There is no limit to your annual out-of-pocket costs when you have Original Medicare (Parts A and B). Medicare Supplement plans in North Carolina help pay some or even all of your healthcare costs.

What is Medigap in North Carolina?

Commonly known as Medigap, Medicare Supplement Insurance helps pay your costs under Original Medicare. This includes Part A, which covers inpatient care, and Part B, which pays for outpatient services.

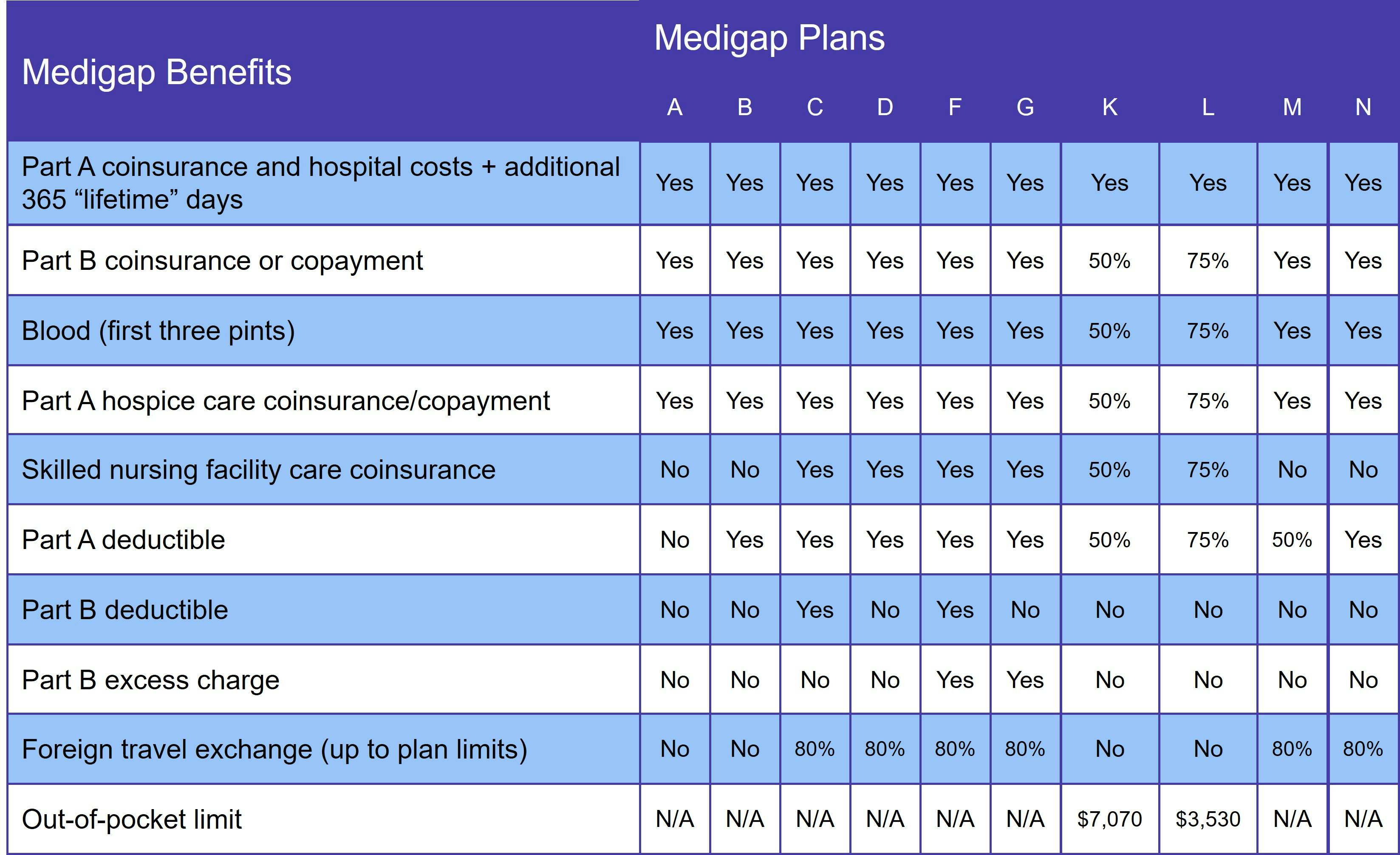

There are 10 standard Medigap plans (A, B, C, D, F, G, K, L, M, and N) although not all insurance companies offer every plan. In addition, some Medigap insurers provide high-deductible versions of one or more Supplement plans.

Medigap plans are standardized, meaning each individual plan has the same benefits no matter where you live or which insurance company you choose.

What does Medigap cover?

North Carolina Medigap coverage varies according to the plan you choose. At a minimum, though, every Supplement plan covers your Medicare Part A coinsurance and gives you 365 extra lifetime reserve days for hospital care.

The following chart demonstrates the benefits of each Medigap plan:

There are no longer any Medigap plans that include prescription drug coverage. These benefits are available with a Medicare Part D prescription drug plan.

When is the best time to join a Medicare Supplement plan in North Carolina?

The best to join a North Carolina Medicare Supplement plan is during your 6-month Medigap Open Enrollment Period (OEP). It begins the day you're both enrolled in Original Medicare and age 65 or older.

During your Medigap OEP, you have what Medicare calls guaranteed issue rights. During this time, you cannot be denied a Medigap policy nor charged more for it, even if you have preexisting conditions.

You also get a Medigap OEP if you qualify for Medicare due to a disability. However, state law only requires Medigap insurers to offer Plan A to beneficiaries who are not yet 65 years old. And while state guidelines guarantee access to a plan, they do not require insurers to charge the same premium as they would if you were age 65 or older. Most under-65 beneficiaries pay much higher Medigap premiums.

Medicare beneficiaries who qualify due to a disability get a second OEP when they turn 65.

Who qualifies for Medicare Supplement Insurance in North Carolina?

If you have Original Medicare, you qualify for Medicare Supplement Insurance in North Carolina.

Medigap Plan C and Medigap Plan F in North Carolina

A new federal law prohibits Supplement plans from covering the Medicare Part B deductible. Medigap Plan C and Medigap Plan F both provide this benefit, so neither plan is available to those who qualify for Medicare on or after January 1, 2020.

You can get the same coverage (minus the Part B deductible) with either Medigap Plan D or Medigap Plan G.

How to choose a Medigap plan in North Carolina

To avoid the medical underwriting process, we recommend you choose the most comprehensive coverage you can afford during your Medigap OEP. You may not be able to find affordable Medigap coverage if you wait.

You should also look at pricing. Most Medigap insurers use one of three pricing methods:

- Community rated: These plans charge the same premium regardless of age, making them the least costly option over time. Few insurance companies use community rated pricing.

- Issue-age rated: Premiums are based on your age when you join the plan but do not go up as you get older. However, they may rise due to inflation.

- Attained-age rated: Premiums start out low and increase as you age. These plans `cost the most over time.

Our Find a Plan tool makes it easy to compare Medigap plans in North Carolina. Simply enter your location information to review Medicare plan options in your area.