Most experts recommend saving around 10 times your pre-retirement income.

It's no secret that most people haven't saved nearly enough for a comfortable retirement. But how much do you need for a "comfortable" retirement? And how does your savings compare to your peers'?

In this article, we look at average retirement savings by age, recommendations to retire comfortably, and suggested steps to help you reach your goals.

Average retirement savings by age

According to the 2019-2020 Federal Reserve Survey of Consumer Finances (CFS), the average retirement savings by age in the U.S. are:

- Ages 18-24: $4,745.25

- Ages 25-59: $9,048.51

- Ages 30-34: $21,731.92

- Ages 35-39: $48,710.27

- Ages 40-44: $101,899.22

- Ages 45-59: $148,950.14

- Ages 50-54: $146,068.38

- Ages 55-59: $223,493.56

- Ages 60-64: $221,451.67

- Ages 65-69: $206,819.35

However, just because that is the average doesn’t mean it’s what experts recommend. The earlier you start saving for retirement the better, but there are general rules of thumb to follow to know how much you should have saved with a goal of retiring at age 67 (full retirement age for Social Security benefits).

How much do you need to save for retirement?

On average, most retirees will need somewhere between 55-80% of their preretirement income to maintain their current lifestyle once leaving the workforce. To get there, experts recommend saving at least 10-15% of your pre-tax income each year.

The 80% rule states that you’ll need to save as much as you’d need to have the equivalent of 80% of your pre-retirement salary. So, if you currently make $75,000 per year, your retirement income would need to be about $60,000 per year. If you retire at age 67 and live to be 80 years old, you’ll need 13 years’ worth of savings. At $60,000 per year, that’s at least $780,000.

However, keep in mind that only about 45% of your retirement income will come from savings, and the rest will likely come from Social Security benefits (about 40%), pensions, or other investments you’ve made throughout the years.

To know how much you need to save for retirement, the first thing to do is estimate your future income needs:

- List your current average monthly expenses, including mortgage or rent, utilities and other bills, groceries, entertainment, debt payments, and others

- From that list, think about the costs that will increase, decrease, stay the same, or be eliminated entirely

- Start a new list that estimates what expenses you’ll have during retirement and the costs be sure to include expenses you may not have now but plan to have in the future, such as traveling

- Multiply that total by 12 to get the estimated annual income you’ll need to afford those expenses

You’ll also want to make sure you have a plan for emergencies and build an emergency fund with at least 6 months’ worth of living expenses (though some experts recommend up to 9-12 months’ worth). This can serve as a back-up plan for unexpected costs or emergencies you may face.

If you need help, you can work with a financial advisor, who can help you stay on track and plan appropriately. Or, use a retirement calculator to better understand where you are in your savings progress today, and how much further you need to go.

Retirement savings by age

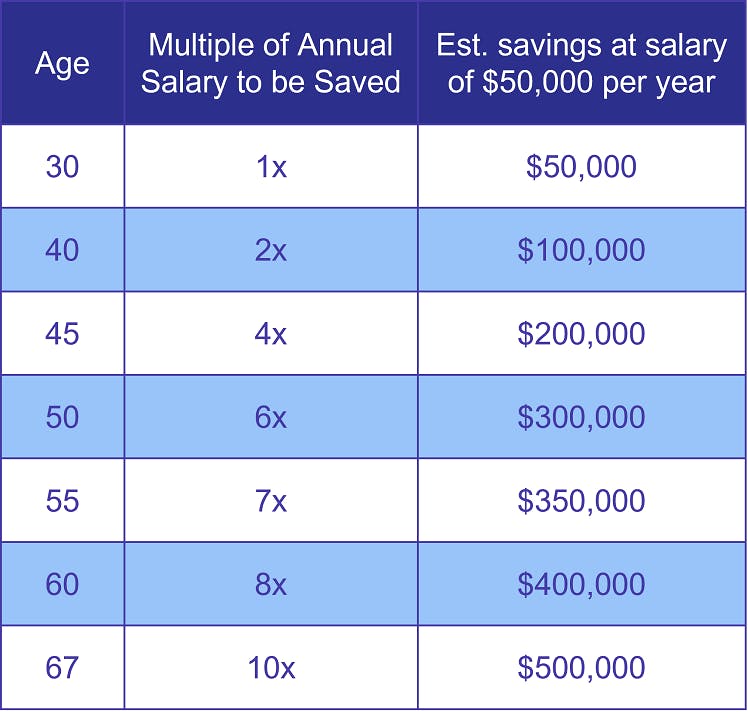

It’s suggested to start saving for retirement as early as you can, even in your 20s. Experts recommend the following benchmarks to help you track toward your savings progress:

The earlier you start saving, the more you’ll be able to funnel away for the future. Here's an example that illustrates this importance:

- Person A saves $100 per month starting at age 25. Assuming annual returns of 10%, this person would have a retirement balance of more than $640,000 by age 65.

- Person B saves $200 per month but doesn't start until age 35. Assuming the same 10% returns, they will have saved closer to $440,000, or $200,000 less, by the time they turn 65.

In this example, you’ll notice it's not all about the balance you're contributing, but instead the age at which you start. It also shows that you don't have to invest huge amounts to ensure returns. In the Person B example, they only contributed $72,000 of their own dollars but earned nearly $380,000 in returns.

However, note the average employee 401(k) contribution rate (as a percentage of salary) is only around 9% (in 2019). Even if you haven’t started yet or feel behind, don’t feel intimidated. There are things you can do to keep your retirement on track and ensure you’re financially secure once you leave the workforce.

How to save for retirement

Regardless of what age you start saving, there are many ways to put dollars aside for living after retirement:

- Employer-sponsored retirement accounts. Your employer likely has a company-provided retirement account, like a 401(k) or 403(b). Have a certain percentage automatically taken out of each paycheck and deposited into that account.

- Employer match. If your employer offers a match, be sure to deposit at least that much. For example, your employer may match your retirement contribution up to 5%, so you should put at least 5% each paycheck to get the match.

- Invest. The younger you are, the more aggressive you may want to invest. Stocks, bonds, mutual funds, and even IRAs are great options to help you grow your savings for retirement. Be sure to understand the terms to avoid any fees or penalties.

- Pay off debt early. The sooner you can pay off your debt, the faster you can put those extra funds into a savings account for retirement. This can include student loans, auto loans, medical bills, credit card debt, and others. Once a debt is paid off, set aside that monthly payment so it can be saved.

- Budget. Creating and sticking to a budget can help you avoid overspending unnecessarily and save you money in the long run.

- Follow the 1% rule. Not everyone can contribute 15% or more of their income to retirement. Life happens, and you may have to adjust how much you’re saving in order to pay for other things. However, if you follow the 1% rule, you increase your retirement contribution by 1% each year. So, if you start at 5%, increase to 6% the following year. Even though it seems minor, this can significantly increase how much you have saved by the time you retire.

- Work with an expert. A financial advisor can help you plan and prepare for retirement. They will assist you in setting your goals, determine how much you’ll need to support your ideal lifestyle, make investment and savings goals, and instruct you on how to get there.

Additional resources

Federal Reserve: Survey of Consumer Finances (SCF)

External Website Link

Social Security Administration (SSA.gov): Learn About Retirement Benefits

External Website Link

ClearMatch Medicare: Best Retirement Investments

Internal Website Link