Although you don't need to renew Medicare every year, it's smart to at least review your options during the Annual Enrollment Period (October 15 through December 7.)

As long as you continue to pay any applicable premiums, you should not need to sign up for or re-enroll in Medicare coverage every year. This is the case whether you’re enrolled in Original Medicare, a Part C Medicare Advantage (MA) plan, or Part D prescription drug plan. Unless you fall into one of the few exceptions, your coverage should automatically renew every year.

Read on to learn when you may have to reapply or re-enroll in your Medicare plan to avoid late enrollment penalties and fees, and ensure you have the coverage you need when you need it.

When you have to re-apply for Medicare

In most cases, you will not have to re-apply for or renew your Medicare coverage each year. However, if you are enrolled in a Medicare Advantage plan or stand-alone Part D prescription drug plan, there could be a few exceptions when your coverage will not be automatically renewed, including:

- Your plan reduces its service area, and you no longer live within the coverage area.

- Your plan doesn’t renew its Medicare contract for the upcoming year, and is no longer affiliated with Medicare. In this case, you’ll receive a non-renewal notice.

- Your plan leaves the Medicare program in the middle of the year.

- Medicare terminates its contract with your plan.

If none of these situations apply, and you are happy with your existing coverage, your policy will automatically renew and you don’t have to take any action.

If one of these situations does apply, you will receive a notice from your plan making you aware of any changes to your coverage, and information on renewing coverage or changing plans (if applicable). Be sure to read any information your plan sends you so you are informed and don’t miss important dates.

If your Medicare Advantage plan ends and you do not take action, you will be placed back into Original Medicare. At that time, you'll have two months to sign up for a new Part D plan (assuming your prescription drug coverage was through your Advantage plan). If you go 63 days without creditable prescription drug coverage, you begin accruing the Part D late enrollment penalty.

Do you have to renew Original Medicare Part A?

Most people do not have to pay a premium for Part A (hospital insurance) and are automatically renewed each year without having to do anything.

One exception may be if you do not sign up for Part A when you turn 65 due to having primary insurance from your employer or spouse’s employer. Once you lose that other primary coverage, you must enroll in Part A to avoid late enrollment penalties.

You are automatically enrolled in Part A if you are already getting Social Security benefits at least four months before you turn 65. If you aren’t getting Social Security benefits, you can enroll in Part A coverage through Social Security by calling, visiting their website, or going to a local branch.

Do you have to renew Original Medicare Part B?

You do not have to renew Part B (medical insurance) coverage as long as you continue to pay the monthly premiums. In most cases, this premium is subtracted on a monthly basis from your Social Security payments; or, if you don’t receive Social Security, you’ll get a monthly bill.

If you do not pay your premium for three months in a row, you’ll get a cancellation notice. While you can pay your missed payments after your cancelation notice, you only have a short time to do so, and then you will lose your Part B coverage.

You can then re-enroll in Part B in the General Enrollment Period (January through March), though you’ll likely face a late enrollment penalty.

Do you have to renew a Medigap policy?

As long as you make your monthly payments on time, you do not have to renew a Medigap policy. However, there may be times when you’d need to make changes to your policy, including if:

- You’re losing your Medigap coverage because the company that issues it is no longer in business

- You’d like to switch Medigap policies for different coverage

Medicare renewal dates

- If your plan doesn’t renew its contract with Medicare, you’ll have a Special Election Period (SEP) from December 8 to the last day of February the following year.

If you are enrolled in a Medicare Advantage plan that doesn’t renew its contract, and don’t enroll in a new plan by the date your current plan ends its contract with Medicare, you’ll automatically be enrolled in Original Medicare.

- If your MA or Part D plan terminates its contract with Medicare, you get a three-month SEP beginning two months before the contract ends and ending one month after the contract ends.

- If Medicare terminates your plan’s contract, you have an SEP beginning one month before the termination effective date and ending two months after the termination effective date.

You can also make changes to your coverage during the Annual Enrollment Period.

What is the Annual Enrollment Period (AEP)?

You should review your coverage annually to make sure it still meets your needs. Benefits, in-network providers and pharmacies, drug formularies, and costs can change from year-to-year and can affect your coverage and how much you pay out-of-pocket.

Review the information your plan sends out each year, including the Annual Notice of Change (ANOC), drug formulary, and Evidence of Coverage (EOC). If you find that the plan or coverage no longer meets your needs or budget, you have a few opportunities to change it.

