Also known asMedigap, Medicare Supplement Insurance plans in Idaho help pay some of the costs not covered by Original Medicare. Private insurance companies sell Medigap policies, although the Medicare program sets guidelines regarding what each plan covers. This page explains your Medicare Supplement plan options and the best time to apply.

What is Medigap in Idaho?

Medigap plans help pay some of your out-of-pocket costs when you have Original Medicare. This includes:

- Medicare Part A, which covers inpatient services received in a hospital or skilled nursing facility (SNF)

- Medicare Part B, which covers outpatient services like doctor visits, lab work, and durable medical equipment (DME)

Original Medicare does not include prescription drug coverage, hearing aids, or routine vision and dental care. You cannot use a Supplement plan to pay for these services.

Unlike Medicare Advantage, there is no limit to your annual out-of-pocket costs with Original Medicare. Joining a Medigap plan protects you against significant medical bills following a lengthy hospital stay.

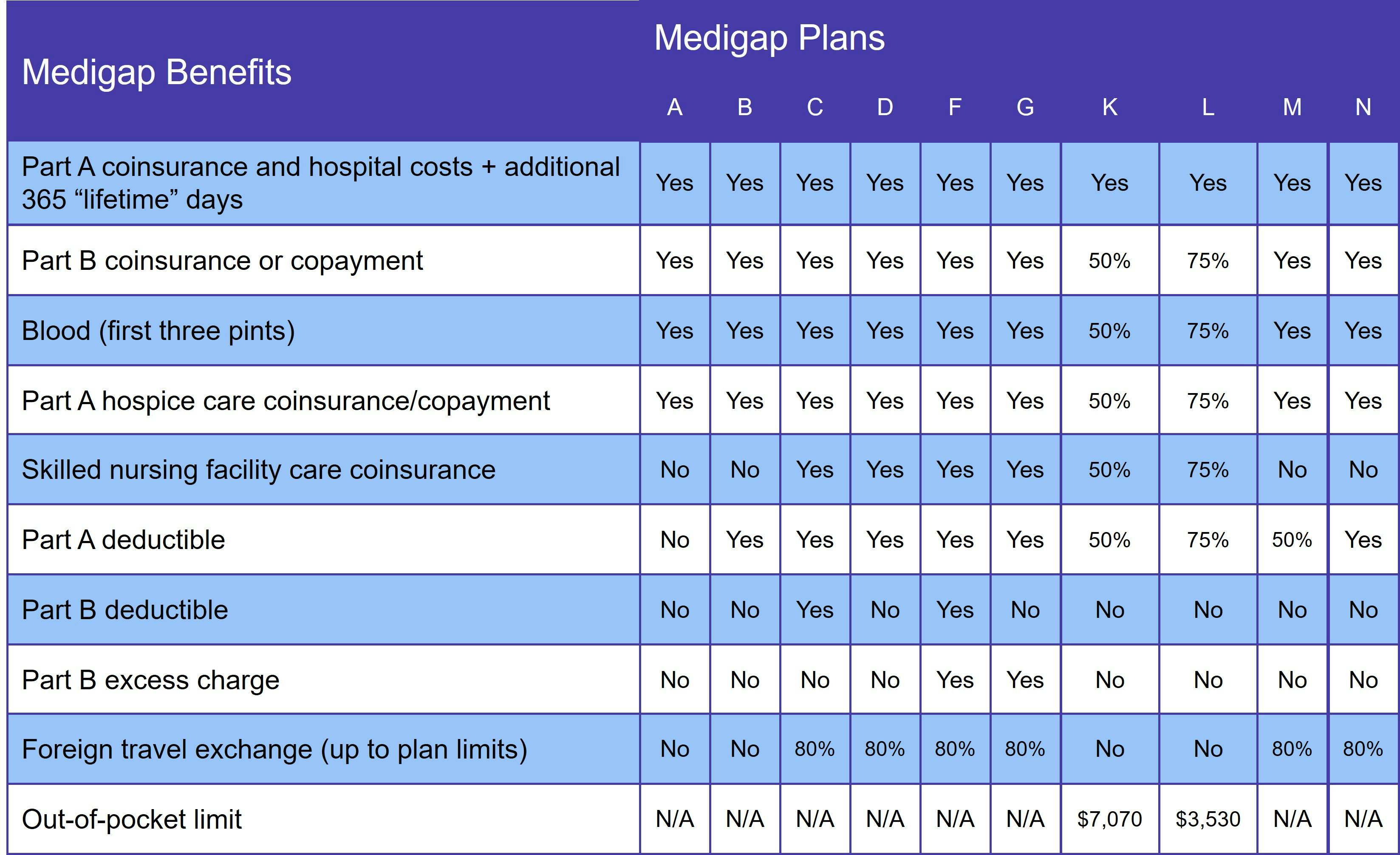

There are 10 Medicare Supplement plans, each represented by a letter (A, B, C, D, F, G, K, L, M, and N). Not every plan is available in every state. In addition, some Medigap insurers offer high-deductible versions of one or more plans.

Medigap plans are standardized, which means that every Plan A, B, D, etc. provides the same coverage no matter which insurance company you choose.

In Idaho, at least 65% of Medigap premiums must go to paying enrollee benefits. That number jumps to 75% if it's a group plan.

Who qualifies for Medicare Supplement Insurance in Idaho?

If you have Original Medicare and are at least 65 years old, you qualify for Medicare Supplement Insurance in Idaho. State law also requires Medigap insurers to offer plans to under-65 Medicare beneficiaries who qualify due to a disability.

This same law also protects these beneficiaries from paying more than 150% of the premiums that their over-65 counterparts pay. (Most states do not have this provision. Their under-65 Medigap beneficiaries can pay up to 20 times more than over-65 beneficiaries do.)

You may only join a Supplement plan if you have Original Medicare. People enrolled in an Advantage plan are not eligible for Medigap.

What does Medigap cover?

Medigap coverage varies based on which plan you choose. The following table shows the covered services of each plan:

No Medigap plan provides prescription drug coverage. You get that by joining either a Medicare Advantage Prescription Drug plan (MA-PD) or standalone Medicare Part D plan. However, if you opt for Medicare Advantage, you may not join a Medigap plan.

