Medicare Supplement Insurance plans in Georgia may help pay for a variety of healthcare costs, including hospital coinsurance and your Part A deductible. This page explains your Medicare Supplement options in Georgia, how the program works, and who qualifies.

What is Medigap in Georgia?

Medicare Supplement Insurance is more commonly known as Medigap, because it's said to "fill the gaps" left by Original Medicare. This means your out-of-pocket costs, such as deductibles and coinsurance. Covered services vary according to which Medigap plan you choose.

Unlike Medicare Advantage plans, there is no limit to your yearly out-of-pocket costs under Original Medicare (Part A, hospital insurance, and Part B, medical insurance). You could walk away from a lengthy hospital stay owing tens of thousands of dollars – even though you have Medicare Part A.

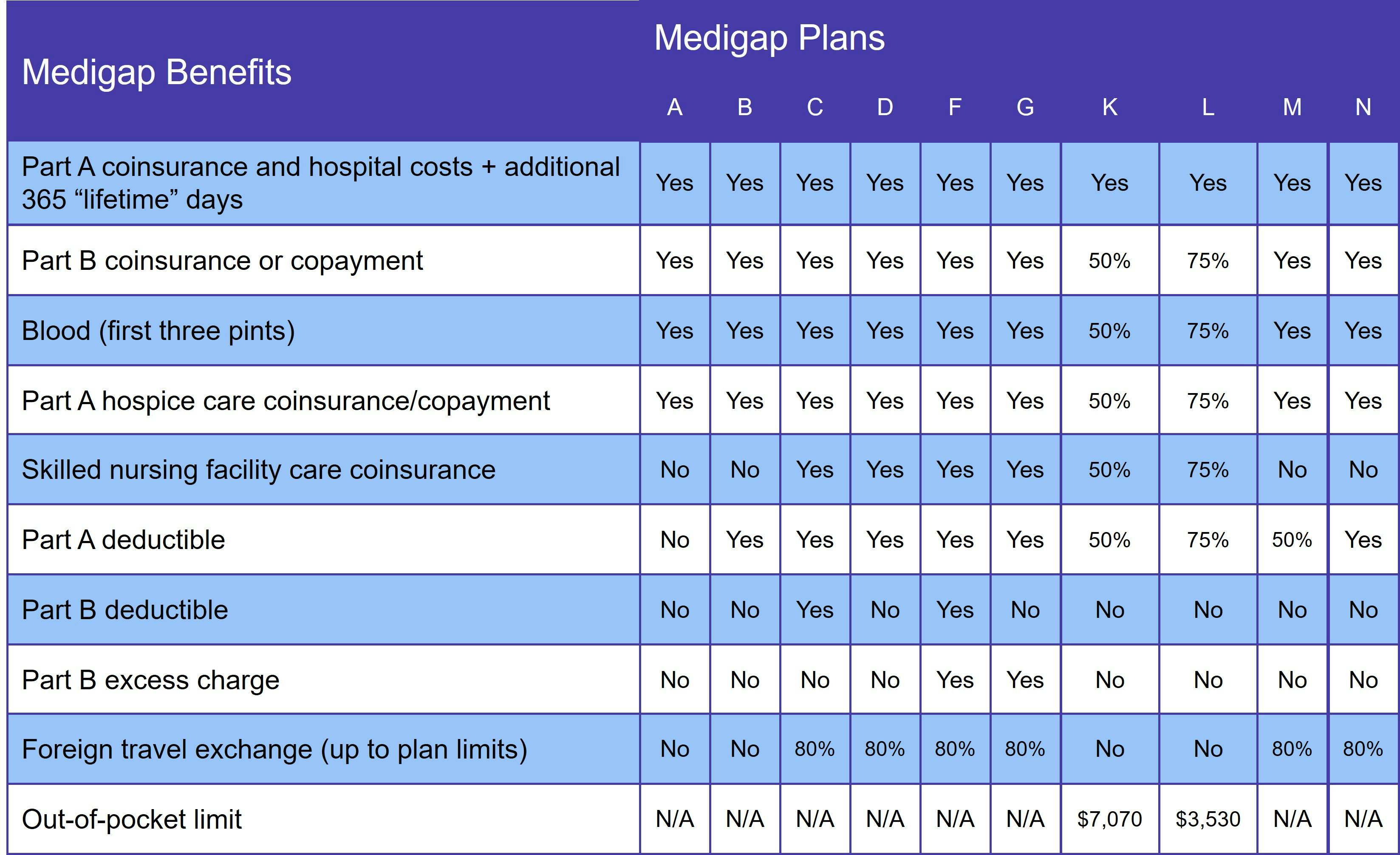

Medigap plans are standardized, which means every Plan A (or B, C, etc.) offers the same benefits no matter which insurance company sells you the plan.

Who qualifies for Medicare Supplement Insurance in Georgia?

If you have Original Medicare and are age 65 or older, you qualify for Medicare Supplement Insurance in Georgia. In addition, people who are under 65 and have Medicare due to a disability may also join a Medigap plan. However, insurers do not have to charge comparable premiums and most do not. Under-65 beneficiaries typically pay several times what their over-65 counterparts pay.

What does Medigap cover?

Medigap coverage varies based on the plan you choose. At a minimum, every plan pays for your Part A coinsurance, the first 3 pints of blood in a transfusion, and gives you an additional 365 lifetime reserve days for hospital care. For plan details, see the following table:

Please note that Medigap plans only help pay for services provided by Original Medicare, which does not include prescription drug coverage. These benefits are available through either a Medicare Advantage Prescription Drug plan (MA-PD) or standalone Medicare Part D plan.

You cannot pair Medigap with a Medicare Advantage plan.

Medigap Plan C and Medigap Plan F in Georgia

Medigap Plan C and Medigap Plan F each include the Part B deductible benefit. As of January 1, 2020, these plans are no longer available to new Medicare beneficiaries. You can get similar coverage – minus the Part B benefit – with either Medigap Plan D (instead of C) or Medigap Plan G (instead of F).

Even though they do not pay for the Part B deductible, most beneficiaries save money with Plans D and G because the premiums are usually lower.

When is the best time to join a Medicare Supplement plan in Georgia?

Your Medigap Open Enrollment Period (OEP) is the best time to join a Medicare Supplement plan in Georgia. This is one of the few times you have a guaranteed issue right, which means your application does not have to go through medical underwriting. This protects you from being denied a Medigap policy or paying more for it due to your age or medical history.

Open Enrollment lasts for 6 months, beginning the first day you are both age 65 and enrolled in Original Medicare.

How to choose a Medigap plan in Georgia

It's important consider your future healthcare needs when choosing a Georgia Medigap plan. It may be tempting to go with the least expensive option, but don't forget medical underwriting. Waiting until your healthcare needs change could make it impossible for you to get more comprehensive Medigap coverage when you really need it.

Once you decide on the coverage you want, it's time to look at price. Luckily, Georgia law prohibits Medigap insurers from raising premiums due to age. That leaves two pricing method options:

- Community rated: Also known as no-age rated, these plans charge the same premium regardless of age. Over time, you'll pay less for a community rated Medigap plan.

- Issue-age rated: Premiums are based on your age at the time you join the plan, not your age throughout the life of the policy. They may rise over time due to inflation, though.

Comparing Medigap plans in Georgia is easy with our Find a Plan tool. Just enter your location information to review Medicare plan options in your area.