During the Annual Enrollment Period (October 15 through December 7), you have the opportunity to make changes to your coverage by:

- Signing up for a Medicare Advantage plan

- Changing from one MA plan to another

- Leaving an MA plan and returning to Original Medicare

- Signing up for a Medicare Part D prescription Drug plan

- Changing from one Part D plan to another

- Dropping your prescription drug plan

From January 1 to March 31, during the Medicare Advantage Open Enrollment Period, you can make additional changes to your health coverage including switching from one MA plan to another or dropping your MA plan and returning to Original Medicare. If making that change causes you to lose your prescription drug coverage, you may also join a stand-alone Medicare Part D drug plan.

If you are happy with your existing costs and coverage, you do not have to take any action and your Medicare coverage will automatically renew for the following year.

Medicare late enrollment

If you do not enroll in Medicare coverage on time, you may have to pay a late enrollment penalty.

Part A late enrollment penalty

If you’re eligible for premium-free Part A coverage you will not have to pay a late enrollment penalty, even if you decide to enroll after you first become eligible.

However, if you aren’t eligible for free Part A coverage, you will have a penalty if you don’t enroll when you’re first eligible. In most cases, your monthly premium will increase 10%, and you’ll have to pay that higher premium for twice the number of years you were eligible for Part A but didn’t have it. For example, if you were eligible for Part A for three years but didn’t enroll, you’ll have to pay a 10% higher monthly premium for six years.

The late enrollment penalty is only applicable if you did not qualify for a Special Enrollment Period.

Part B late enrollment penalty

If you don’t sign up for Part B when you’re eligible, you will most likely have to pay a late penalty. This penalty will last for as long as you have Part B.

To calculate the penalty, take your standard monthly premium amount and increase it by 10% for each 12-month period you could have had Part B but didn’t. For example, if you could have had Part B for two years but didn’t, you’d have to pay a 20% penalty. Your monthly premium would be increased by 20% for as long as you have Part B.

Part D late enrollment penalty

You may incur a late enrollment penalty if at any time after your initial enrollment penalty, there’s a period of 63 or more days in a row where you don’t have Part D or creditable prescription drug coverage. You’ll have to pay the penalty for as long as you have Medicare coverage.

