Medicare Part D provides prescription drug coverage, something that was missing from Original Medicare.

One of the main frustrations with Original Medicare is that it doesn’t offer any prescription drug coverage. Although Medicare health insurance plans offer a lot of coverage, there is no way to get prescription drug coverage through your main Medicare plans. However, Part D plans are an easy and affordable way to get prescription drug coverage and an option that many seniors consider.

If you want to add a Part D prescription drug plan (PDP) to your Original Medicare, you aren't free to do so at any time. Like Original Medicare, Part D plans use enrollment periods that limit when you’re able to enroll without facing penalties. Understanding how to add a Part D plan to your Medicare coverage is important if you don’t want to have to pay these penalties later on.

What is Medicare Part D: How does it work?

Part D offers Medicare prescription drug coverage. Importantly, these plans are offered by private insurance companies, not the federal government. This means that unlike Part A and Part B, there is a variety to the coverage: not every plan is the same. When you look at a plan, make sure that you understand their formulary, or the list of drugs that they cover. This will ensure that you get the coverage that you need.

Medicare prescription drug plans vary in cost, but there may be an additional amount that you will have to pay if you're what Medicare calls a "high earner". This is called the Income-Related Monthly Adjustment Amount (IRMAA) and fewer than 5% of Medicare beneficiaries owe it. The table below lists the surcharge at each income level.

Enrolling in Part D: The Initial Enrollment Period

Three months before you turn 65, you will enter the Initial Enrollment Period (IEP). During this seven-month period, you will be able to enroll in Medicare Part A, as well as Medicare Part B and Part D without any late penalties. This period begins three months before your birthday month, includes your birthday month, and lasts for three months after, for a total of seven months.

You will be enrolled in Medicare automatically if you begin collecting Social Security benefits at least four months before turning 65. Otherwise, you must choose to sign up for Medicare, which you do through the Social Security Administration (SSA) here.

During your IEP, you can enroll in a Part D drug plan for the first time without facing any late penalties. If you enroll in a Part D plan after your IEP ends, then you may have to pay a late enrollment penalty (LEP). However, there are some situations in which this can be avoided, which we’ll discuss below.

Enrolling During the Annual Enrollment Period

The Annual Enrollment Period (AEP) lasts from October 15th to December 7th each year. During this time, you’ll be able to enroll in a Part D plan, but you may have to pay the late penalty if you’re enrolling late. When you sign up during the Annual Enrollment Period, your coverage will begin on January 1st of the following year.

