Medicare Supplement Insurance plans in Alaska help pay some of your out-of-pocket costs under Original Medicare.

What is Medigap in Alaska?

If you have Original Medicare (Part A, hospital insurance, and Part B, medical insurance), you can get help paying for some of your out-of-pocket costs with a Medicare Supplement plan.

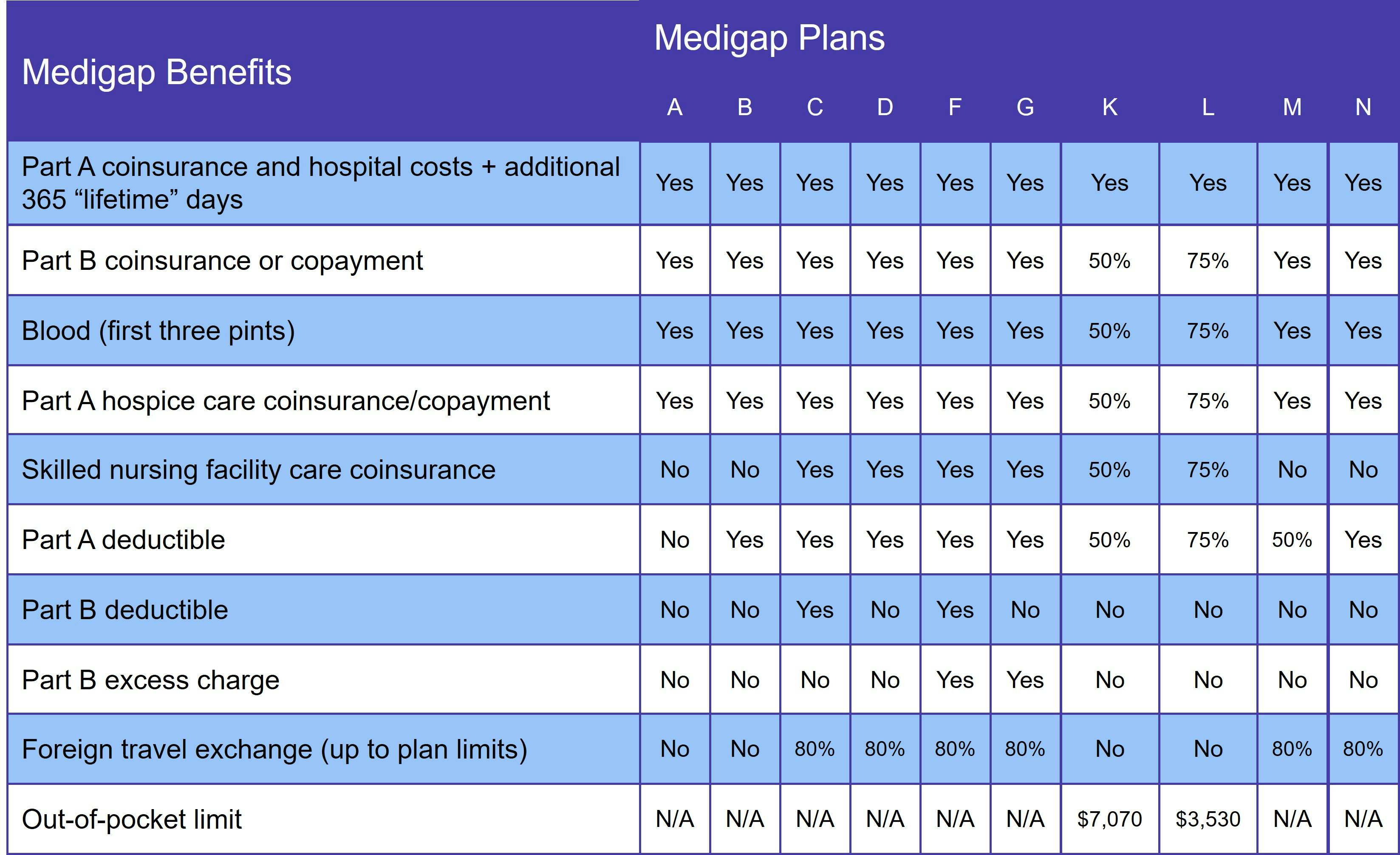

More commonly known as Medigap, these plans help cover a variety of healthcare costs. The plans are standardized, which means that Plan A provides the same coverage no matter where you buy it. The same is true for Plan B, Plan C, Plan D, etc. At a minimum, all Medigap plans cover your Part A coinsurance and give you an extra 365 lifetime reserve days for hospital stays.

Unlike Medicare Advantage plans, there is no yearly out-of-pocket maximum for Original Medicare. If you have a lengthy hospital stay, you could owe tens of thousands of dollars in medical bills without a Supplement plan.

Who qualifies for Medicare Supplement Insurance in Alaska?

Once you enroll in Original Medicare and are over age 65, you qualify for Medicare Supplement Insurance in Alaska.

Currently, the Medicare program oversees Medigap while leaving it up to the states to establish guidelines for beneficiaries who are under age 65. Most states require private insurers who sell Medicare Supplement plans to provide access to those who qualify due to illness or disability. Although Alaska is not one of them, the state offers the Alaska Comprehensive Health Insurance Association (ACHIA) for its high-risk pool of beneficiaries.

What does Medigap cover?

Medigap plans only pay for services that are covered by Original Medicare. The level of coverage varies according to the plan you choose.

You cannot use your Supplement plan to pay for services not provided by Parts A and B. If you need prescription drug coverage, you should join either a standalone Medicare Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD).

Please note that you cannot have both Medigap and a Medicare Advantage plan.

Medigap Plan C and Medigap Plan F in Alaska

As of 2020, federal law prohibits Medicare Supplement plans from covering the Medicare Part B deductible. If you did not qualify for Medigap BEFORE January 1, 2020, you may not sign up for Plan C or Plan F.

Those who were eligible for Medigap before 2020 may join any plan, including C and F. However, that does not mean that they should. Historically, once a Supplement plan is no longer available, premiums begin to rise.

With the exception of the Part B deductible, Plans D and G offer the same coverage as Plans C and F, respectively.

When is the best time to join a Medicare Supplement plan in Alaska?

The best time to enroll in an Alaska Medigap plan is during your 6-month Medigap Open Enrollment Period (OEP). This begins the first day you are both enrolled in Original Medicare and are age 65 or older.

Your Medigap OEP is one of the few times you have a guaranteed issue right, which means your application will not go through medical underwriting. This is the process by which insurance companies determine whether to provide coverage and what your premium would be. When you have guaranteed issue rights, you cannot be denied a Medigap policy nor charged more for it, even if you have preexisting medical conditions.

How to choose a Medigap plan in Alaska

Since benefits are standardized, you need to first decide what level of coverage you need. Keep in mind that, unless you have a guaranteed issue right, your Medigap application will go through medical underwriting, even if you already have a Supplement plan. In other words, you can't just decide to change to a plan with better coverage. It's a good idea to buy the Medigap plan that you think will serve you best long-term.

Costs will vary according to the provider you choose, so compare these carefully. Company reputation is also important, so do a bit of research to learn more about what other customers think. Online reviews are a good place to start.

Comparing Medigap plans in Alaska is easy with our Find a Plan tool. Just enter your zip code to see Medicare plan options in your area.