Medicare Supplement plans in Arkansas help pay for a variety of services covered by Original Medicare. Also known as Medigap, the plans are offered by private insurance companies. This page explains your Medicare Supplement plan options and how the program works.

What is Medigap in Arkansas?

As in the rest of the country, Arkansas Medigap plans help pay for a variety of healthcare costs for people who have Original Medicare. This includes Part A, hospital insurance, and Part B, medical insurance.

Medicare Supplement plans help protect you against exorbitant out-of-pocket costs. Unlike Medicare Advantage, Original Medicare has no annual out-of-pocket limit. So even if you have Parts A and B, you can still wind up with substantial medical debt, particularly if you require multiple or lengthy hospital stays.

Medigap plans are standardized, which means the coverage for Plan A (or B, C, etc.) is the same no matter which insurance provider you choose. Costs, however, are not standardized. Each insurance company sets its own premiums.

Finally, Medicare Supplement Insurance is not a standalone health plan like you have with Medicare Advantage or an employer. As the name suggests, these plans supplement your Original Medicare coverage. They do not replace it.

Who qualifies for Medicare Supplement Insurance in Arkansas?

If you are enrolled in Original Medicare and are aged 65 or older, you're eligible for Medigap in Arkansas.

Most states in America – including Arkansas – require Medigap insurers to offer at least one plan to people who qualify for Medicare due to a disability or illness. The insurance company may charge these Medicare beneficiaries higher premiums, though, and most do.

Other Arkansas Medigap guidelines include:

- Insurers must follow "no age rating" guidelines, meaning they cannot charge a higher premium based on someone's age – assuming that "someone" is at least 65 years old.

- Medigap providers in Arkansas may base premiums on medical history and tobacco use.

- At least 65 percent of premium revenues collected by Medigap insurers must go toward paying enrollees' medical claims (for enrollees age 65 and older).

What does Medigap cover?

Arkansas Medigap coverage depends on which plan you choose, although every option covers at least the following:

