you get your services in a hospital outpatient clinic or department)

- A percentage of the Medicare-approved amount for each service you get from a doctor for partial hospitalization mental health services (as long as the doctor accepts assignment). You’ll also pay coinsurance for each day of partial hospitalization services you get in a hospital outpatient setting or community mental health center.

- Hospital copayment for each service you get in a hospital outpatient setting, except for certain preventive services

There is no limit on Part B coinsurance costs, so these out-of-pocket costs can add up if you visit the doctor often or need other services or supplies.

Late enrollment penalty

If you do not enroll in Part B when eligible. Your monthly premium may go up 10% for each 12-month period you could have had Part B but didn’t. It looks like this:

- 12 full months = 10% penalty

- 24 full months = 20% penalty

- 36 full months = 30% penalty

And so on.

In most cases, you’ll have to pay this penalty each time you pay your premiums for as long as you have Part B, and it could increase the longer you go without coverage. This is a life-long penalty.

How much does Medicare Part C cost?

Part C, or Medicare Advantage, is an alternative way to receive your Medicare benefits. These plans, offered by private insurance companies who contract with Medicare, offer the same coverage you’d get with Original Medicare Part A and Part B, as well as additional benefits. These additional benefits may include vision, hearing, dental, fitness programs, prescription drug coverage and more.

While out-of-pocket costs may vary, there is an out-of-pocket maximum for Part C plans. You cannot spend more than $8,850 (in 2024) on healthcare expenses per year for in-network services, or $11,300 for out-of-network services.

Monthly premium

The Part C monthly premium varies by plan. It can be as little as $0, or it can be more. On average, you'll pay a little less than $20 for an Advantage plan premium.

Whether your plan has a monthly premium or not, you still have to pay your Medicare Part B premium.

Part C deductible

Deductibles vary by plan. Compare plan costs with our Find a Plan tool quickly and easily. Just enter your zip code to review costs and benefits of Medicare Advantage, Part D, and Medigap plans in your area.

Part C coinsurance

Copayments and/or coinsurance also vary by plan. Another reason it's important to compare your options carefully.

How much does Medicare Part D cost?

Part D, or prescription drug coverage, can be purchased as a stand-alone plan, or included with a Part C plan. Part D plans can also vary in cost based on a number of different factors, including deductibles, premiums, coinsurance and copays that can vary by plan.

Monthly premium

In 2024, the national average monthly premium will be about $34.70, though costs vary by plan.

However, if you have a higher income based on your IRS tax return, you may have to pay an income-related monthly adjustment amount in addition to your plan premium. The chart above includes the surcharge if you owe the Part D IRMAA.

Part D deductible

Your deductible cannot be more than $545 in 2024. However, this is yet another price variable that depends on the plan you choose. Some Part D plans have no deductible while other set it lower than the federal max.

Part D coinsurance

Copayments and/or coinsurance can vary by plan depending on what tier your drug falls into.

Part D drugs are split into levels called “tiers,” and each tier has different copayments. Typically, tiers are:

- Tier 1: preferred generics (least expensive)

- Tier 2: generics

- Tier 3: preferred brand names

- Tier 4: nonpreferred brand names

- Tier 5: specialty drugs (most expensive)

Part D plans have a temporary limit on what the drug plan will cover, called the “coverage gap” or “doughnut hole.” This kicks in after you and your plan have spent a combined $5,030 (in 2024) on Part D prescriptions. Once you reach the coverage gap, you’ll pay no more than 25% of the cost for covered drugs.

Then, once you have paid $8,000 in out-of-pocket costs, you have reached the “catastrophic coverage” and your prescription drug coverage begins paying for most of your drug expenses again. The most you'll pay for the rest of the year is $4.50 for generic prescriptions and $11.20 for name brand drugs.

