Commonly known as Medigap, Medicare Supplement Insurance plans help cover a variety of out-of-pocket costs under Original Medicare. Private insurance companies provide these plans, under the guidance of Medicare and state governments. Maine legislators have enacted numerous consumer protections for Medigap beneficiaries. This page explains the Medicare Supplement Insurance plans in Maine and how to choose the best coverage for your unique needs.

What is Medigap in Maine?

If you have Original Medicare, Medigap plans help pay some of your out-of-pocket costs. Original Medicare includes Part A, hospital insurance, and Part B, medical insurance. It does not limit your annual out-of-pocket, though, which could lead to significant healthcare costs. This is where Medigap comes in.

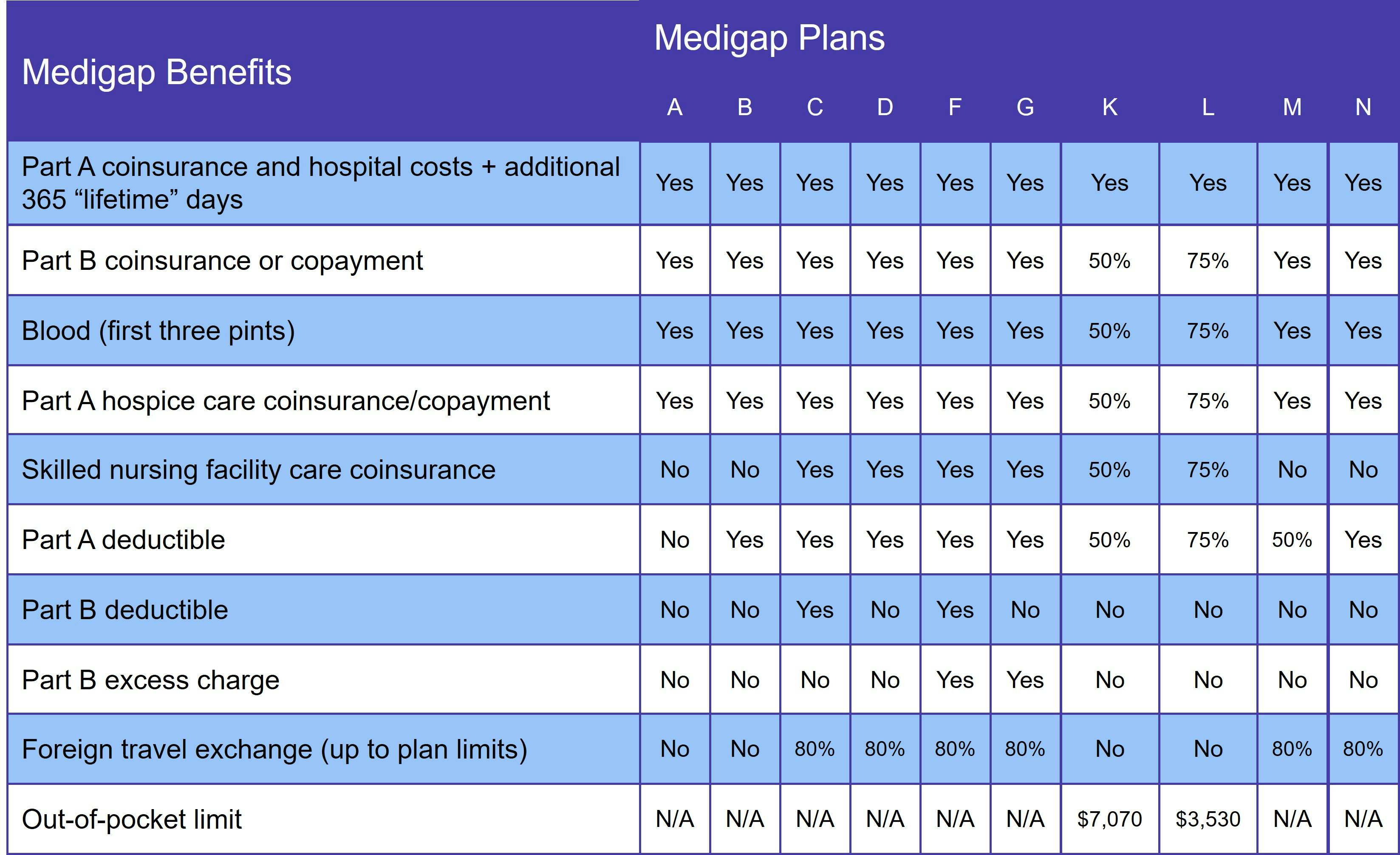

There are 10 standard Medigap plans (A, B, C, D, F, G, K, L, M, and N), although not all Medigap insurers offer every plan. Each plan is standardized, meaning that every Plan A (or B, D, etc.) has the same benefits no matter which insurance company provides it.

