If you have Original Medicare, there is no limit to your annual out-of-pocket costs, which is why so many Nebraskans choose supplemental coverage. According to America's Health Insurance Plans (AHIP), around 60% of Nebraska Medicare beneficiaries have a Medicare Supplement plan, more commonly known as Medigap. This page describes Medicare Supplement plans in Nebraska, who qualifies, and when to apply.

What is Medigap in Nebraska?

Medigap earned its name because it fills in the "gaps" left by Original Medicare, which includes Part A, hospital care and Part B, medical services.

The word "gaps" refers to your out-of-pocket costs. It does not mean services and benefits not included with Original Medicare. Although Parts A and B cover a wide array of services, prescription drug coverage, routine vision care, hearing aids, and dental care are a few of the benefits not included. That means your Supplement plan will not reimburse you for these costs.

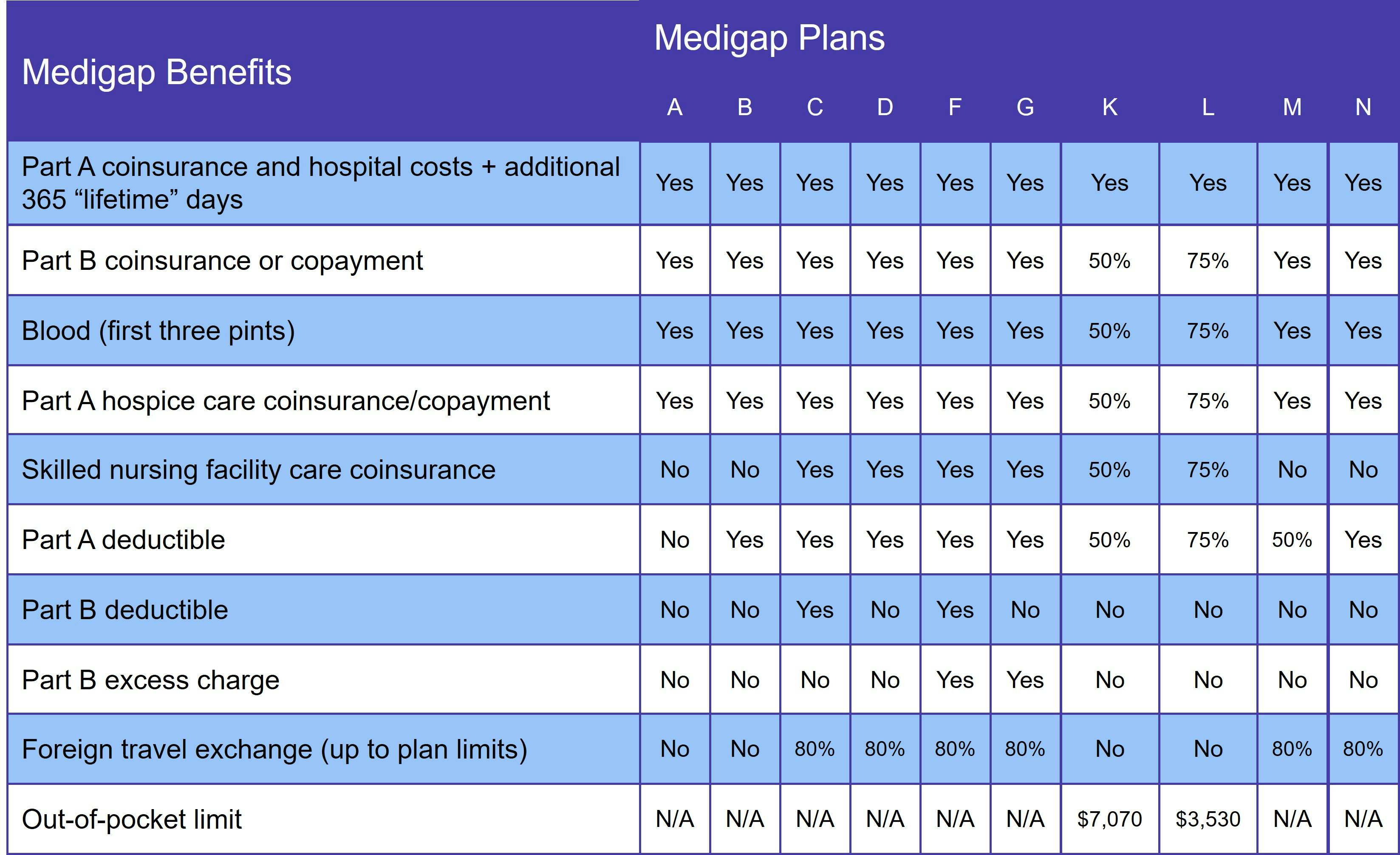

There are 10 standard Medigap plans: A, B, C, D, F, G, K, L, M, and N. Private insurance companies provide the plans, operating under state and federal guidelines. However, not every Medigap insurer offers every plan. In addition, some insurance companies provide high-deductible versions of one or more Medicare Supplement plans.