Part D late enrollment

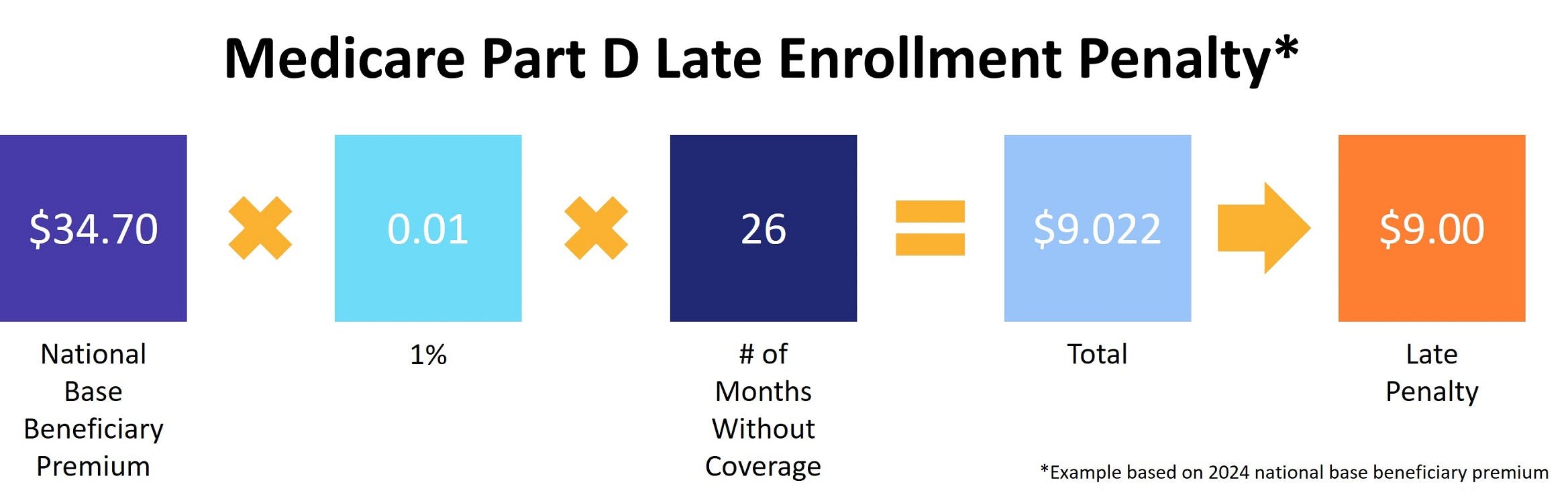

Medicare requires you to have at least basic prescription drug coverage within 63 days of when you become eligible for Medicare. If you don’t have proper coverage, you may have to pay a late enrollment penalty. (Even if you don’t take any prescription medications when you become eligible for Part D, you should still enroll to avoid a future penalty.)

This fee is 1% of the average monthly prescription premium costs, multiplied by the number of months you were late in enrolling. This cost will be added to your monthly premium, and the extra cost is permanent.

If you were to go 26 months without prescription drug coverage, the late fee calculation would look like this:

What is Medigap?

When you’re enrolled in Medicare Part A and Part B, you can purchase a Medigap plan to help fill the gaps in your coverage, such as payment for copays, deductibles, and healthcare when you travel.

When you have a Medigap plan, Medicare will pay its share of the Medicare-approved amount for covered health care costs, then your Medigap plan pays its share. This helps cut down on your out-of-pocket costs.

Once you qualify, you must pay a monthly premium for the coverage in addition to your monthly Part B premium. Medigap premiums can increase each year.

Because Medigap plans are sold by private insurance companies, they can charge a higher monthly premium. This is especially the case if you don’t enroll during the Medigap Open Enrollment Period, or enroll without guaranteed issue rights. In that case, you may be subject to medical underwriting and charged a higher premium.

Some Medicare supplement plans also have a deductible you must meet before the insurance company starts covering your costs.

Medicare monthly cost

Your monthly cost with Medicare will vary depending on a number of factors, including:

- Whether you have a Part A premium

- Whether you have Part C Medicare Advantage plan coverage

- Whether you purchase a stand-alone Part D plan, or you have prescription drug coverage included in a MA plan

- Hospital or medical services you may (or may not) need

- Prescription drugs you may need filled

Does Medicare Cover All of My Costs?

While we know there are services and supplies that Medicare doesn’t cover fully, so you’d pay a copay or coinsurance, there are also services Medicare doesn’t cover at all.

For example, in most cases Medicare doesn’t cover:

- Treatment abroad

- Dental checkups or procedures

- Dentures

- Eye exams

- Eyeglasses

- Hearing aids

- Routine foot care

- Long-term care

If Medicare doesn’t cover the service, you’d be responsible for paying 100% of the costs out-of-pocket.

How to lower Medicare costs

There are a few things you can do to help lower your Medicare costs.

First, the Medicare Savings Program helps low-income beneficiaries pay for Medicare premiums, copays and deductibles. The Extra Help program helps pay for prescription drug coverage. If you believe you are eligible for either of these programs, contact Medicare.

If you’re eligible for Medicaid, the federal-and-state-funded health insurance program for low-income Americans, you may qualify for lower cost healthcare. To find out if you’re eligible, contact Medicaid directly.

Additionally, each year, compare plans and costs. Look at the different Medicare benefits you’ve used in the past year, and consider which you may need to use next year. If your preferred doctor is out-of-network, consider finding a plan where they are in-network. Ask your doctor about switching to generic or lower-cost prescription drugs. There are many ways you can take advantage of your coverage and plan options to save money.

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs

- Social Security Administration: Extra Help