Medicare Supplement Insurance plans in Colorado help pay some of your healthcare expenses when you have Original Medicare (Parts A and B). More commonly known as Medigap, Medicare Supplement plans can protect you from significant out-of-pocket costs if you don't qualify for Medicaid or have a secondary health insurance through an employer-sponsored group health plan.

This page describes how Medicare Supplement Insurance works, your coverage options, and how to compare plans.

What is Medigap in Colorado?

Colorado Medicare Supplement plans cover a variety of out-of-pocket costs under Original Medicare, which includes:

- Medicare Part A covers inpatient services received in a hospital or skilled nursing facility (SNF) as well as hospice care

- Medicare Part B covers outpatient services like doctor visits, durable medical equipment (DME), outpatient procedures performed in surgery clinics or hospitals, lab work, and more

Original Medicare does not include prescription drug coverage, vision, dental, or hearing aids, so you cannot use a Medigap plan to pay for these services.

Medigap plans are standardized, meaning each plan "letter" provides the same benefits no matter which insurance company you choose. Even if you move to another state, your coverage under Medigap Plan A (B, C, etc.) will not change. However, premiums are set by the private insurance companies that sell the plans, not by the Medicare program.

It's important to note that Medicare Supplement Insurance is not the same as a private, standalone health plan. As the name suggests, these policies supplement the coverage provided by Original Medicare; they do not replace it.

Who qualifies for Medicare Supplement Insurance in Colorado?

Coloradans who are age 65 or older and enrolled in Original Medicare qualify for Medicare Supplement Insurance. In addition, Colorado law requires Medigap insurers to provide plan options for people under age 65 who qualify for Medicare due to a disability.

There is no law, though, that requires these insurance companies to charge comparable premiums for these plans. If you have Medicare due to a disability and apply for a Medicare Supplement plan, expect to pay significantly more for it.

What does Medigap cover?

