Medicare Part A and Part B, or Original Medicare, have no annual out-of-pocket maximum, so it makes sense that so many beneficiaries look for a way to supplement their coverage. New Jersey Medicare Supplement plans help to pay for a multitude of healthcare costs.

What is Medigap in New Jersey?

New Jersey has 10 Medicare Supplement plans available: A, B, C, D, F, G, K, L, M, and N, all of which are standardized. This means that, regardless of your insurance provider or location, every plan provides the same benefits. However, not every insurer offers all 10 plans, and some may have high-deductible versions of one or more plans. Though the benefits of these plans are standardized, prices are not, so premiums vary from company to company.

Unlike Original Medicare, Medigap insurance is not guaranteed unless you have a guaranteed issue right. Otherwise, your application goes through medical underwriting, which includes answering various health-related questions. The answers to these questions are used to decide whether to sell you a Medigap policy and how much you’ll pay each month.

Who qualifies for Medicare Supplement Insurance in New Jersey?

Anyone enrolled in Original Medicare who is aged 65 or older qualifies for Medicare Supplement Insurance. Medigap insurers are required by most states to offer plans to those who are under 65 but qualify for Medicare due to disability. This includes New Jersey, which requires that insurers offer Medigap Plan D to applicants under 65. Medigap insurers in New Jersey are also required to dedicate 65% of collected premiums to paying member claims; this increases to 75% for group policies.

What does Medigap cover?

