It's not surprising that Medicare beneficiaries often try to supplement their coverage in some way, since Original Medicare (Medicare Part A and Part B) has no annual out-of-pocket maximum. In Rhode Island, Medicare Supplement plans (also known as Medigap) help cover various healthcare costs, including co-insurance and deductibles. Benefits vary based on your plan, with the right choice depending on your specific needs.

What is Medigap in Rhode Island?

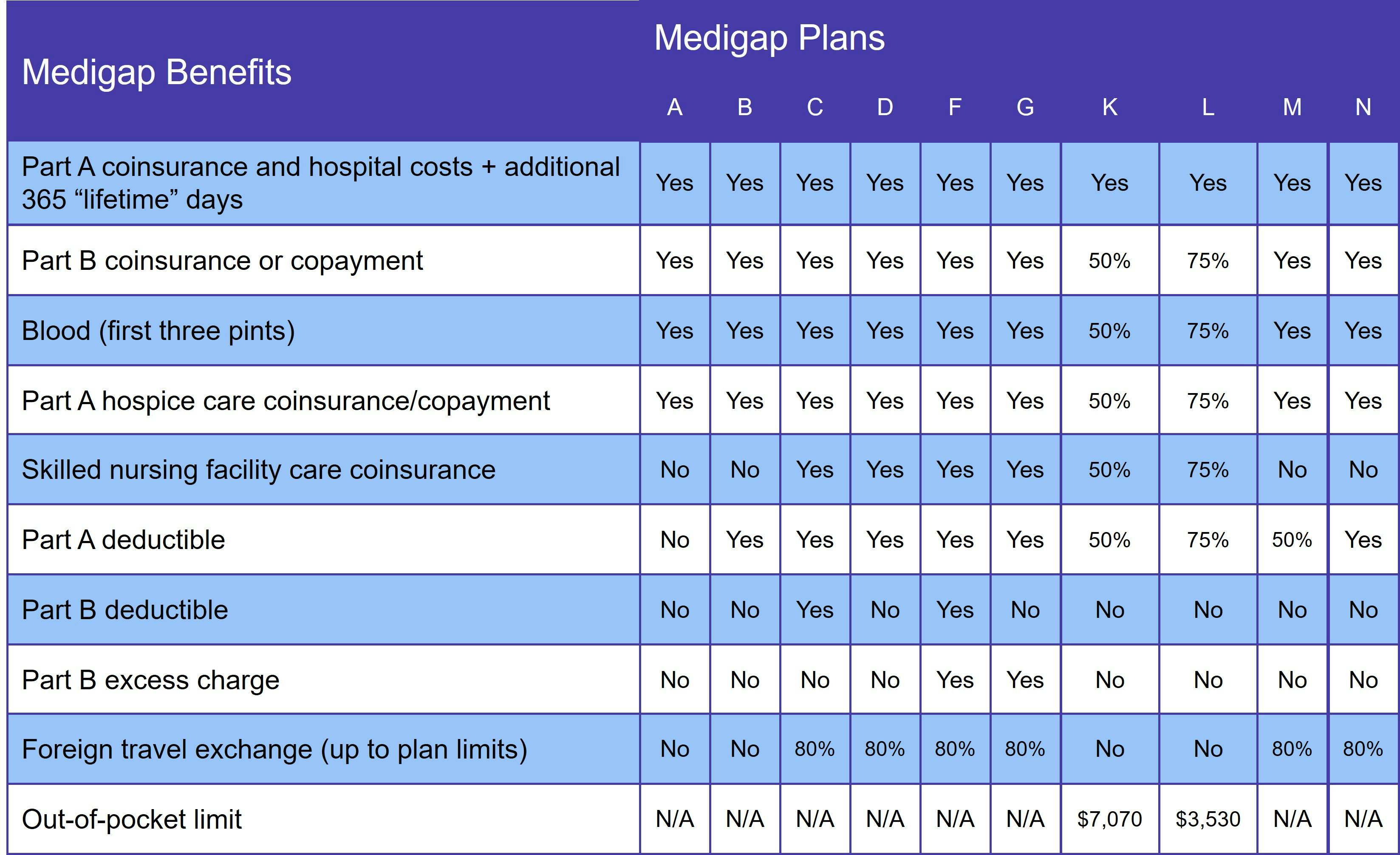

The 10 standard Medicare Supplement plans available for Rhode Island residents are A, B, C, D, F, G, K, L, M, and N. Though these are the standard plans, some insurers may offer high-deductible versions of plans. Since Medigap is standardized, no matter who you purchase your policy through, each plan has the same benefits. This does not apply to costs, however, as prices differ depending on the insurance company you select.

With Original Medicare, you cannot be denied coverage if you meet the necessary qualifications (age, disability, etc.), but even if you are 65 and enrolled in Medicare you may be denied Medigap. Unless you have a guaranteed issue right, Medicare Supplement plan applications go through medical underwriting, which involves answering a series of health-related questions to determine eligibility. Your answers to these questions dictate whether an insurer will sell you a Supplement plan and the cost of it.

Who qualifies for Medicare Supplement insurance in Rhode Island?

As soon as you are 65 or older and enrolled in Original Medicare, you qualify for a Medigap plan in Rhode Island. Though most states require Medigap insurers to offer plans to those who are not 65 but qualify for Medicare due to disability, Rhode Island does not. Blue Cross Blue Shield of Rhode Island, however, does provide Medigap Plan A to beneficiaries under 65.

What does Medigap cover?

Coverage for Medicare Supplement plans depends on the specific plan you choose. However, every Medigap plan covers your Medicare Part A co-insurance and provides an additional 365 lifetime reserve days for inpatient hospital care.

The table below shows the benefits included in each Medigap plan:

Only services provided by Original Medicare are covered by Medigap insurance; prescription drug coverage is not included. Prescription benefits are obtained through Medicare Part D plans.

When is the best time to join a Medicare Supplement plan in Rhode Island?

The best time to sign up for a Medicare Supplement plan in Rhode Island is during your six-month Medigap Open Enrollment Period (OEP). Your OEP starts the day you are both 65 or older AND enrolled in Medicare Parts A and B. During this period, you have guaranteed issue rights, which means you cannot be denied a Supplement policy or charged a higher premium. Those on Medicare due to a disability who are under 65 qualify for a Medigap OEP once they have turned 65.

Medigap Plan C and Medigap Plan F in Rhode Island

Medigap Plans C and F are unavailable to new Medicare beneficiaries as of January 1, 2020. With the exception of the Part B deductible, Medigap Plan D and Medigap plan G offer the same benefits as Plan C and Plan F, respectively.

How to choose a Medigap plan in Rhode Island

Because Medicare Supplement plans in Rhode Island are standardized, you must first decide on the level of coverage you need. It is recommended you choose a plan that is affordable, but still offers all the benefits you may want. Remember that, due to medical underwriting, you may not be able to upgrade your plan down the road.

The way an insurance company prices its plans can give you an idea of long-term plan expenses. Most insurers price one of the following ways:

- Attained-age rated: This pricing method usually costs the most over the life of the plan, with premiums starting low and rising as you age.

- Community rated: Often called no-age rated plans, this method charges the same regardless of age. You may pay more up front, but less in the long run.

- Issue-age rated: Though rates may rise over time due to inflation, issue-age rated plans charge based on how old you are when you join and do not go up just because you get older.

In Rhode Island, the majority of Medigap insurers use attained-age and issue-age pricing methods.

To easily find and compare Medigap plans in Rhode Island, use our Find a Plan tool. Just provide your location information to see Medigap options in your area.