Medigap plans are standardized, which means that you get the same benefits with every Plan A (or B, D, etc.), no matter which insurance company you choose or where you live. Premiums, however, are not standardized. Medigap insurers set their own premiums and pricing methods, according to guidelines set by Medicare and the Nebraska state government.

Please note that Supplement plans are not standalone health insurance the way Medicare Advantage, Medicaid, or private insurance plans are. Again, they supplement your Medicare coverage; they do not replace it.

How is Medicare different in Nebraska?

While the main program is the same – insurance companies sell you policies that help cover some or all of your out-of-pocket costs – each state determines whether to set additional guidelines for Medigap insurers.

Nebraska Medigap differs in a couple of ways. First, enrollment levels are much higher here compared to the national average. Taking the United States as a whole, only around one-third of Original Medicare beneficiaries have a Medicare Supplement plan. As we said earlier, though, around 60% of Nebraska Original Medicare beneficiaries have a Supplement plan. This is likely due to the large number of Nebraska counties that have no Medicare Advantage plan options (around 25%).

The state of Nebraska also does not require Medigap insurers to offer plans to Medicare beneficiaries who qualify based on a disability and are under age 65. There are insurance companies that do, but state law does not require it.

Nebraska does provide a safety net for under-65 Medicare beneficiaries, courtesy of the NECHIP. If you're under 65 and can't get coverage due to medical underwriting, you can through NECHIP. Premiums vary based on your age, tobacco use, and the deductible you choose (between $5,000 and $10,000).

Who qualifies for Medicare Supplement Insurance in Nebraska?

If you have Original Medicare and are age 65 or older, you qualify for Medicare Supplement Insurance in Nebraska. Those who have Original Medicare but are not yet 65 years old may apply for a Supplement plan. However, insurance companies do not have to provide one.

What does Medigap cover?

Medigap coverage varies according to which plan you choose. At a minimum, though, every Supplement plan covers your Part A coinsurance and provides an additional 365 lifetime reserve days for inpatient hospital care. The following table shows the benefits included with each Medigap plan:

No Supplement plan includes prescription drug coverage. You get help paying these costs by joining a Medicare Part D prescription drug plan.

Your second option is a Medicare Advantage Prescription Drug plan (MA-PD). However, you may not have both Medigap and an Advantage plan. This is true even if the Advantage plan does not provide prescription drug coverage.

Medigap Plan C and Medigap Plan F in Nebraska

Beginning on January 1, 2020, Medigap plans may no longer cover the Medicare Part B deductible. Two supplement plans offer this benefit: Medigap Plan C and Medigap Plan F. If you already had one of these plans, you may keep it. However, if you first became eligible for Medicare in 2020, you may not join either Plan C or Plan F.

Two Medicare Supplement plans provide the same coverage as Plans C and F, minus the Part B deductible. These are Medigap Plan D and Medigap Plan G. We've been recommending these options for years, because most beneficiaries enjoy a lower out-of-pocket overall, since the difference in monthly premiums is usually greater than the Part B deductible.

When is the best time to join a Medicare Supplement plan in Nebraska?

Your Medigap Open Enrollment Period (OEP) is the best time to join a Medigap plan in Nebraska. It lasts for 6 months, starting with the first day you're enrolled in Original Medicare.

We recommend signing up for Medigap during your Open Enrollment Period because it's one of the few times you have guaranteed issue rights. During your Medigap OEP, insurers cannot deny you coverage or charge you more for it, even if you have preexisting medical conditions.

When you do not have a guaranteed issue right, your Medigap application goes through a process called medical underwriting. This includes answering a series of questions regarding age, tobacco use, and medical history. If you do not have guaranteed issue rights, your answers to these questions may lead to a denial of coverage or higher premiums.

How to choose a Medigap plan in Nebraska

The first thing you need to do when choosing a Nebraska Medigap plan is decide how much coverage you need. You may be tempted to choose the plan with the lowest premium. We encourage you to remember the medical underwriting requirement. If you wait to apply for a Medigap plan that offers more comprehensive coverage, such as Plan G, you may not be able to get it. Or, it may cost you significantly more. When choosing a Supplement plan, it's always a good idea to consider your future medical needs.

Although benefits are standardized, Medigap premiums vary according to the provider, so compare costs carefully. Pricing methods include:

- Attained-age rated: Premiums start out low but rise as you age. These policies are usually the most expensive option over time.

- Community rated: Also known as no-age rated, these plans charge the same premium regardless of age. Over time, these are usually the cheapest Medigap plans.

- Issue-age rated: Premiums are based on your age at the time you join the plan, not your age throughout the life of the policy. They may rise over time due to inflation, though.

Our Find a Plan tool makes it easy to compare Medigap plans in Nebraska. Simply enter your location information to review Medicare plan options in your area.