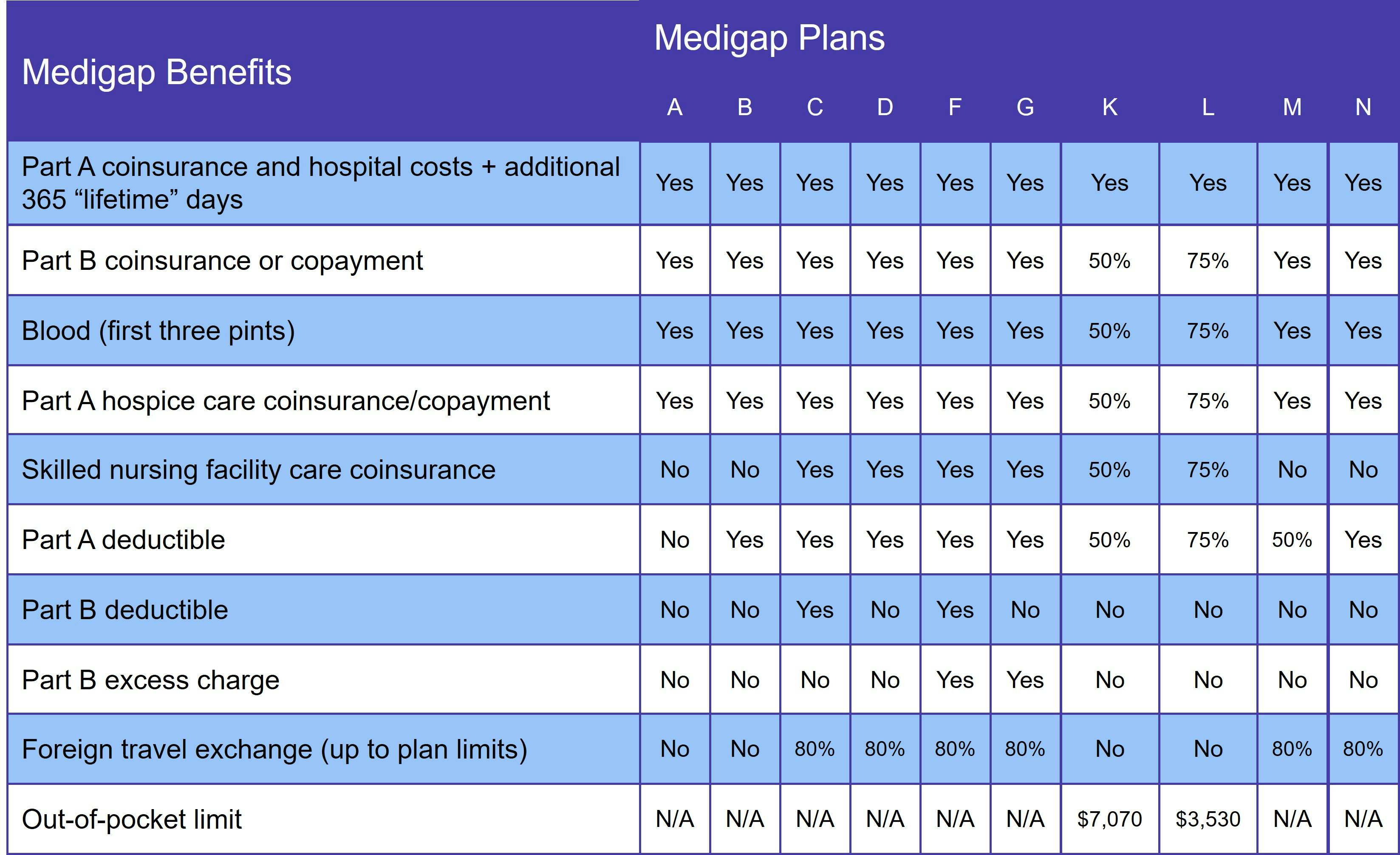

Though Medigap benefits depend on the plan you choose, there are some constants you can expect. For example, every Medigap plan provides an additional 365 lifetime reserve days for inpatient care and pays for any Medicare Part A co-insurance.

The table below lists Medigap plan benefits:

Remember that Medicare Supplement Insurance does not include prescription drug coverage. That is acquired through a Medicare Part D plan. You may also get drug coverage through a Medicare Advantage plan that includes prescription drug coverage, but this would mean you could not have a Medigap plan. Federal law prohibits joining both a Medicare Advantage and a Medigap plan.

Medigap Plan C and Medigap Plan F in New Jersey

Starting January 1, 2020, new Medicare beneficiaries are unable to sign up for Medigap Plans C and F, since a change in federal law bars Medigap plans from paying a beneficiary's Medicare Part B deductible. We recommend Medigap Plans D or G, which, minus the Part B deductible, provide the same benefits offered by Plan C and Plan F respectively.

When is the best time to join a Medicare Supplement plan in New Jersey?

Your six-month Medigap Open Enrollment Period (OEP) is the best time to join a New Jersey Medicare Supplement plan. Beginning the day you are both 65 or older and enrolled in Original Medicare, this is one of the only times you have guaranteed issue rights, which means (as long as you're 65) your application cannot be rejected and you cannot be charged more, even if you have pre-existing conditions.

Medicare beneficiaries under the age of 50 can only get the same protections if they use Horizon Blue Cross Blue Shield of New Jersey, but between 50 and 64, you can use any New Jersey Medigap insurer. You get a second OEP once you turn 65, which is treated as if you are enrolling in Medicare – and Medigap – for the first time.

How to choose a Medigap plan in New Jersey

Medigap plans are standardized in New Jersey, so the first step in choosing a plan is deciding how much coverage you need. Be sure to consider your possible needs in the future and select a plan with the most comprehensive benefits you can afford. Medical underwriting may prevent you from upgrading later on.

Next you must consider cost. Medigap insurers base their prices on one of three methods:

- Attained-age rated: Starting low, premiums in this price plan go up as you age and typically cost the most over time.

- Community rated: Usually the least expensive pricing method, premiums are not based on age. This is also known as no-age rated pricing.

- Issue-age rated: Premiums do not go up as you get older and are based on your age at the time of joining the plan. The only rise in cost comes from inflation.

The majority of Medigap insurers in New Jersey use the attained-age or issue-age pricing methods.

Our Find a Plan tool makes comparing Medigap plans in New Jersey quick and easy. Simply enter your location information to start reviewing Medicare plans available to you.