Medigap Plan C and Medigap Plan F in Idaho

There are two plans that pay for the Medicare Part B deductible: Medigap Plan C and Medigap Plan F. However, these plans are no longer available to anyone who becomes eligible for Medicare on or after January 1, 2020.

You can get the same coverage – minus the Part B deductible – with either Medigap Plan D (in lieu of Plan C) or Medigap Plan G (instead of Plan F). The good news is that your total out-of-pocket with either plan is usually less than you'd pay with Plans C or F, thanks to lower monthly premiums.

When is the best time to join a Medicare Supplement plan in Idaho?

The best time to join an Idaho Medigap plan is during the first 6 months you are both age 65 or older AND enrolled in Original Medicare. This is known as your Medigap Open Enrollment Period (OEP) and it's one of the few times you have guaranteed issue rights.

Guaranteed issue means that you cannot be denied a Medigap policy nor charged a higher rate for it. If you do not have a guaranteed issue right, your application goes through medical underwriting. This process involves answering a series of health-related questions. The insurance company uses your answers to decide whether to sell you a policy and at what rate.

If you qualify for Medicare due to a disability, you also get a 6-month Open Enrollment Period. Once you turn 65, you get a new OEP and the chance to get a Medigap policy for the same rate that other over-65 beneficiaries pay.

How to choose a Medigap plan in Idaho

Since Medigap benefits are standardized, you don't need to compare plans between providers. You do, however, need to decide how much coverage you want. When choosing a plan, remember that you'll likely have to go through medical underwriting if you ever decide you want more comprehensive coverage. It's important to buy a Medicare Supplement plan that considers both current and future healthcare needs.

Price comes next. Plan benefits may be standardized, but insurance companies set their own premiums. Idaho prohibits insurers from using attained-age rating, protecting beneficiaries from paying higher premiums as they grow older. That leaves two pricing methods:

- Community rated: These plans charge the same premium regardless of age. Over time, you pay less when your plan is community rated.

- Issue-age rated: Premiums are based on your age at the time you join the plan, not your age throughout the life of the policy. They may rise over time due to inflation, though.

Our Find a Plan tool makes it easy to compare Medigap plans in Idaho. Simply enter your location information to review Medicare plan options in your area.