Medicare Supplement Insurance plans in Connecticut may help cover a variety of out-of-pocket costs, including coinsurance, hospice care, and the Medicare Part A deductible. More commonly known as Medigap, Supplement plans are only available to Original Medicare beneficiaries.

What is Medigap in Connecticut?

Medigap plans are sold by private insurance companies and help pay numerous healthcare costs under Original Medicare. This includes Medicare Part A, hospital insurance, and Medicare Part B, medical insurance.

Although Medicare Advantage plan enrollees are protected by annual out-of-pocket limits, there is no such protection for beneficiaries who have Original Medicare. If you have chronic medical conditions or require multiple or lengthy hospital stays, you could face significant medical bills. A Medicare Supplement plan can protect you from this.

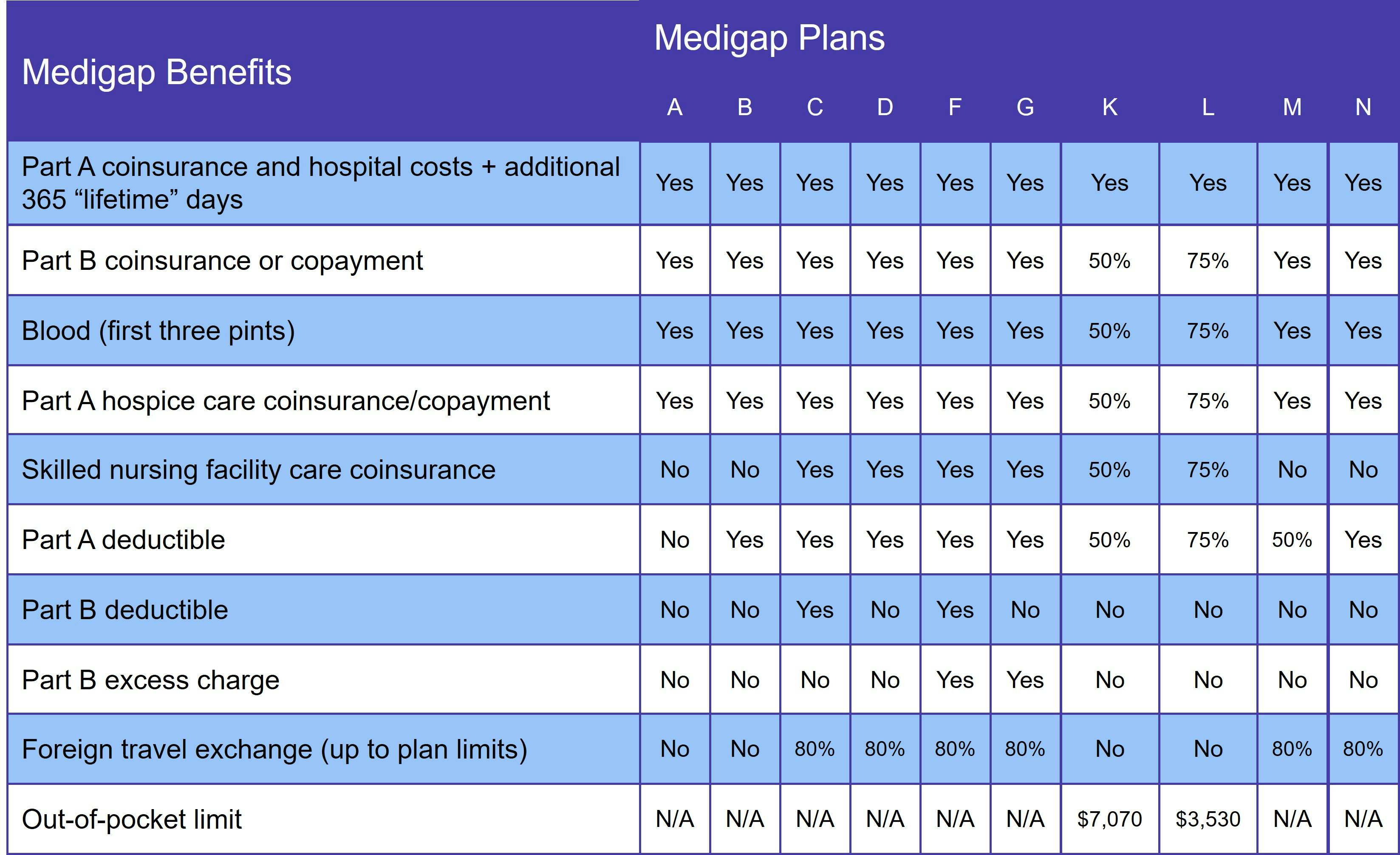

There are 10 Supplement plans, each represented by a letter: A, B, C, D, F, G, K, L, M, and N. In addition, some states offer high-deductible versions of one or more plan options.

Every Medigap plan is standardized, which means that you get the exact same benefits with Plan A, B, C, etc., regardless of which insurance company you choose. Although plan benefits are standardized, prices are not. The insurer determines its premiums.

Finally, Medicare Supplement plans are not standalone health insurance such as you get with an Advantage plan. They supplement your Medicare coverage; they do not replace it.

Who qualifies for Medicare Supplement Insurance in Connecticut?

If you have Original Medicare and are age 65 or older, you qualify for Medicare Supplement Insurance in Connecticut.

Medigap insurers must offer at least Plan A to Connecticuters who qualify for Medicare due to a disability and are not yet 65. In addition, if the insurer sells Plans B and C to those aged 65 and older, they must also offer those options to younger Medicare beneficiaries.

What does Medigap cover?

Medicare Supplement Insurance helps pay the beneficiary's share of services covered by Original Medicare (Parts A and B). Benefits vary depending on which plan you choose. At a minimum, every Medigap plan covers 100% of your Part A coinsurance and at least part of your Part B coinsurance. The following table details what each Medigap plan covers:

