A Medicare Supplement plan in Oklahoma helps pay for a variety of healthcare costs. Also known as Medigap, these policies may cover hospital and hospice care, doctor visits, and more. This page describes how Medigap plans work and when is the best time to apply.

What is Medigap in Oklahoma?

Medigap plans help pay your out-of-pocket costs under Original Medicare, which includes Part A, hospital insurance, and Part B, medical services. Unlike Medicare Advantage (also known as Medicare Part C), there is no yearly out-of-pocket maximum with Original Medicare. This can leave you with significant healthcare costs, particularly if you have one or more chronic conditions or require a lengthy hospital stay.

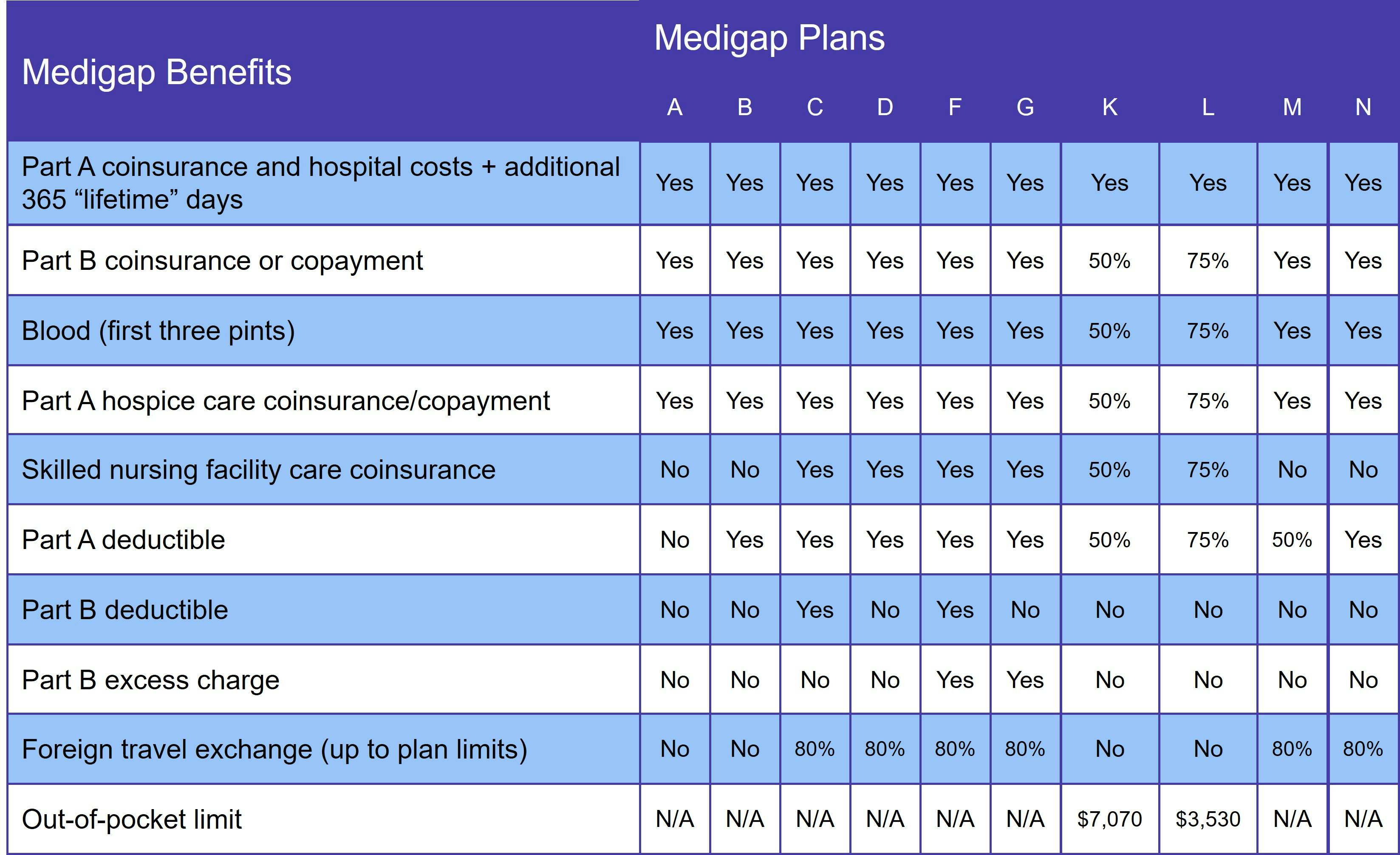

Which services the plan pays for depends on which plan you choose. There are 10, each represented by a letter (A, B, C, D, F, G, K, L, M, and N). In addition, some insurers offer high-deductible versions of one or more Medigap plans.

Medicare Supplement plans are standardized, meaning the benefits of each plan do not change no matter which insurance company you choose or where you live.

Please note that Medicare Supplement plans are not standalone health insurance such as you get with an Advantage plan.

Who qualifies for Medicare Supplement Insurance in Oklahoma?

You qualify for Medicare Supplement Insurance in Oklahoma if you are age 65 or older and enrolled in Original Medicare.

Beneficiaries who are younger than 65 and qualify for Medicare due to a disability or illness may also enroll in a Medigap plan. Oklahoma was actually one of the first states to extend this protection to under-65 Medicare beneficiaries.

Insurance companies do not have to offer all of their plans, though, and most make only Plan A available to beneficiaries who qualify due to a disability instead of age. State statute requires Medigap insurers to provide coverage at a premium similar to what over-65 enrollees pay.

What does Medigap cover?

Supplement plans help pay for a variety of healthcare services covered by Original Medicare. The following table details the benefits offered by each Medigap plan:

The important note is that Medigap only covers services provided by Original Medicare. If you need prescription drug coverage, you get that by joining either a standalone Medicare Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD).

You cannot have both Medigap and an Advantage plan.

Medigap Plan C and Medigap Plan F in Oklahoma