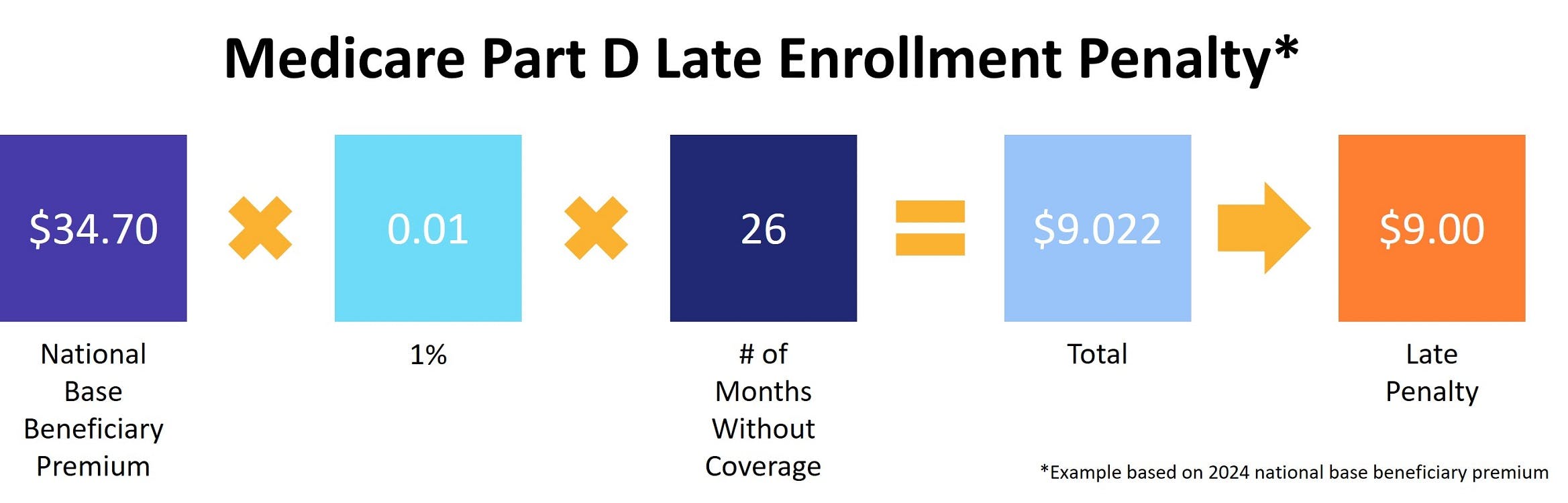

To calculate the penalty, multiply 1% of the national base beneficiary premium ($34.70 in 2024) by the number of full, uncovered months you didn’t have creditable coverage. The premium is then rounded to the nearest $0.10 and added to your Part D monthly premium. If you went 26 months without coverage, the calculation looks like this:

How much does Medicare cost?

Medicare Parts A, B, C and D have different costs associated with them. With each, you could pay a monthly premium, and have different deductible, copay and coinsurance costs.

Part A costs

Monthly premium

You do not have a monthly premium for Part A coverage as long as you or your spouse paid Medicare taxes for at least 10 years (40 quarters) while working.

If you have not paid the applicable taxes, you may purchase Part A coverage if you’re 65 or older and have or are enrolling in Part B coverage. You must also be a U.S. citizen or legal permanent resident. If you paid Medicare taxes for less than 30 quarters (7.5 years), you’ll pay up to $505 per month in 2024. If you paid for 30-39 quarters (7.5-9.75 years), you’ll pay $278 per month.

Deductible

In 2024, the Part A deductible is $1,632 per year. You must pay this much out-of-pocket before Medicare kicks in and contributes to medical costs.

Copays and coinsurance

With Part A coverage, you rarely have to pay a copay for hospital stays, skilled nursing home stays, or hospice care. In most cases, these copays are covered by Medicare. One exception is if you’re in hospice, you may have a copay for prescription drugs you receive.

However, you may have annual coinsurance costs with Part A depending on the length of your stay in a hospital or covered facility. This includes:

- $0 for days 1-60

- $408 per day for days 61-90

- $816 per each lifetime reserve day after day 90 (up to 60 days over your lifetime)

- Beyond lifetime reserve days, you are responsible for all costs.

Part B costs

Monthly premium

In 2024, the standard monthly premium for Part B coverage is $174.40. If your income (as reported on your IRS tax return from two years prior) is above $103,000, you may pay a higher premium.

Deductible

In 2024, the Part B deductible is $240 per year. You must pay this much out-of-pocket before Medicare kicks in and contributes to medical costs.

Copays and coinsurance

Part B also covers most copayments. Most of the time you won’t have a copayment when you visit the doctor, though you may sometimes have one if you get outpatient hospital or mental health services.

You will have coinsurance costs once you reach your deductible. In most cases you’ll pay 20% of the Medicare-approved amount for:

- Most doctor services (including medically necessary services and preventive services)

- Outpatient therapy

- Durable medical equipment (DME)

Part C and Part D costs

The Part C and Part D monthly premiums vary by plan. Copays, coinsurance, deductibles and other out-of-pocket costs also vary by plan. Contact your plan or compare costs before making a decision to ensure it meets your budget and coverage needs.

That being said, the average monthly premium for a stand-alone Medicare Part C plan is around $19, and the average monthly premium for Part D plans is expected to be about $45 in 2024, though your plan could be more or less.

How to find the best Medicare plan for you

Whether you’re shopping for coverage for the first time, or you’re looking to make a change to your existing coverage, there are a few things to consider and ask yourself to ensure you find the best coverage for your needs and budget.

- Review your healthcare spending from the previous year. Did you meet your deductible? What were your out-of-pocket costs? Did you get diagnosed with an illness or chronic condition, or start taking different prescription medication?

- Check to ensure the doctors, pharmacies, medications and durable medical equipment suppliers you currently use or may need in the future are in-network.

- Review any changes listed in the ANOC and understand if they positively or negatively affect you.

- Review increases in premiums, deductibles, maximum out-of-pocket limits and copays. Make sure you are comfortable with any of these changes.

- If you are enrolled in a Medicare Advantage plan, review benefits you used/needed, and benefits you didn’t use or need. Do you still benefit from being enrolled in an MA plan?

Additional resources

- ClearMatch Medicare: Find a Medicare Plan

- Medicare.gov: Costs