Many Medicare beneficiaries choose to supplement their coverage, and with no annual out-of-pocket limit, it makes sense. There are multiple healthcare expenses Medicare Supplement plans help to cover in Texas.

What is Medigap in Texas?

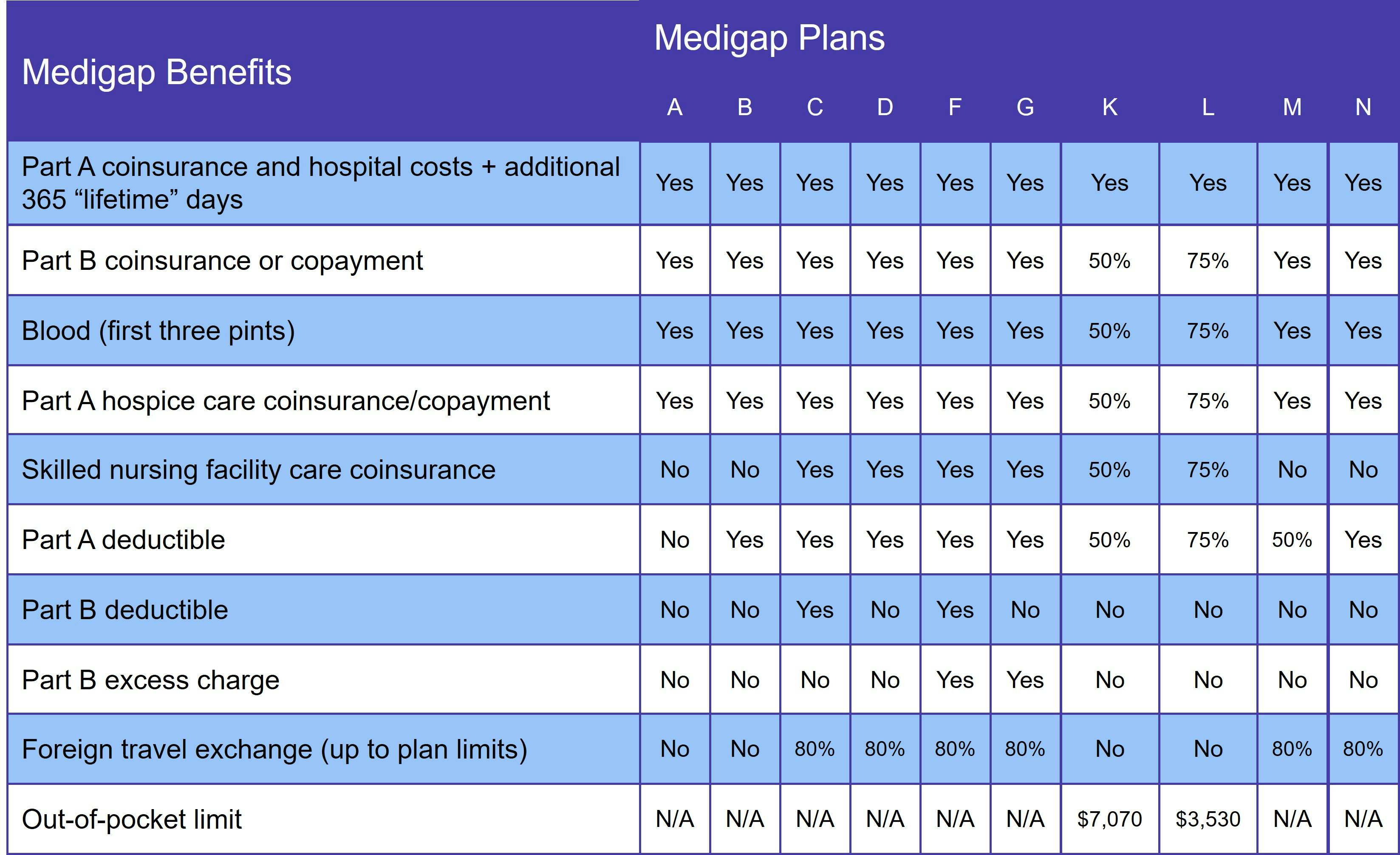

When you have Medicare Part A and Part B, also referred to as Original Medicare, Medigap plans help to cover your out-of-pocket costs. In Texas, there are 10 basic Medicare Supplement plans: A, B, C, D, F, G, K, L, M, and N. However, not all Medigap insurers offer all 10 options, and some companies may offer higher-deductible versions of plans. Because Medigap plans are standardized, you get the same benefits on a particular plan no matter which insurance company you choose. But remember, only benefits are standardized. As long as they follow federal and state guidelines, Medigap insurers can set their own premiums.

It is important to note that Supplement plans are not guaranteed as long as you are 65 in the same way that Original Medicare is. Applications for Medigap go through medical underwriting, which means answering health-related questions before approval. Companies decide whether to sell a Medigap policy – and how much it will cost you – based on your answers. The only way you can avoid medical underwriting is if you have a guaranteed issue right. (See the best time to join… section.)

What does Medigap cover?

Coverage for Medicare Supplement plans varies based on the plan you choose. There are two constants, however: every Medigap plan gives you 365 additional lifetime reserve days for inpatient hospital care and pays for your Medicare Part A co-insurance.

The following table shows the benefits included in each Medigap Plan:

Prescription drug coverage is not included in any Medigap plan. For this, you need to sign up for a Medicare Part D prescription drug plan or a Medicare Advantage plan that includes drug coverage. It is important to note, however, that you cannot have both a Medicare Advantage Plan and a Medigap Plan.

Medigap Plan C and Medigap Plan F in Texas

Medigap Plans C and F are not available to people who qualified for Medicare on or after January 1, 2020. Instead, we recommend Plan D or Plan G, which offer the same benefits as Plans C and F respectively, except for the Medicare Part B deductible. They typically provide a lower out-of-pocket cost, as well, due to lower premiums.

When is the best time to join a Medicare Supplement plan in Texas?

Your six-month Medigap Open Enrollment Period (OEP) is the best time to join a Medicare Supplement plan in Texas. Your OEP gives you guaranteed issue rights. It begins the day you enroll in Original Medicare. If you are 65 or older, your Medigap application cannot be rejected and you cannot be charged a higher premium, regardless of any preexisting conditions. If you are under 65, you are still guaranteed a Medigap Plan A policy, but you can be charged a higher premium.

If you qualify for Medicare due to a disability, when you turn 65, you get a second Medigap OEP.

How to choose a Medigap plan in Texas

The best way to choose a Medicare Supplement plan is to find one at a comfortable cost, that still provides any comprehensive benefits you may need. Be sure to thoroughly check all of the benefits offered by any prospective choices. The majority of Medigap insurers use one of the following pricing methods:

- Attained-age rate: Usually the most expensive over time, with this pricing method, premiums start low and rise as you age.

- Community rated: Typically thought of as the cheapest plans, community rated, or no-age rated, plans charge the same premium at any age.

- Issue-age rated: Though prices may rise due to inflation, premiums for this pricing method are based on your age at the time you join the plan.

Attained-age and issue-age rates are the most common methods used by Medigap insurers in Texas.

To easily compare Medigap plans in Texas, use our Find a Plan tool. Just enter your location information to find Medigap options near you.