If you don't have a guaranteed issue right, your Medigap application goes through medical underwriting. This process requires applicants to answer questions regarding their medical history, tobacco use, age, and more. Insurers use your answers to these questions to determine whether to sell you a plan and at what premium.

How Medigap works in Maine

Maine has some of the most extensive Medigap consumer protections in the country. Examples include:

- Beneficiaries with disabilities: Federal law does not require Medigap insurers to offer plans to beneficiaries who qualify due to a disability instead of age. Maine state law does. Whether you qualify for Medicare due to age or disability, you get the same Medigap Open Enrollment Period (OEP) protections.

- Expanded trial rights: Under federal law, Medigap beneficiaries who switch to a Medicare Advantage plan can return to their original Supplement plan as long as they return to Original Medicare within 12 months. This is known as trial rights. Maine law gives beneficiaries an extra 2 years (for 3 years total) to make that switch, so long as they join a Medigap plan within 90 days of leaving their Advantage plan. This also applies to beneficiaries who sign up for Medicare Advantage as soon as they become eligible for Medicare.

- Premium protections: Maine is one of the few states that protects Medigap beneficiaries from paying higher premiums due to their age – including enrollees who qualify for Medicare due to a disability and aren't yet 65 years old. Premiums may only vary based on tobacco use.

- Switching plans: Assuming they haven't had a 90-day break in their coverage, Maine Medigap beneficiaries may switch to a different plan that provides equal or lesser benefits than their current plan, even when they don't have guaranteed issue rights.

- Yearly guaranteed-issue: Medigap insurers must provide one month every year during which all applicants are guaranteed acceptance in Plan A, even if they have preexisting medical conditions.

For full details, please see Maine's Bureau of Insurance, Consumers page.

Who qualifies for Medicare Supplement Insurance in Maine?

If you're enrolled in Medicare Parts A and B, you're eligible for Medicare Supplement Insurance in Maine. This is true whether you qualify for Medicare due to age or disability.

What does Medigap cover?

Medigap benefits vary according to which plan you choose. The following chart details which benefits are available with each Supplement plan:

No Medicare Supplement plan includes prescription drug coverage. You get these benefits with a Medicare Part D prescription drug plan. Standalone Part D coverage can be added to your Original Medicare benefits. Or, you may choose a Medicare Advantage Prescription Drug plan (MA-PD). However, Medicare Advantage enrollees may not sign up for Medigap, even if their Advantage plan does not include prescription drug coverage.

Medigap Plan C and Medigap Plan F in Maine

If you qualified for Medicare on or after January 1, 2020, you may not enroll in either Medigap Plan C or Medigap Plan D. New changes in federal law prohibit Supplement plans that cover the Medicare Part B deductible and both plans provide that benefit.

Luckily, you can get the same coverage (minus the Part B deductible) with either Medigap Plan D or Medigap Plan G. As an added bonus, both plans usually have lower monthly premiums than Plans C or F, so your overall out-of-pocket should be less.

If you qualified for Medicare before January 1, 2020, you may still join either plan. However, we still recommend Plans D and G, as premiums tend to rise sharply once a Medigap plan is discontinued.

When is the best time to join a Medicare Supplement plan in Maine?

Even with Maine's enhanced consumer protections, your 6-month Medigap Open Enrollment Period (OEP) is still the best time to sign up for a Supplement plan. This is one of the few times you qualify for guaranteed issue rights, which means Medigap insurers cannot charge you a higher premium or reject your application for any reason.

How to choose a Medigap plan in Maine

When choosing a Maine Medigap plan, the first thing to consider is how much coverage you want. We typically recommend planning for future healthcare needs, since upgrading to a Supplement plan with more robust benefits can be difficult or result in a lapse of coverage.

Your next consideration is cost. Although Medigap plan benefits are standardized, premiums are not. Each Medigap insurer sets its own premiums, with states often establishing guidelines.

Most Medigap insurers use one of three pricing methods:

- Attained-age rated: Premiums start out low but go up as you age. These policies are usually the most expensive option over time.

- Community rated: Also known as no-age rated, these plans charge the same premium regardless of age. Over time, most experts agree that these are the cheapest Medigap plans.

- Issue-age rated: Premiums are based on your age at the time you join the plan, not your age throughout the life of the policy. They may rise over time due to inflation, though.

As we said above, though, Maine only allows insurers to consider tobacco use in setting premiums.

It's easy to compare Medigap plans in Maine with our Find a Plan tool. Simply enter your location information to review the Medicare plan options in your area.