It's important to note that Medigap only pays for services covered by Original Medicare, which does not include prescription drug coverage. For that, you need either a standalone Medicare Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD).

Medigap Plan C and Medigap Plan F in Connecticut

Beginning January 1, 2020, new Medicare beneficiaries could no longer buy a Medigap plan that covered the Medicare Part B deductible. This means that two options, Plan C and Plan F, are not available to people who qualified for Medicare after December 31, 2019.

You may still join Plans C and F if you were eligible for Medicare before 2020. However, we advise against this. Plan D and Plan G provide the same coverage as Plans C and F, respectively, minus the Part B deductible. And their lower premiums nearly always mean that you have a lower overall out-of-pocket.

When is the best time to join a Medicare Supplement plan in Connecticut?

The best time to join a Connecticut Medicare Supplement plan is during your Medigap Open Enrollment Period (OEP). It lasts for 6 months, beginning the day you are both age 65 or older and enrolled in Original Medicare.

While most Medicare beneficiaries have to worry about medical underwriting and being denied a Medigap plan outside their OEP, the law is different in Connecticut. Here, your Medigap application cannot be denied due to your age or health status.

How to choose a Medigap plan in Connecticut

In most states, it's important to choose a Medicare Supplement plan that considers your future healthcare needs. But with Connecticut law allowing you to change Medigap plans at any time without undergoing medical underwriting, you can buy just the coverage you need.

After deciding on the level of coverage, you'll want to compare pricing. Connecticuters are lucky here, as well, as state law requires Medigap insurers to use community rating. Over time, experts agree that this the least expensive option, as rates will not go up due to age, health, or gender.

It's easy to compare Medigap plans in Connecticut with our Find a Plan tool. Simply enter your location information to review Medicare plan options in your area.

Speak with a Licensed Insurance Agent

M-F 8:00am-10:00pm | Sat 9:00am-6:00pm EST