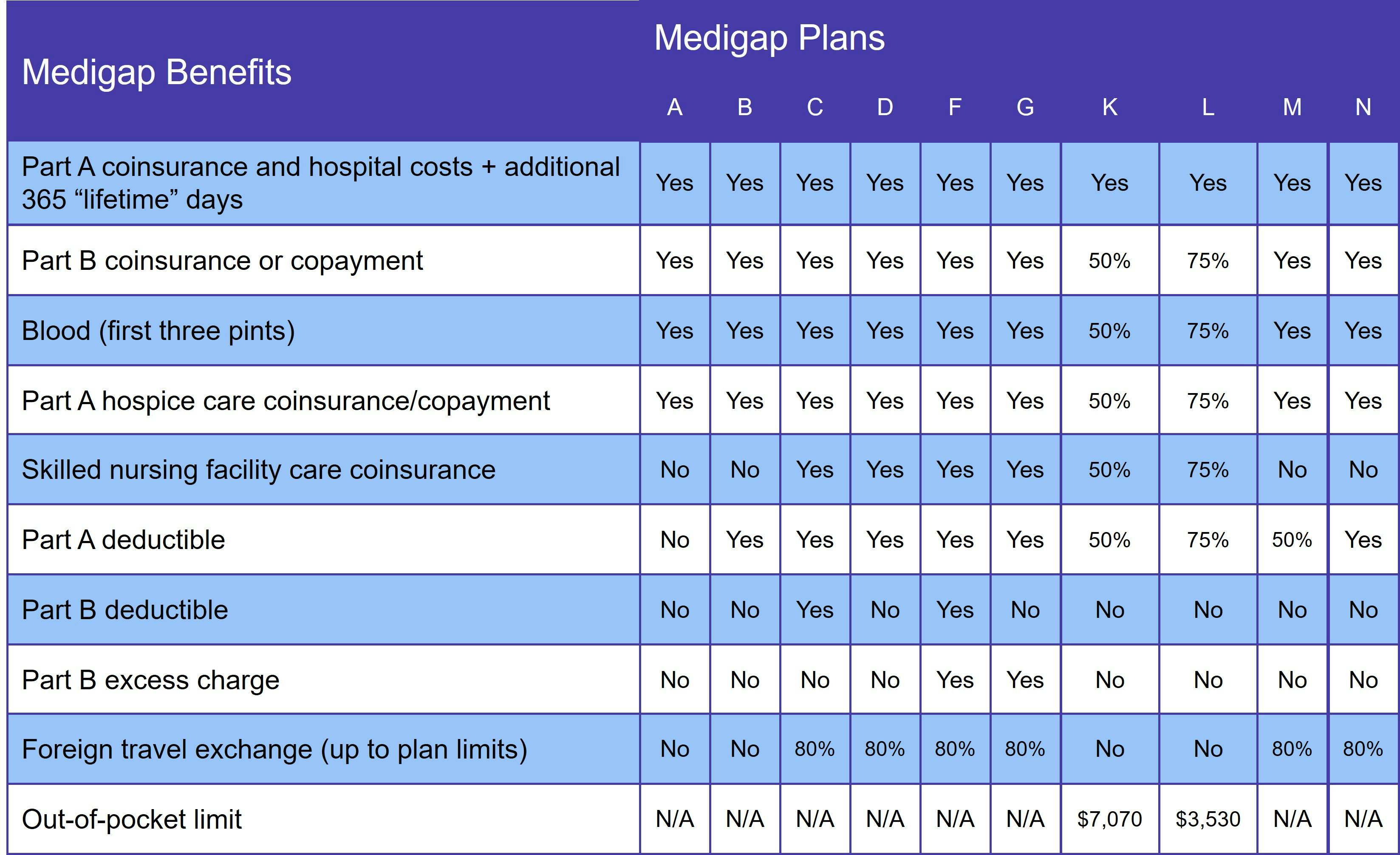

Medicare Supplement plans cover a variety of services provided with Medicare Parts A and B. Coverage may include coinsurance, deductibles, and care received in a foreign country. Benefits vary according to which plan you choose. The following table lists what each plan pays for:

There are no Medigap plans that provide prescription drug coverage. For that, you need to join either a standalone Medicare Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD). Please note that you cannot have both Medigap and a Medicare Advantage plan.

Medigap Plan C and Medigap Plan F in Colorado

Plans that cover the Medicare Part B deductible are no longer available to people who qualify for Medicare after January 1, 2020. This includes Medigap Plan C and Medigap Plan F. Comparable alternatives are Medigap Plan D and Medigap Plan G, which offer the same benefits as Plans C and F, respectively, minus the Part B deductible.

If you already had either Plan C or Plan F, you may keep it. You may also join either plan if you qualified for Medicare before January 1, 2020, although we do not recommend it. Premiums on discontinued Medigap plans typically rise over time, since there are no new enrollees to help manage plan costs.

When is the best time to join a Medicare Supplement plan in Colorado?

The best time to join a Medigap plan in Colorado is during your Medigap Open Enrollment Period (OEP). It begins the day you are both age 65 or older AND enrolled in Medicare Parts A and B. If you apply for a Medigap plan during your Open Enrollment Period, you cannot be denied coverage or charged more for it, even if you have preexisting medical conditions.

If you don't qualify for guaranteed issue rights and your Medigap OEP has ended, your application goes through a process called medical underwriting. This involves a series of questions about your age, medical history, tobacco use, and more. The insurance company uses your answers to these questions to determine whether to sell you a Medigap policy and at what price.

Coloradans who qualify for Medicare due to a disability also get a 6-month Medigap Open Enrollment Period. They have guaranteed issue rights during this period, but do not have the same premium protections that beneficiaries aged 65 and older do. However, once they turn 65, they get the same guaranteed issue rights – including premium protections – that other 65-year-old Medicare beneficiaries enjoy.

How to choose a Medigap plan in Colorado

Since benefits are standardized, you don't need to compare the coverage of every Plan A (or B, C, etc.) offered in Colorado. But you do need to decide how much coverage you want and/or need. Remember, there are few cases where your application does not have to go through medical underwriting. That's why we always recommend buying a Supplement plan based on your projected medical needs.

Although benefits are standardized, costs are not. Private insurance companies sell Medigap plans and are allowed to set their own premiums. These may vary according to where you live. Pricing methods include:

- Attained-age rated: This is the most common type of pricing. Premiums start out lower, particularly if you sign up when you're 65, but increase as your age does. Over time, these policies are typically the most expensive.

- Community rated: Also known as no-age rated, you'll pay the same premium no matter how old you are. Over time, these Medigap plans cost the least.

- Issue-age rated: Insurers base your premiums on your age at the time you enrolled in the plan. Your monthly premium may rise over time due to inflation, but never because of age.

Comparing Colorado Medicare Supplement Plans is easy with our Find a Plan tool. Simply enter your location information to review Medicare plan options in your area.

Speak with a Licensed Insurance Agent

M-F 8:00am-10:00pm | Sat 9:00am-6:00pm EST