- Medicare Part A coinsurance

- First 3 pints of blood in a transfusion

- An additional 365 lifetime reserve days for inpatient hospital care

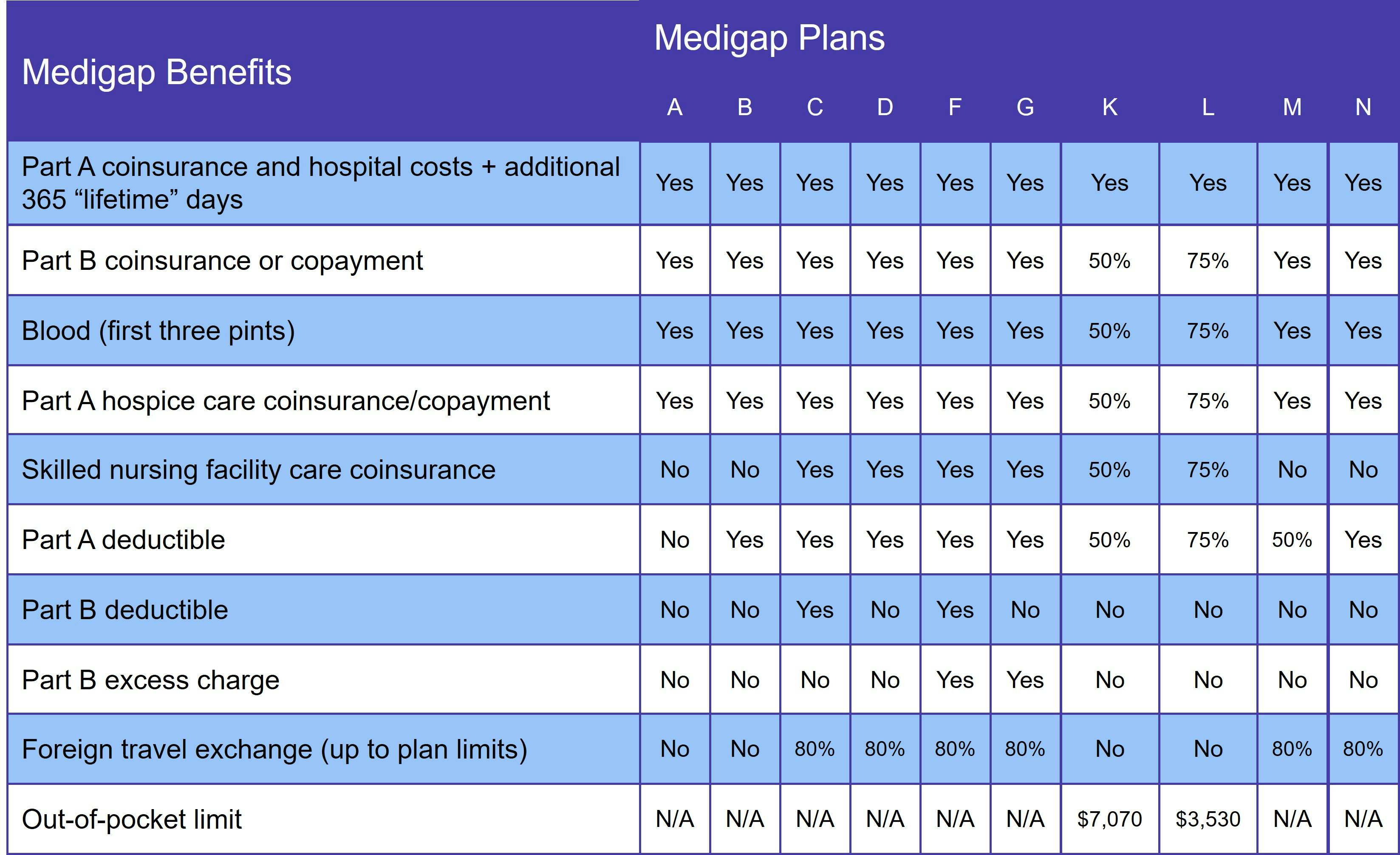

The following table details the coverage information for each Medigap plan:

Medicare Supplement Insurance only pays for benefits covered by Original Medicare. That means that you cannot use your Medigap plan to pay for services like prescription medications, routine eye care, or dental.

You can get prescription drug coverage with either a standalone Medicare Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD). Please note that you cannot have both an Advantage plan and Medigap.

Medigap Plan C and Medigap Plan F in Arkansas

As of January 1, 2020, Medigap plans are no longer allowed to cover the Medicare Part B deductible. This coverage is included with Medicare Plan C and Plan F. As a result, the new guidelines restrict enrollment in either plan to people who qualified for Medicare before 2020.

With the exception of the Part B deductible, Medigap Plan D and Medigap Plan G provide the same coverage as Plans C and F, respectively.

When is the best time to join a Medicare Supplement plan in Arkansas?

Your 6-month Medigap Open Enrollment Period (OEP) is the best time to apply for a Medicare Supplement plan in Arkansas. Your Medigap OEP begins the day you are both age 65 or older and enrolled in Medicare Parts A and B.

The Medigap Open Enrollment Period is one of the few times you qualify for guaranteed issue rights. This means you cannot be denied a Medigap policy or charged a higher premium, even if you have preexisting medical conditions.

If you do not have guaranteed issue rights, your Medigap application goes through a process known as medical underwriting. This involves the insurance company asking you a series of health-related questions. Your answers determine your premium and even whether the insurer will offer you a Medigap plan.

How to choose a Medigap plan in Arkansas

When deciding which Medigap plan you want, consider your future healthcare needs. Remember, unless you have a guaranteed issue right, your Supplement application goes through medical underwriting. This means that you may not be able to get more comprehensive coverage at a later date. Or, you may be able to get a plan, but will pay a higher premium for it.

Although Medigap plans are standardized, what the insurance company charges for them is not. Compare costs carefully, but also consider the insurer's reputation. Online reviews are a good starting point for understanding customer satisfaction with a particular company.

Comparing Medigap plans in Arkansas is easy with our Find a Plan tool. Just enter your zip code and coverage start date to begin reviewing Medicare plan options in your area.

Speak with a Licensed Insurance Agent

M-F 8:00am-10:00pm | Sat 9:00am-6:00pm EST