Medicare Supplement plans in Washington help cover a variety of out-of-pocket medical costs, such as coinsurance and deductibles. Also known as Medigap, private insurers provide these plans, with Medicare setting guidelines regarding benefits and coverage. If you're over 65, Washington provides extensive Medigap protections. The same can't be said for Medicare beneficiaries who have turned 65 yet.

What is Medigap in Washington?

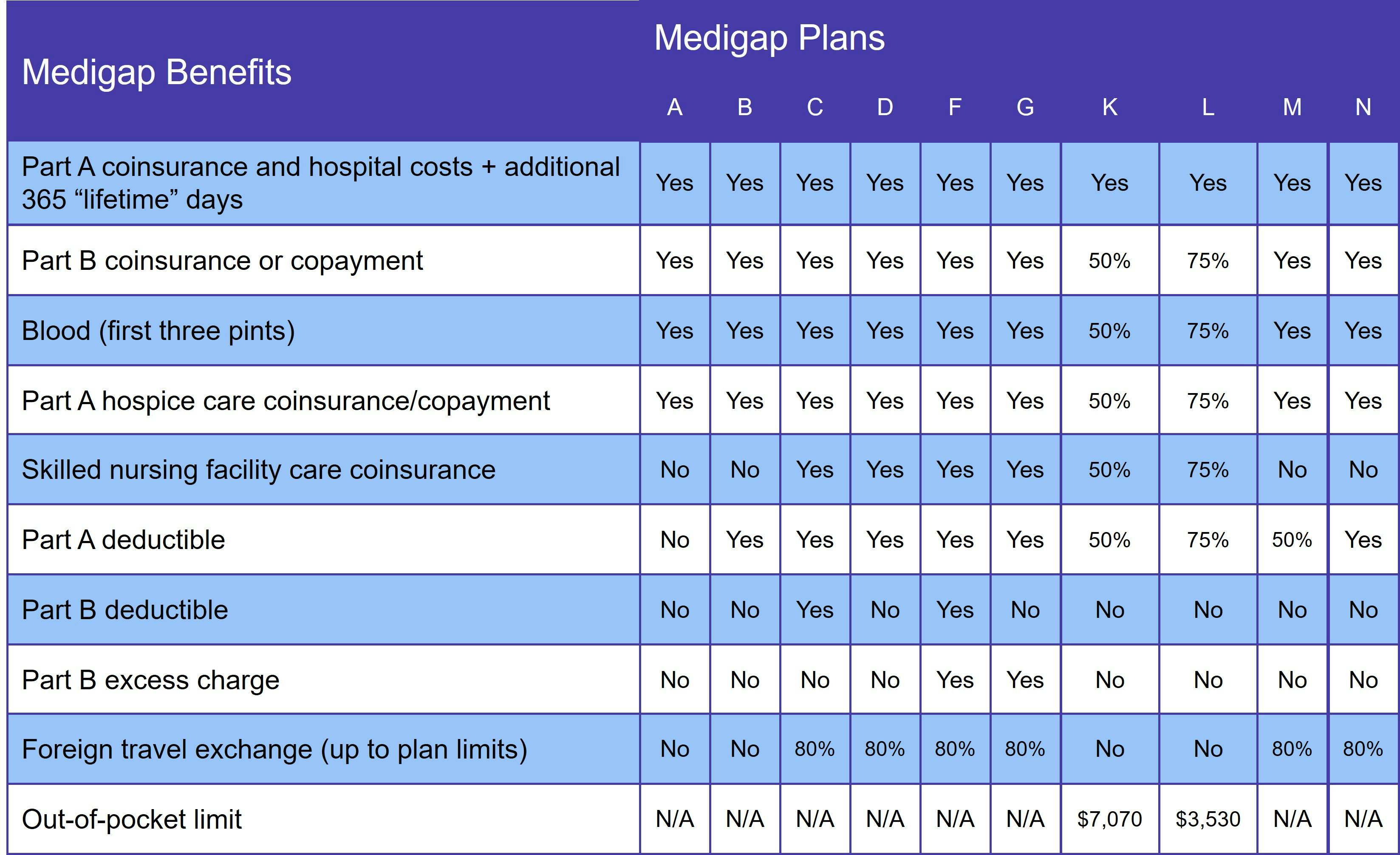

There are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, and N). Not all insurers offer every Medigap plan and some provide high-deductible versions of one or more options.