Understanding the Part D Late Enrollment Penalty

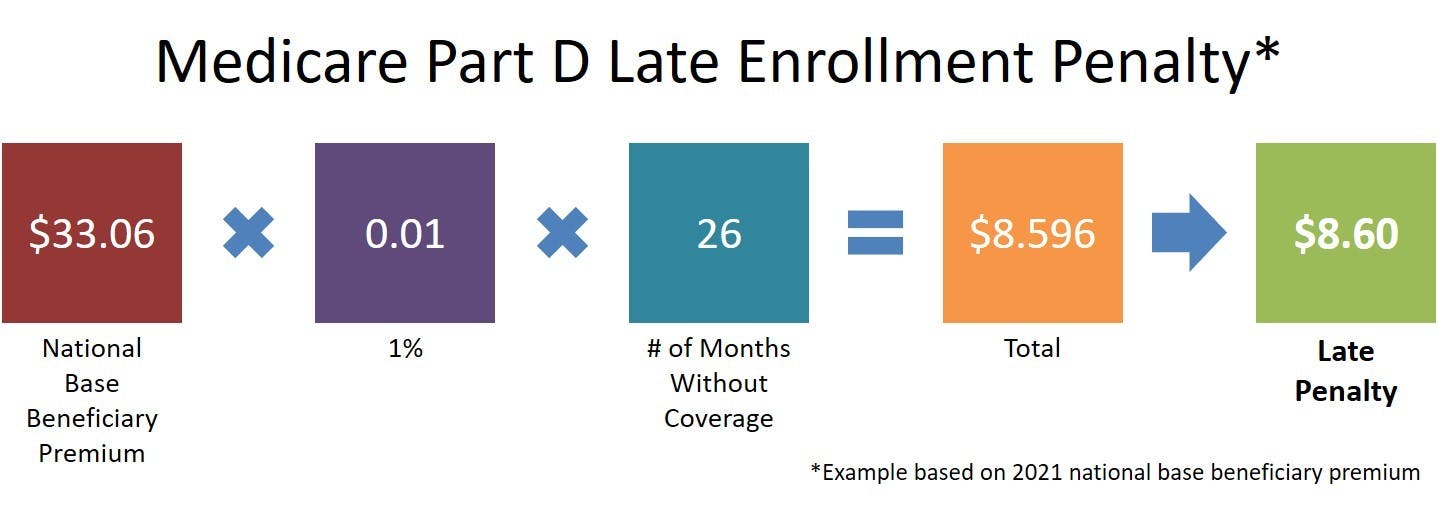

If you enroll in a Part D plan after your Initial Enrollment Period, you may have to pay a late fee. This penalty is an additional monthly fee that you pay along with your premium each month. It is not a one-time fee; you'll owe this extra charge the entire time you have Medicare. The graphic below shows how the late enrollment penalty is calculated.

The penalty amount depends on how many months you go without creditable prescription drug coverage (i.e., insurance that's comparable to Medicare in terms of price and coverage). It also changes each year, as the national base beneficiary premium changes.

How to Avoid the Late Enrollment Penalty

Avoiding the late enrollment penalty is simple - just maintain prescription drug coverage (not a discount program).

Maintain Creditable Prescription Drug Coverage

If your Initial Enrollment Period comes and goes, but you have creditable health care coverage until you transition to a Part D plan, you won’t have to pay the late enrollment penalty. Creditable coverage refers to coverage that is as comprehensive as Part D plans are required to be. The details won’t matter too much for most people, and the best way to find out is to inquire with your employer or your health plan directly; they will be able to tell you if your coverage is creditable.

If you enroll in a Part D plan after your creditable coverage ends, whether using a Special Enrollment Period or an Open Enrollment Period, you won’t have to pay the Late Enrollment Penalty.

Triggering a Special Enrollment Period (SEP)

When it comes to Medicare enrollment, Special Enrollment Periods (SEPs) allow you to make changes to your Medicare coverage without penalties and outside the usual enrollment periods. SEPs are triggered by things such as losing employer-based coverage or moving out of a coverage area. The basic idea behind Special Enrollment Periods is to make sure you don’t get punished with penalty fees due to things that are outside of your control.

If you are covered by an employer-based prescription drug plan during your Initial Enrollment Period, and later lose it, this will trigger an SEP. The full list of qualifying special circumstances is here.

Extra Help for Part D

Extra Help is a program for low-income Medicare beneficiaries that helps pay your Part D premiums, deductibles, coinsurance, and other out-of-pocket prescription drug costs.

You will usually be notified that you qualify for Extra Help by Social Security or by Medicare directly. If you receive one of these notices, you can show them to your insurance company, which will then alter your plan following the Extra Help guidelines. The details will vary depending on your exact situation, but it will result in you paying less.

You will also be eligible for Extra Help if you receive Medicaid. If you have a Medicaid card from CMS or other documentation that shows that you have Medicaid, you can use this to show to your plan. Different plans accept different documents as proof that you qualify for Extra Help, so make sure to double-check with your specific plan about what you need.

If You Have Medicare Advantage

If you have a Medicare Advantage plan that covers prescription drugs, you can't enroll in a Part D plan at the same time. If you disenroll in your Medicare Advantage plan during the Annual Enrollment Period, you should then choose a new standalone Part D plan. Your coverage will begin on January 1.

You can also choose a standalone Part D plan if you decide to drop your Medicare Advantage Prescription Drug plan during the Medicare Advantage Open Enrollment Period, which occurs every year between January 1 and March 31.

Options for PFFS and MSA

If you are enrolled in a Medicare Savings Account or Private Fee-for-Service plan, you may already have prescription drug coverage. If not, you will be able to enroll in a Part D plan as usual. The same restrictions will apply, so make sure you enroll on time.

Can Medigap Plans Help?

Medigap plans, also known as Medicare Supplement Insurance, help pay some of your out-of-pocket costs when you have Original Medicare. However, they only cover services included with Parts A and B, which means you cannot use a Medigap plan to pay for prescription medications (or anything else not covered by Original Medicare).

Choosing a Medicare Part D Plan

Our Find a Plan tool makes finding the right Part D plan easy. Just enter your zip code, any prescriptions you take, and start scrolling through the Part D plans in your area.

Additional resources

Special Circumstances (Special Enrollment Periods)

External Website Link

Find Your Level of Extra Help

External Website Link

Medicare Benefits

External Website Link

How to Choose a Medicare Part D Plan

Internal Website Link