Also known as Medigap, Medicare Supplement Insurance helps cover a multitude of costs associated with Medicare Parts A and B, or Original Medicare. Original Medicare has no annual out-of-pocket limit, so it makes sense that so many look for a way to supplement coverage.

What is Medigap in Illinois?

Original Medicare is made up of Medicare Part A (hospital insurance) and Part B (medical insurance). A Medigap plan helps pay for some of your out-of-pocket costs when you have Original Medicare.

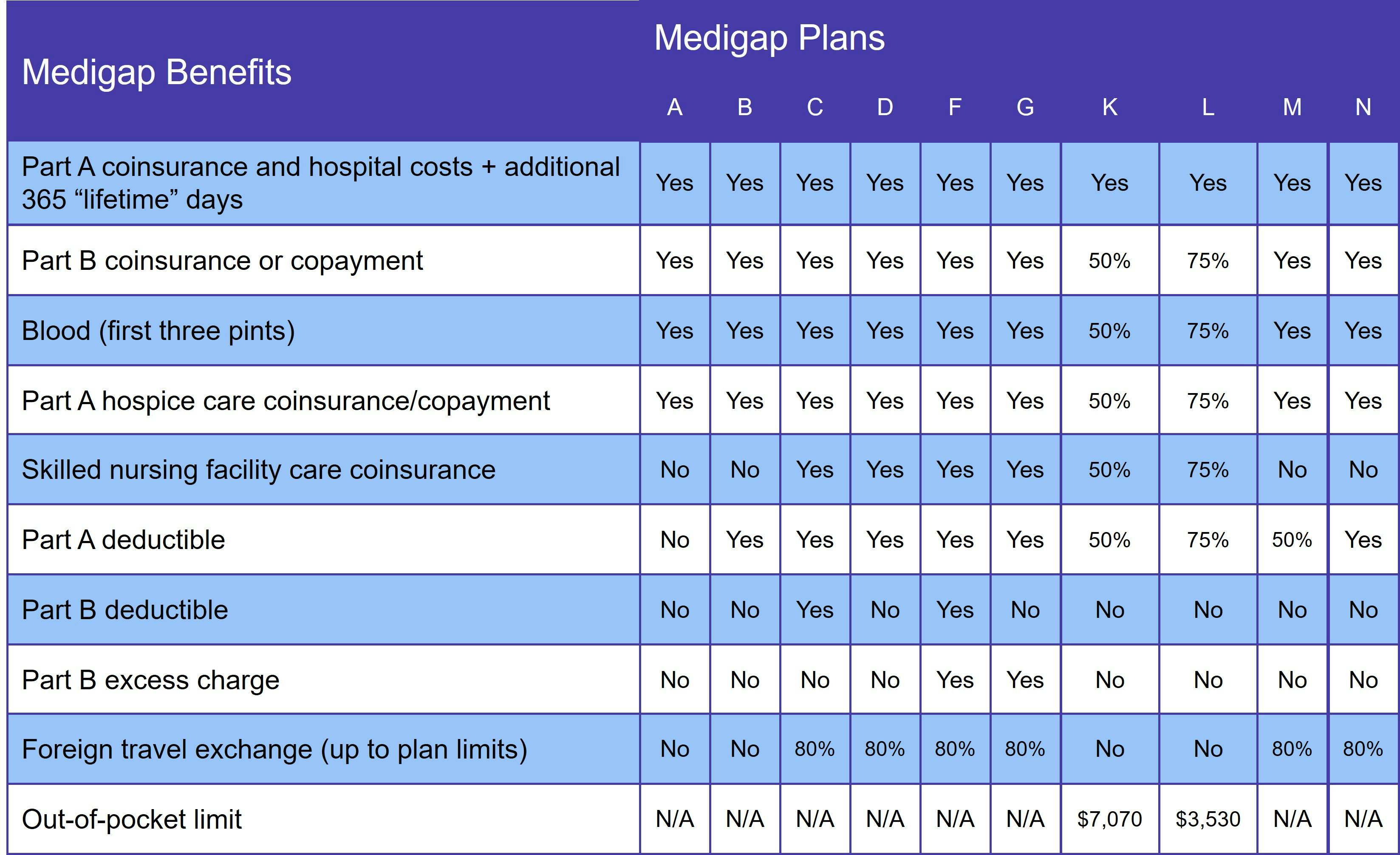

Medicare Supplement plans in Illinois are standardized, so you get the same benefits for a plan regardless of the provider. The 10 basic plans available are A, B, C, D, F, G, K, L, M, and N. Some insurance companies offer high-deductible versions of these plans, and not all providers offer all 10 plans.

It is important to note that, unless you have a guaranteed issue right, all Medigap applications must go through medical underwriting. This means answering questions based on age, medical history, and other health-related queries. The insurance company uses those answers to decide the rate of a policy and whether to offer one at all.

Who qualifies for Medicare Supplement insurance in Illinois?

In Illinois, you qualify for Medicare Supplement insurance as long as you have Original Medicare. Medigap insurers must offer Supplement plans to Medicare enrollees under 65. However, you typically pay a lower premium if you are 65 or older. That being said, Illinois law prohibits charging Medigap applicants under 65 more than their highest rate for a beneficiary who is over 65.

What does Medigap cover?

Medigap benefits vary depending on the plan you choose, but there are a couple of benefits you can be sure of. Every Supplement plan pays for Medicare Part A co-insurance, and they all provide an extra 365 lifetime reserve days for inpatient care.

This table compares the benefits of Medicare Supplement plans:

Note that, since Medigap only covers services covered by Original Medicare, prescription drug coverage is not included. For that, you need a Medicare Part D plan or a Medicare Advantage plan with drug coverage. However, choosing a Medicare Advantage plan means you cannot have Medigap.

Medigap Plan C and Medigap Plan F in Illinois

If you qualify for Medicare on or after January 1, 2020, Medigap Plan C and Medigap Plan F are unavailable. This is due to a federal law prohibiting Supplement plans from covering the Medicare Part B deductible. Medigap Plans D and G include the same coverage, with the exception of the Part B deductible.

When is the best time to join a Medicare Supplement plan in Illinois?

The best time for you to join an Illinois Medicare Supplement plan is your Medigap Open Enrollment Period (OEP), which begins the day you sign up for Original Medicare. Unlike many other states, Illinois requires Medigap coverage to be offered to Medicare beneficiaries who haven’t yet turned 65. This OEP is one of the few times you have a guaranteed issue right and your application cannot be denied. If you are 65 or older, you also cannot be charged more.

You get a second OEP when you turn 65 if you qualify for Medicare due to disability. You also get the same six months of guaranteed issue rights, even if you've already had a Medigap plan.

How to choose a Medigap plan in Illinois

Because of medical underwriting, it is important to consider any future healthcare needs and to sign up during your OEP. Otherwise, you might not be able to get the comprehensive coverage you need. The actual benefits of Medigap Supplement insurance depend on the specific plan you choose.

Most Medigap insurers charge one of three ways:

- Attained-age rated: Premiums may start low, but they grow as you age. These policies are usually more expensive over time.

- Community rated: Insurers charge the same premium regardless of beneficiary age.

- Issue-age rated: Based on your age at the time you join the plan, the only reason these plans may increase in cost is because of inflation.

To quickly and easily find Medigap plans in Illinois, use our Find a Plan tool. All you have to do is enter your location information and you’re ready to compare Medicare plans in your area.