As of January 1, 2020, Medigap Plan C and Medigap Plan F are no longer available to new Medicare beneficiaries. If you qualified for Medicare before 2020, you may still join one of the plans. We do not recommend this, though, as premiums tend to rise sharply once a Medigap plan is discontinued.

With the exception of the Medicare Part B deductible, you can get the same coverage with Medigap Plan D (in place of C) or Medigap Plan G (in place of F). In addition, the lower monthly premiums for these plans typically lead to a lower annual out-of-pocket, despite beneficiaries having to pay their Part B deductible.

When is the best time to join a Medicare Supplement plan in Oklahoma?

The best time to sign up for an Oklahoma Supplement plan is during your 6-month Medigap Open Enrollment Period (OEP). It begins the day you are enrolled in Parts A and B and applies to beneficiaries who age into Medicare as well as those who qualify due to a disability.

Your Medigap OEP is one of the rare instances that you have a guaranteed issue right. This means that your application cannot be denied due to age or medical history. Guaranteed issue rights also mean that you cannot be charged more for the policy.

If you do not have guaranteed issue rights, your Medigap application goes through a process called medical underwriting, whereby the insurer reviews your medical history and decides whether to offer you a policy and at what rate.

Medicare beneficiaries who qualify due to a disability get a second Medigap OEP once they turn 65. At this point, they get the same guaranteed rights as if they were brand-new to the Medicare program.

How to choose a Medigap plan in Oklahoma

When deciding how much coverage you need, it's always a good idea to plan for your future healthcare needs so you can avoid the risk of being denied coverage due to medical underwriting.

Since plans are standardized, your next concern is cost. Medigap insurers use one of three rating systems:

- Attained-age rated: Premiums start out low but rise as you age. These policies are usually the most expensive option over time.

- Community rated: Plans charge the same premium regardless of age. Over time, these Medigap plans cost the least.

- Issue-age rated: Premiums are based on your age upon joining the plan. They won't go up just because you get older but they may rise due to inflation.

Age-based rating is the most common method used by Oklahoma Medigap insurers, but some offer community rated plans.

Our Find a Plan tool makes it easy to compare Medigap plans in Oklahoma. Just enter your location information to review Medicare plan options in your area.