"Standardized" means that each plan "letter" has the same benefits, no matter which insurance company provides it. While benefits are standardized, though, premiums vary according to which insurer you choose.

The main reason Medicare beneficiaries choose to join a Medigap plan is that there is no annual out-of-pocket limit with Original Medicare. That means that, if you have any chronic conditions or require a lengthy hospital stay, you could face significant medical bills. A Medigap policy helps protect you from this type of debt.

You can only join a Medicare Supplement plan if you have Original Medicare. This includes:

- Medicare Part A, which covers inpatient care received in a hospital or skilled nursing facility (SNF)

- Medicare Part B, which covers outpatient services, such as doctor visits, durable medical equipment (DME), and lab work

Neither Part A nor Part B covers prescription medications.

Supplement plans are not standalone insurance, such as Medicare Advantage, TRICARE, and Medicaid. (You cannot have both Medigap and a Medicare Advantage plan.)

How is Medigap different in Washington?

Each state is allowed to set certain guidelines around Medigap, as long as they at least meet the minimum federal requirements. Washington has enacted a variety of consumer protections for its Medigap beneficiaries.

To start, the state does not allow Medigap insurers to base premiums on age. It also limits the waiting period for people who have preexisting conditions.

Washington also gives Medigap enrollees guaranteed issue rights year-round. That means you can change your Supplement plan without going through medical underwriting – an extremely rare benefit. In most states, you can be denied coverage or charged a higher premium if you don't have a guaranteed issue right. And there aren't many ways to get that protection.

What does Medigap cover?

Medigap plan benefits vary according to which plan you choose. At a minimum, though, every Medicare Supplement plan covers the Part A coinsurance and gives you an extra 365 lifetime reserve days for inpatient care. The following table outlines benefits under each Medigap plan:

Supplement Insurance does not include prescription drugs. You can get these benefits with a Medicare Part D prescription drug plan.

Who qualifies for Medicare Supplement Insurance in Washington?

You qualify for Medicare Supplement Insurance in Washington once you have Original Medicare and are age 65 or older. If you aren't yet 65 but qualify for Medicare due to a disability, state law does not guarantee you coverage. However, some Medigap insurers offer plans to under-65 beneficiaries.

The Washington State Health Insurance Pool provides supplemental coverage to Medicare beneficiaries who have a disability. Click here to learn more.

When is the best time to join a Medicare Supplement plan in Washington?

Your 6-month Medigap Open Enrollment Period (OEP) is the best time to join a Medicare Supplement plan in Washington. It starts the day you enroll in Original Medicare (Parts A and B) and are at least 65 years old.

If you aren't yet 65 but have Medicare due to a disability, you'll get a Medigap Open Enrollment Period as soon as you turn 65. At that point, you get the same protections as if you were brand-new to Medicare.

Medigap Plan C and Medigap Plan F in Washington

As of January 1, 2020, federal law prohibits new beneficiaries from joining a Supplement plan that covers the Medicare Part B deductible. Two plans – Medigap Plan C and Medigap Plan F – provide this coverage.

If you already have one of these plans, you may keep it. You can also join Plan C or Plan F if you qualified for Medicare before January 1, 2020. However, you should expect premiums to rise significantly over the next few years.

We recommend Medigap Plan D or Medigap Plan G, which provide the same benefits as Plans C and F, minus the Part B deductible. And with lower premiums, most enrollees pay less out-of-pocket, even though these plans don't cover the Part B deductible.

How to choose a Medigap plan in Washington

When choosing a Washington Medigap plan, the first step is determining how much coverage you need. We generally recommend getting the most robust coverage you can afford, since medical underwriting makes it difficult (if not impossible) to change plans after your Medigap OEP. But Washingtonians don't have this same worry.

Once you decide which Medigap plan you want, it's time to compare costs. Washington requires Medigap insurers to use community rating. Compared to age-based pricing, your premiums are generally higher in the beginning. But over the life of your policy, community rated plans cost much less.

Our Find a Plan tool makes it easy to compare Medigap plans in Washington. Simply enter your location information to review Medicare plan options in your area.